Don’t Fight the Fed—Not Even NVIDIA Can

TradingKey - Markets have spent the past week looking for reasons to explain the pullback. Talk of an “AI bubble”—or pressure from the recent crypto selloff— has circulated widely. But what’s starting to look more plausible: it’s not the trades—it’s the central bank.

The current wave of “AI skepticism” gripping headlines can largely be traced back to one date: October 29, when Fed Chair Jerome Powell gave markets something they didn’t want. If Powell had said what many were hoping—something to the effect of “given the fragility of growth, more cuts are likely”—there's every chance the market would’ve gone on to enjoy a classic late-November seasonal lift. Instead, we got the opposite—and equities have struggled ever since.

It was another reminder of the old Wall Street rule: Don’t fight the Fed. Even Nvidia—arguably one of the few real Alpha stories in an otherwise Beta-dominated macro tape—couldn’t do enough to offset the tone shift.

Nvidia CEO Pushes Back Against “Bubble” Narrative

Wednesday brought two major moments for Nvidia, both highly visible.

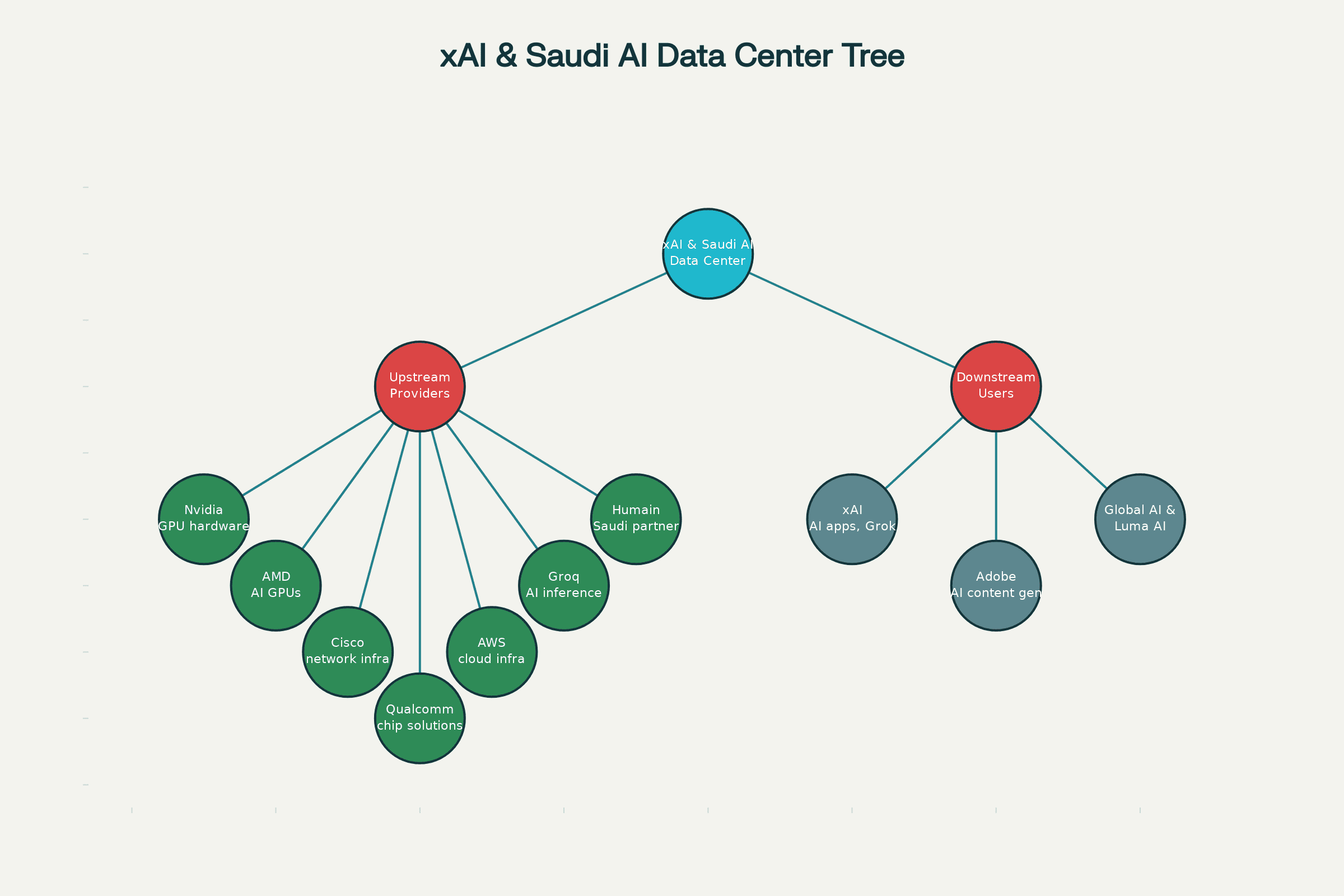

First, CEO Jensen Huang appeared alongside Elon Musk at the U.S.-Saudi Investment Forum in Washington. There, Saudi officials announced plans to build a hyperscale data center equipped with hundreds of thousands of Nvidia GPUs. The facility’s first anchor client will be Musk’s AI firm, xAI. The Kingdom also said it aims to launch its own foundational model, “ALLAM,” and will jointly steer operations with global tech partners.

That night, Nvidia reported earnings—and crushed expectations. The company also gave an unusually bullish guide: management said it now has revenue visibility of around $500 billion for its next-generation Blackwell and Rubin platforms through the end of 2026.

