Exclusive Survey: What AI Investors Really Think About Bubble Warnings

Key Points

Buying quality stocks and holding through the volatility of a potential bubble is an important principle for improving returns.

Dollar-cost averaging is another tool that can be used to smooth out risk from potential bubbles.

- These 10 stocks could mint the next wave of millionaires ›

Investors fear that artificial intelligence (AI) stocks are in a bubble, and yet they plan to keep buying and holding anyway. This is one of the most surprising takeaways from The Motley Fool's 2026 AI Investor Outlook Report.

Among the investors surveyed, 57% said that they don't plan to make changes to their AI stock investments -- they plan to just keep holding what they have. Another 36% said they plan to buy even more AI stocks. This means 93% of investors plan to buy or continue to hold AI stocks.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Don't misunderstand: These investors are implementing an incredibly sound investing principle, so I agree that it's a good idea. Consider that even the best-performing stocks of the past decade had substantial drawdowns at one time or another. The path to market-crushing returns required investors to hold through this volatility. It's why one of the easiest paths to improving investment returns is to improve your ability to hold on.

However, the 2026 report found that 41% of investors believe there's a speculative bubble in AI stocks and only 26% believe that current prices are sustainable. A bubble occurs when the prices of stocks rise faster than the value of the businesses. If that's the predominant perception, it's surprising that investors keep buying and holding more AI stocks.

What should investors do?

Stock market bubbles can pop, leaving investors with big losses as prices come back down to earth. That's the risk of buying and holding. But if AI is truly on such a world-changing path, then investors risk missing out on life-changing gains by not investing.

I believe investors can do a couple of things to avoid both risks. First, be selective with investment decisions. If AI stocks are generally in a bubble, there are undoubtedly more speculative options than others. A top-notch AI business, such as Alphabet, is unlikely to disappoint investors over the long term. Investing in a random AI start-up you only just heard about in passing probably won't work out as well.

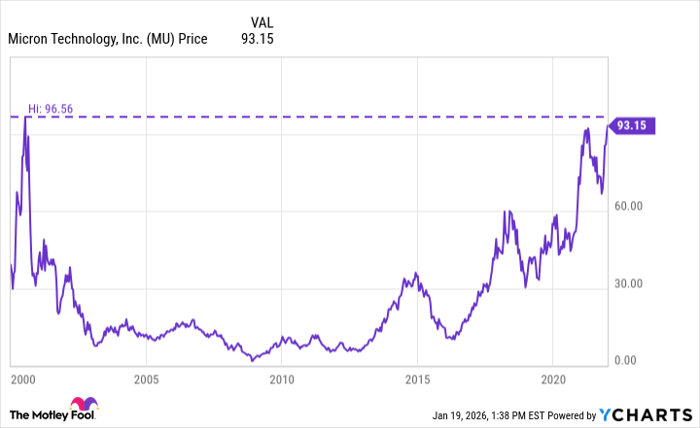

Second, investors who buy AI stocks today don't need to invest everything all at once. Take Micron Technology as an example from the dot-com bubble. If you only invested once in Micron stock and it happened to be the height of the bubble, it would have taken over 20 years for your investment to recover.

MU data by YCharts

However, Micron's work in computer memory was important then. And its high-bandwidth memory is more important today than ever, thanks to AI. For investors who invested at the top of the bubble but continued investing over the years, recovery has been much faster, and long-term returns have been much higher.

The concept is called dollar-cost averaging (DCA) -- investing smaller sums at regular intervals to build a full position. It eliminates the risk of investing everything right before a bubble potentially bursts, but it still gets investors into the game to avoid the risk of missing out on an important investing trend.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 937%* — a market-crushing outperformance compared to 194% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Stock Advisor.

See the stocks »

*Stock Advisor returns as of January 22, 2026.

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet and Micron Technology. The Motley Fool has a disclosure policy.