US-Europe Trade War Reignites, Bitcoin’s $90,000 Level at Risk

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

TradingKey - As the US-EU tariff war reignites, Bitcoin prices are weakening and may briefly fall below the $90,000 mark.

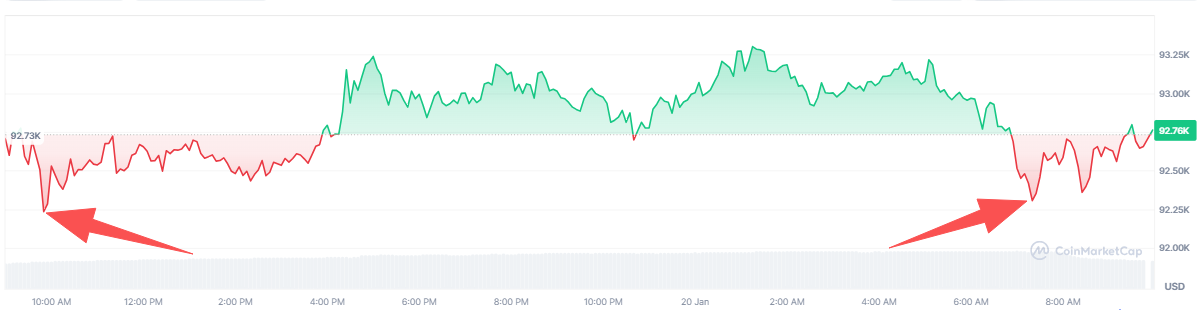

Over the past 24 hours, Bitcoin ( BTC) prices have dropped to $92,000 twice, and the bears remain dominant. During this period, Bitcoin prices rebounded slightly, rising only about $1,000—a gain of just 1%, indicating weakness and exhaustion among the bulls.

[Bitcoin Price Chart, Source: CoinMarketCap]

[Bitcoin Price Chart, Source: CoinMarketCap]

Since the U.S. threatened to impose tariffs on eight European nations, Bitcoin has declined for three consecutive days, while spot gold prices ( XAUUSD) have surged against the trend to set new record highs, currently trading above $4,600 per ounce and sitting at $4,673.

[Spot Gold Price Chart, Source: TradingView]

[Spot Gold Price Chart, Source: TradingView]

On January 17, U.S. President Trump stated on social media, "Due to the Greenland issue, starting February 1 this year, all goods exported to the U.S. from eight EU countries will be subject to a 10% tariff. By June 1, the tariff will increase to 25%." This news triggered a surge in safe-haven demand, driving gold prices sharply higher, while Bitcoin reversed its gains and fell.

There are about 10 days left before the US-EU tariffs take effect; however, will the Greenland tariffs actually be implemented? During Trump's second term, he has frequently walked back certain tariff threats, such as the 25% tariff announced this month on countries trading with Iran, which has yet to see any action. In other words, Trump may simply be issuing threats without eventual enforcement.

Furthermore, Senate Democrats are attempting to block Trump's tariffs on Europe from being implemented. Senate Democratic Leader Schumer stated: "Senate Democrats will introduce legislation to block these tariff policies from taking effect, to prevent further damage to the U.S. economy and our European allies."

In the face of U.S. tariff threats, relevant parties are responding. Among them, EU lawmakers are prepared to suspend the ratification of trade agreements between the EU and the U.S. Furthermore, eight European nations issued a joint statement on January 18, stating, "(The U.S.) threat of additional tariffs undermines transatlantic relations and risks triggering a dangerous downward spiral; the eight nations will coordinate a united response."

Currently, Trump has not issued further statements regarding the stance of European parties and is highly likely to respond at the World Economic Forum Annual Meeting in Davos. This Wednesday (January 21), Trump returns to the Davos Forum after six years to deliver a speech on "How We Can Cooperate in an Increasingly Competitive World." Whether the acquisition of Greenland and the tariffs will be part of his discussion is becoming a focal point for the market.

If Trump signals a softening on tariffs during his Davos speech, it would provide a short-term boost for a Bitcoin price rebound. However, if he maintains a rigid stance or even escalates the tariff war, it will inevitably embolden the bears to suppress Bitcoin prices, potentially testing the downside again or even breaking below the $90,000 threshold. Historically, the impact of tariff wars on Bitcoin prices has been transitory; this year, the primary focus remains on the choice of the Federal Reserve Chair and the outlook for interest rate cuts.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.