Unsurprisingly, questions about a tech overbuild came up again. Huang responded with a firm “no,” arguing that the market is going through three long-term structural shifts: the move from general-purpose to accelerated computing, the shift from traditional ML to generative AI, and the emergence of “agentic” and physical AI applications.

Mixed Employment Data Brings Rate-Cut Debate Back into Focus

Thursday’s NFP report only added to the confusion. The numbers were mixed—and so were the interpretations.

One camp viewed the slight uptick in unemployment as added justification for a December rate cut. The other—backed by stronger-than-expected job growth—said it confirms the Fed should hold steady, especially since no new jobs data will be released before the December 9–10 policy meeting.

Indeed, due to the recent government shutdown, the Bureau of Labor Statistics confirmed that the October jobs report was canceled outright, and that November’s data won’t arrive until December 16—after the FOMC.

Morgan Stanley, for its part, landed firmly in the “no-cut” camp. In a note out shortly after the report, the bank withdrew its forecast for a 25bp cut in December, citing “unexpected labor resilience.” Payrolls increased by 119,000, and while the unemployment rate ticked up slightly to 4.4%, the firm called the broader tone “stabilizing.”

Traders appear unconvinced either way. After the data hit, the implied probability of a December cut moved only modestly—to about 35%, according to CME data.

In the meantime, Fed speakers came out swinging.

Vice Chair Michael Barr said that with inflation still around 3%, “policy caution” remains essential. Kansas City Fed President Jeffrey Hammack warned that premature cuts could prolong inflation and invite financial excess. New York Fed’s David Miran separately suggested that the central bank is unlikely to resume MBS purchases anytime soon. Chicago Fed President Austan Goolsbee added that the case for “preemptive cuts” isn’t compelling at this stage.

