Prediction: SOXX Will Outperform S&P 500 and Nasdaq 100 in 2026

Key Points

Thanks to the emergence of AI, semiconductors have been one of the best-performing sectors of the past few years.

The biggest performance drivers of 2026 have gone beyond Nvidia (NVDA) and Broadcom (AVGO), suggesting the sustainability of positive momentum.

This improved breadth and acceleration in spending should produce another market-beating year for chip stocks.

- 10 stocks we like better than iShares Trust - iShares Semiconductor ETF ›

The semiconductor sector typically moves in cycles. It can experience long periods of strong growth, but then be followed by a slowdown or contraction. When the structural environment changes, the industry's leaders can see big returns for years.

That's what we've seen over the past couple of years in the semiconductor space. And it could be a nice setup for the iShares Semiconductor ETF (NASDAQ: SOXX) in 2026.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Prediction: SOXX will outperform the S&P 500 & Nasdaq 100 in 2026 as AI infrastructure spending accelerates

Over the past few years, semiconductor chips have been the core component of the artificial intelligence (AI) revolution.

In 2024 and 2025, the focus was building the infrastructure necessary to support high growth and demand. In 2026, the story likely broadens into a theme of more full-scale adoption. That could benefit the "next-in-line" companies involved in cloud computing, autonomous systems, and data centers.

All of these trends rely on semiconductors, and the buildout to support AI is likely to last for years. That means billions of dollars of investment will continue to flow into this space. That gives the sector a very good chance for success where the biggest winners may go beyond just Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO).

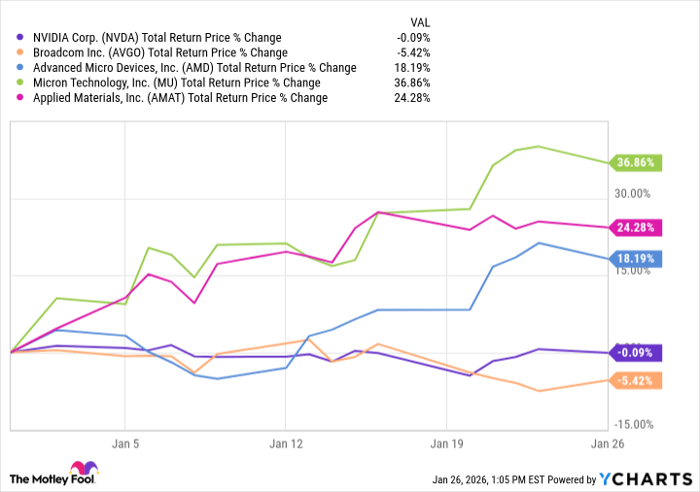

And so far they have. Applied Materials (NASDAQ: AMAT), Micron Technology (NASDAQ: MU), and Advanced Micro Devices (NASDAQ: AMD) -- all top-five holdings of the iShares Semiconductor ETF -- have all delivered 18%+ gains this year (as of Jan. 26, 2026) to help lift performance.

NVDA Total Return Price data by YCharts

That kind of breadth will be the key to sustained outperformance. And it should lead to market-beating returns again in 2026.

Should you buy stock in iShares Trust - iShares Semiconductor ETF right now?

Before you buy stock in iShares Trust - iShares Semiconductor ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and iShares Trust - iShares Semiconductor ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $456,457!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,174,057!*

Now, it’s worth noting Stock Advisor’s total average return is 950% — a market-crushing outperformance compared to 197% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 30, 2026.

David Dierking has positions in iShares Trust-iShares Semiconductor ETF. The Motley Fool has positions in and recommends Advanced Micro Devices, Applied Materials, Micron Technology, Nvidia, and iShares Trust-iShares Semiconductor ETF. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.