Want to Earn $2 Million in the Stock Market? Here's What You'll Need to Invest Each Month.

Key Points

S&P 500 ETFs can be a smart way to build wealth while limiting risk.

A long-term outlook is key to maximizing earnings in the stock market.

Investing in individual stocks may be a better way to earn above-average returns.

- 10 stocks we like better than S&P 500 Index ›

Americans believe it takes an average net worth of $2.3 million to be considered wealthy, according to a 2025 survey from Charles Schwab, or around $839,000 to be "financially comfortable."

Investing is one of the simplest and most effective ways to build wealth, and you don't need to be a stock market expert to get started. If you have a goal of accumulating $2 million in the stock market, here's what you'd need to invest each month to get there.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Choosing the right investment

Where you choose to invest will depend largely on your risk tolerance and what you're trying to achieve. If you're a beginner or are simply looking for a no-fuss investment that you can buy and hold for decades, an S&P 500 ETF can be a great choice.

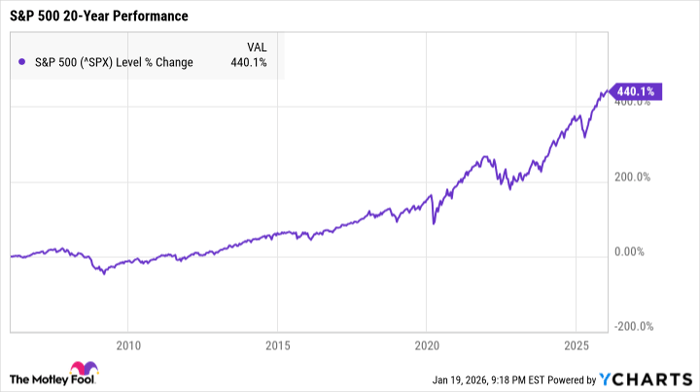

The S&P 500 (SNPINDEX: ^GSPC) is made up of 500 leading U.S. companies, and an S&P 500 ETF includes the same stocks as the index while aiming to replicate its performance.

^SPX data by YCharts

The primary advantage of an S&P 500 ETF is its long-term stability and track record. Analysis from Crestmont Research found that every 20-year period in the S&P 500's history has ended in positive total returns. This means that if you'd simply held an S&P 500 fund for 20 years, you'd have made money no matter how severe the volatility was in those decades.

Building a $2 million portfolio

Staying in the market for decades is key to maximizing your earnings in the stock market, so the sooner you can get started investing, the better.

Historically, the total returns of the S&P 500 have produced a compound annual growth rate of around 10%. If you're earning a 10% average annual return going forward, here's approximately what you'd need to invest each month to build a portfolio worth at least $2 million, depending on how many years you can invest:

| Number of Years | Amount Invested Each Month | Total Portfolio Value |

|---|---|---|

| 20 | $3,000 | $2.062 million |

| 25 | $1,700 | $2.006 million |

| 30 | $1,050 | $2.073 million |

| 35 | $625 | $2.033 million |

| 40 | $400 | $2.124 million |

Data source: Author's calculations via investor.gov.

One potential downside to the S&P 500 ETF is that it can only earn average returns. This investment follows the performance of the market, so it can't beat the market.

That might not be a dealbreaker for everyone, but if you're looking to earn higher-than-average returns, you may be better off investing in individual stocks. This approach requires more research, but you'll likely earn more than you would with a broad market ETF.

The S&P 500 ETF is a simple and straightforward investment that can help build long-term wealth, but getting started investing early is key. With enough time and consistency, you could potentially accumulate millions of dollars in the stock market.

Should you buy stock in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $470,587!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,091,605!*

Now, it’s worth noting Stock Advisor’s total average return is 930% — a market-crushing outperformance compared to 192% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 21, 2026.

Katie Brockman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.