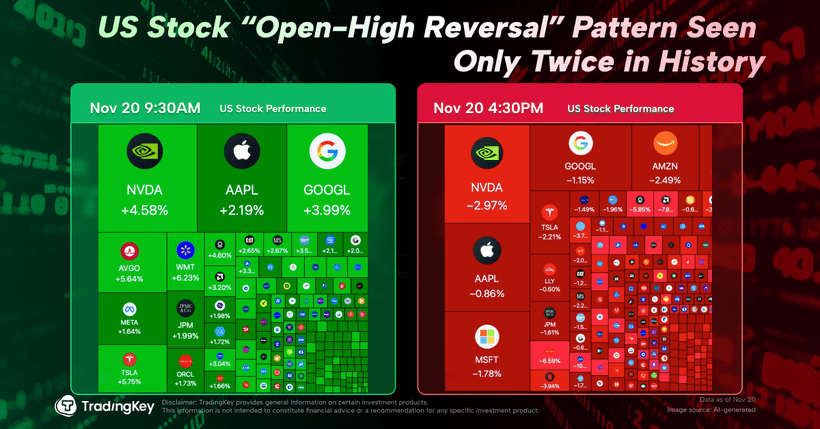

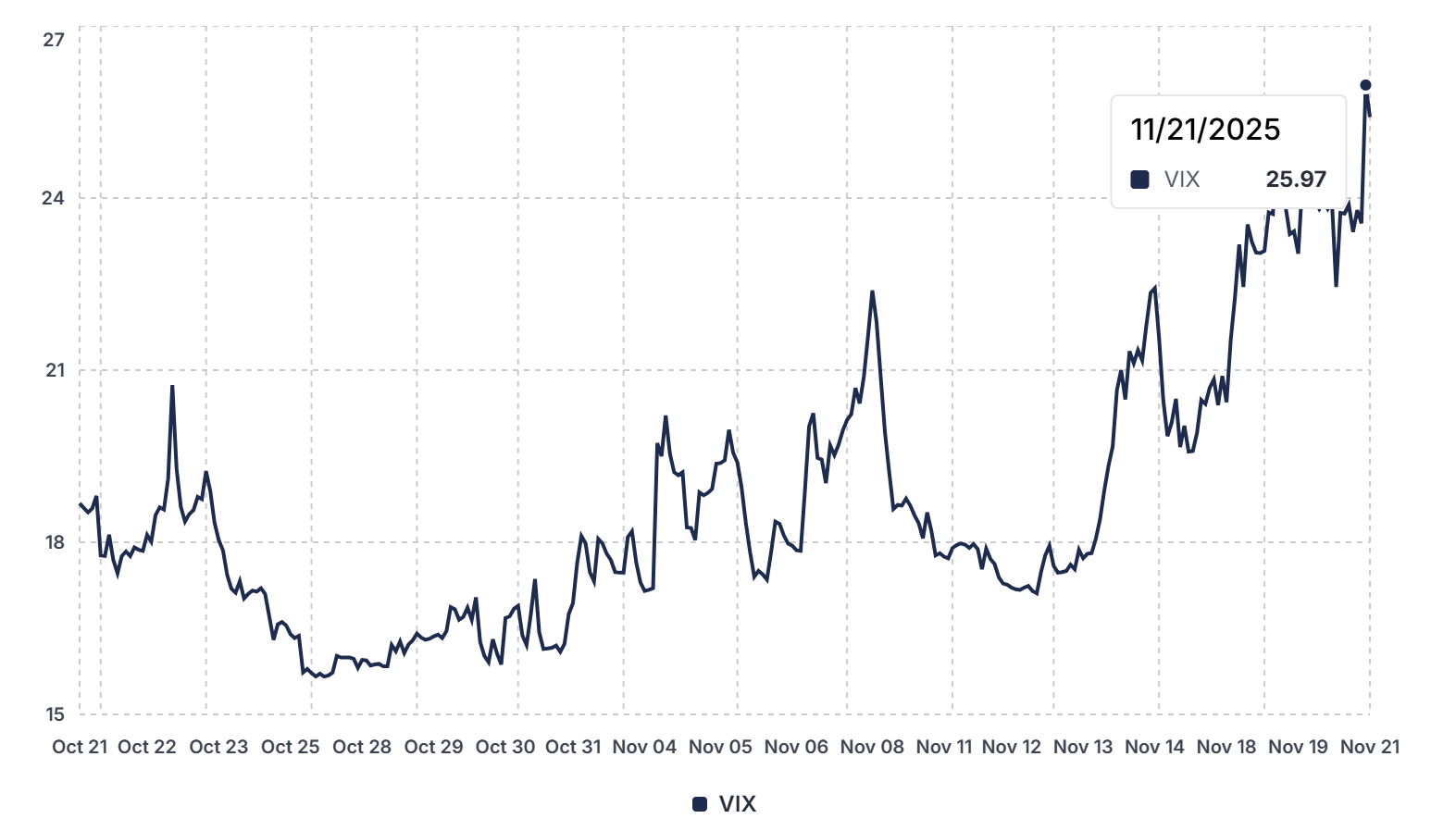

VIX Spikes, Risk Assets Slide

On Thursday morning, fresh off Nvidia’s stellar report, markets opened higher. Tech led the early gains. But by mid-morning in New York—around 10 a.m.—bid support faded. Then came a broad selloff: stocks, crypto, and other risk assets moved lower together.

