A $3 Trillion Market Opportunity: My Top AI Stock to Buy in February

Key Points

Nvidia continues to launch new GPUs year after year.

The stock barely trades at a premium to the S&P 500.

- 10 stocks we like better than Nvidia ›

Artificial intelligence (AI) investing is still the best place to be if you're looking to maximize returns on your investment. While the jury is still out on whether generative AI will provide adequate returns on the massive amount of money being invested in the technology, there are several companies benefiting from the massive artificial intelligence spending spree right now.

The most popular example is Nvidia (NASDAQ: NVDA), and I still think it's the best AI investment available on the market. The company is pursuing an estimated $3 trillion market opportunity by 2030, and with its dominance, the stock likely is just getting started.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Nvidia is at the heart of AI

Nvidia makes graphics processing units (GPUs), the most popular computing units to deploy with AI workloads. Nvidia continuously innovates and is launching a new chip architecture that provides huge improvements over last year's model.

Compared to Blackwell GPUs, next-gen Rubin GPUs require a fourth of the number to train an AI model, and a tenth of the number to provide inference. That's a huge advantage and will drive many to upgrade to the latest and greatest model from Nvidia.

Nvidia is on a one-year product development cycle, so investors will also learn about its next-generation architecture sometime later this year. With each improved GPU launch will come greater capabilities and a bigger price tag. But if a client has to pay only double the cost to receive four to 10 times the performance, that's a win for everyone involved.

While a ton of GPUs have been deployed already, this is just scratching the surface of what's necessary to run an AI-first business and consumer world. This will require many more data centers, and many that were announced throughout 2025 won't need chips until 2027 or beyond. It takes a long time to build these gigantic facilities, and filling them with computing units is one of the last steps.

This supports Nvidia's projection that global data center spend will rise to $3 trillion to $4 trillion annually by 2030. The company already has orders stretching out several years because companies want to secure computing units before they need them. The growth case for Nvidia is just getting started, yet the stock barely trades for an above-market premium.

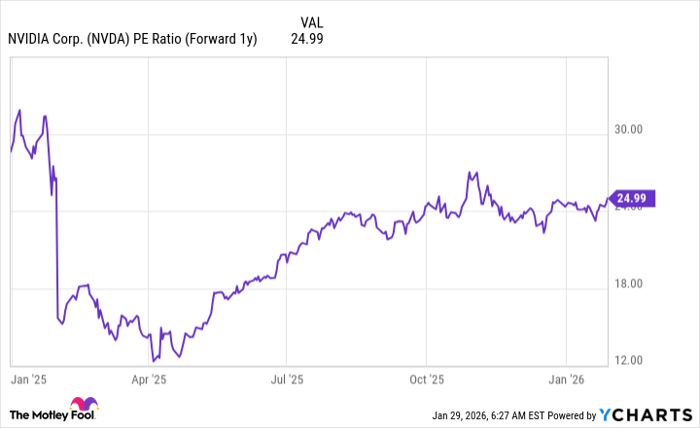

NVDA PE Ratio (Forward 1y) data by YCharts

At 25 times fiscal 2027 earnings (ending January 2027), Nvidia is barely more expensive than the S&P 500 index, which trades for 22.2 times forward earnings.

That's really not much of a premium to pay for a stock that has a massive market opportunity and is growing its revenue fast. I think Nvidia is the top AI stock to buy in February, and investors should scoop up shares before it reports Q4 earnings that month.

Should you buy stock in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $450,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,171,666!*

Now, it’s worth noting Stock Advisor’s total average return is 942% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 2, 2026.

Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.