2 Stocks to Buy Hand Over Fist Before the Nasdaq Soars Higher in 2026

Key Points

These two companies are growing, and they can help investors capitalize on AI growth in two different ways.

Both companies have solid revenue backlogs that should help them sustain impressive growth momentum.

- 10 stocks we like better than CoreWeave ›

The year may have just begun, but technology stocks are already showing early signs of a promising 2026. The Nasdaq-100 Technology Sector index is up 3.4% so far in 2026, far outpacing the S&P 500 index's 0.3% gain.

It won't be surprising to see tech stocks delivering another year of impressive gains in 2026, primarily driven by the healthy spending on artificial intelligence (AI) infrastructure. Goldman Sachs predicts that the S&P 500 could jump by double-digit percentages again this year, with AI infrastructure investment and adoption being among the reasons behind the investment bank's bullishness.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Given that AI stocks could outperform the S&P 500 in 2026, it's important to take a closer look at a couple of tech stocks that seem worth buying before the market heads higher this year.

Image source: Getty Images.

This AI infrastructure company is skyrocketing in 2026

Shares of CoreWeave (NASDAQ: CRWV) are already up 29% this year. That should come as a massive relief for investors as the neocloud company was under pressure in the second half of 2025 following a blockbuster initial public offering (IPO) in March.

CoreWeave's pullback last year was mainly due to broader concerns about the sustainability of AI spending and circular financing deals. The company's growth, however, has been robust in recent quarters, and its massive revenue pipeline makes it clear that its red-hot growth is sustainable.

CoreWeave provides dedicated AI data centers to customers. These data centers are powered by graphics processing units (GPUs), making them ideal for hyperscalers, enterprises, AI labs, and start-ups to run AI workloads in the cloud. These customers can rent data center compute capacity from CoreWeave, in addition to buying storage and networking services.

CoreWeave's business model has been a hit among customers. This is evident from the fact that the company's revenue tripled in the first nine months of 2025 to $3.56 billion. Meanwhile, lucrative contracts from Meta Platforms, OpenAI, and other customers sent CoreWeave's backlog to $55.6 billion at the end of Q3 2025, up from $15 billion in the year-ago period.

This huge backlog will support CoreWeave's future growth as it builds additional AI data center capacity to fulfill customer contracts. So, it is easy to see why CoreWeave's top-line growth is likely to remain solid in 2026 and 2027.

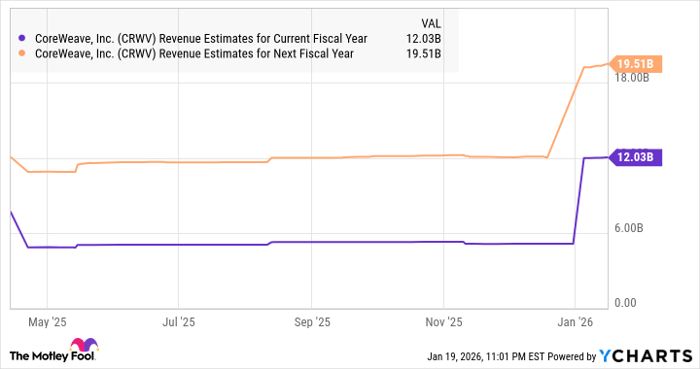

Data by YCharts.

CoreWeave finished 2025 with an estimated revenue of $5.1 billion, and the chart above suggests that its top line could jump fourfold in just two years. Given that CoreWeave is trading at 12 times sales, a slight premium to the U.S. technology sector's average price-to-sales ratio of almost 9, which its stunning growth can justify, it looks worth buying hand over fist right now.

The market could reward the stock with a premium multiple going forward, and that's precisely the reason why this stock could continue soaring this year.

AI productivity gains are powering this company's growth

Palantir Technologies (NASDAQ: PLTR) is emerging as the go-to provider of generative AI software solutions for both enterprise and government customers. The company reported a big jump in demand for its Artificial Intelligence Platform (AIP), which enables customers to connect their data to generative AI tools to boost productivity.

The improved decision-making, greater automation, and reduced redundancy explain why AIP has been a major success, enabling Palantir to not just attract new customers but also gain bigger contracts from existing customers. This is why the company's earnings more than doubled year over year in the third quarter of 2025.

Moreover, the company's growth has been accelerating with each passing quarter.

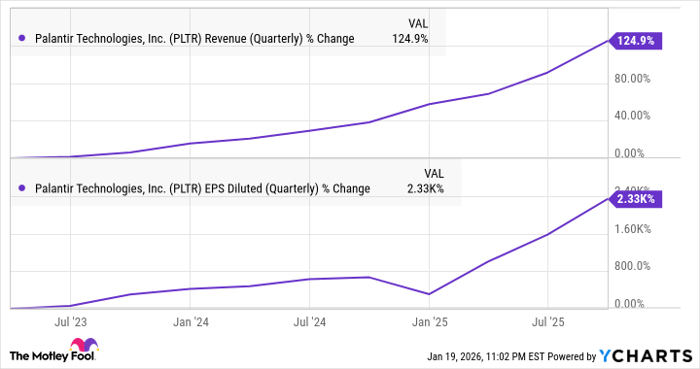

Data by YCharts.

Palantir introduced AIP in April 2023, and the chart above shows that the platform's rapid adoption has supercharged the company's growth since last year. Even better, Palantir seems poised to continue crushing Wall Street's expectations and clocking stronger-than-expected earnings growth.

Consensus estimates project a 40% increase in Palantir's earnings in 2026, but it can easily do much better than that. After all, Palantir is winning new business faster than it is fulfilling existing contracts. This led to a 91% increase in Palantir's remaining deal value (RDV) in Q3 to $8.6 billion, much higher than the 63% spike in revenue.

Also, Palantir's customer count increased by 45% on a year-over-year basis. Given that the new customers Palantir onboards go on to expand AIP deployment across more areas of their business, there is a strong likelihood that Palantir's RDV will increase.

Moreover, the strong unit economics of Palantir's business could help ensure triple-digit earnings growth in 2026. So, even though Palantir trades at an expensive 172 times forward earnings, it can justify that valuation by crushing consensus estimates. That could set the stock up for more upside in 2026, which is why growth investors can still consider buying Palantir stock even after the stunning gains it has achieved so far.

Should you buy stock in CoreWeave right now?

Before you buy stock in CoreWeave, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CoreWeave wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $460,340!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,123,789!*

Now, it’s worth noting Stock Advisor’s total average return is 937% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 22, 2026.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs Group, Meta Platforms, and Palantir Technologies. The Motley Fool has a disclosure policy.