Monero Price Forecast: XMR retreats as bearish outlook targets 200-day EMA

- Monero retreats by nearly 5% so far on Friday after the 50-day EMA capped a short-lived recovery earlier this week.

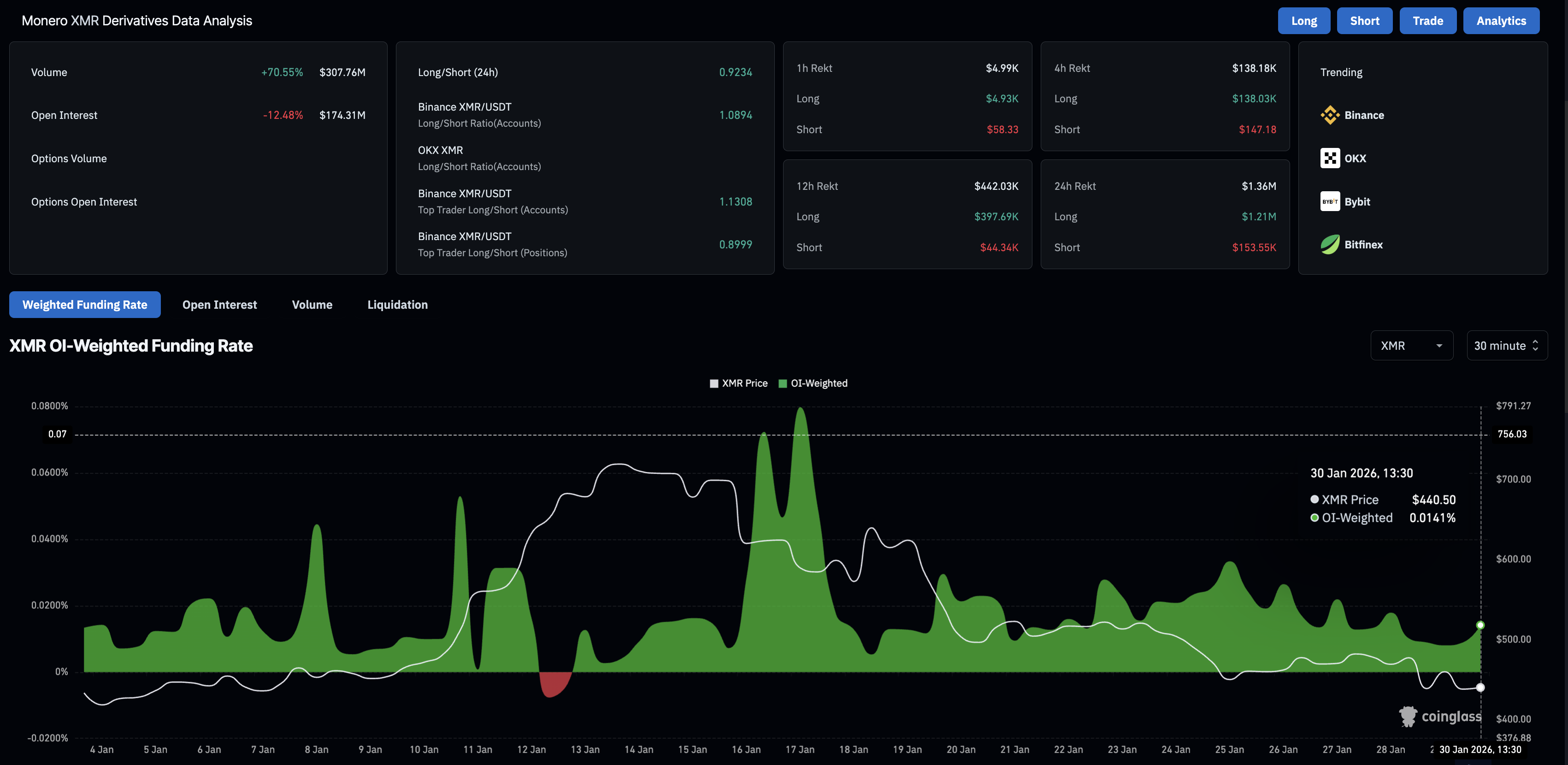

- Derivatives data show persistent bullish interest among traders despite capital outflows and massive liquidations.

- The technical outlook for Monero remains bearish, putting the 200-day EMA at $386 into the spotlight.

Monero (XMR) is down almost 5% at press time on Friday, extending the 2% loss from the previous day. The privacy coin retains positive funding rates, a sign of bullish interest among traders, despite massive outflows from XMR derivatives. Technically, the outlook for Monero is bearish, with prices testing a crucial support zone above $400.

Mixed sentiment in XMR derivatives

Monero’s retail strength flashes mixed signals, with positive funding rates amid declining XMR futures Open Interest (OI) and massive long liquidations. CoinGlass data show that the XMR OI is down 12.48% over the last 24 hours, to $174.31 million, indicating a reduction in the value of outstanding contracts.

Consistent with the outflow, long liquidations of $1.21 million over the last 24 hours outpace short liquidations of $153,550, suggesting a bullish positional wipeout.

However, the funding rate at 0.0141% indicates a spike in bullish interest among traders willing to pay a premium to hold long positions. A sustained bullish positional buildup would increase the risk of large long liquidations if the downtrend continues.

Monero risks losing the $400 mark

Monero is down nearly 7% over the last two days, as the 50-day Exponential Moving Average (EMA) at $481 capped the rebound earlier on Wednesday. The privacy coin crosses below the 100-day EMA at $439, while the short-term averages hold above the 200-day EMA at $386, keeping the long-term bias bullish.

The Moving Average Convergence Divergence (MACD) indicator and its signal line decline below zero on the daily chart, and the intense negative histogram suggests bearish momentum is rising. The Relative Strength Index (RSI) at 40 indicates a bearish shift, with selling pressure increasing and further downside room before oversold conditions are reached.

As of Friday, Monero tests the support zone slightly above the January 2 low of $412, and a decisive close below it could target the 200-day EMA at $386.

However, a rebound in XMR from the 100-day EMA at $439 could target the 78.6% Fibonacci retracement level at $495, measured from the January 2 low at $412 to the January 14 high at $800.