Data showed the VIX closing at 26—its highest level since April. The S&P 500 logged its biggest single-day loss since April 8.

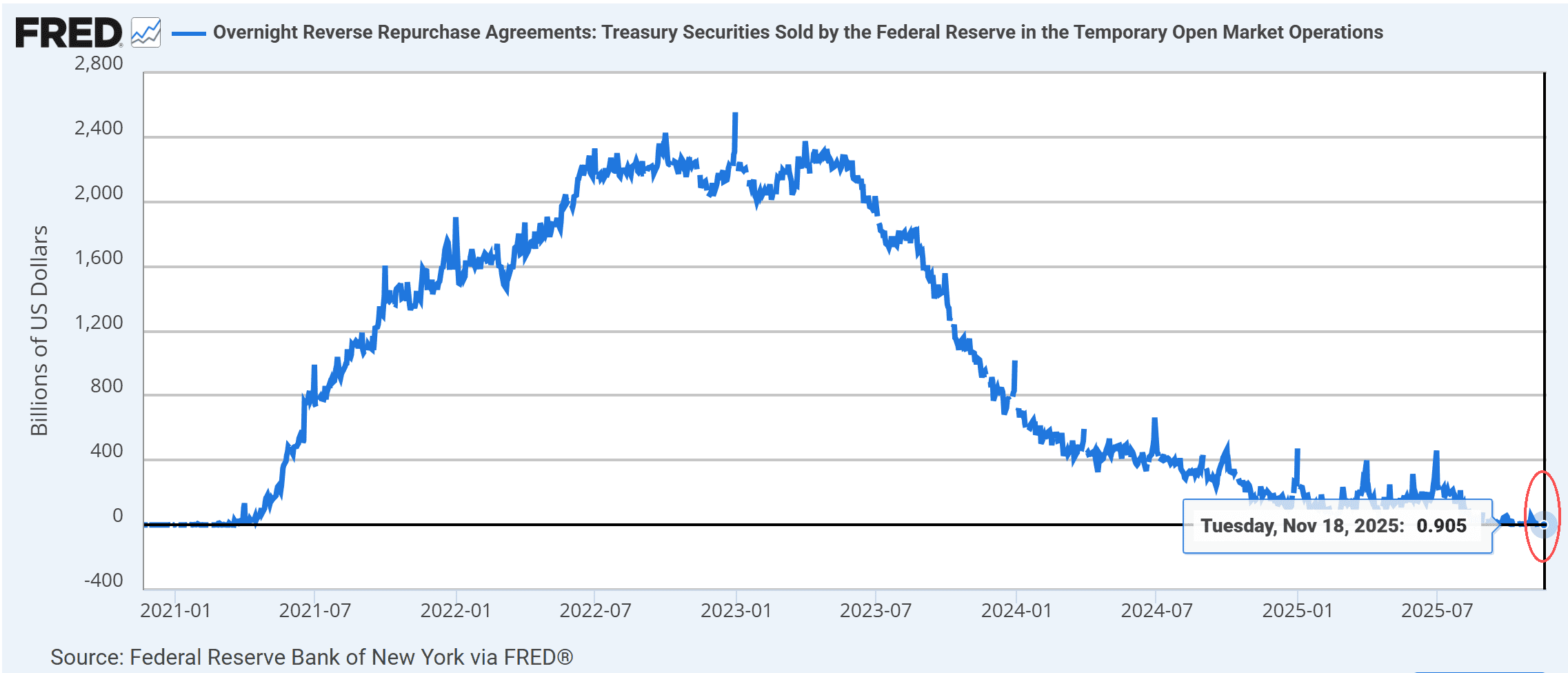

Expectations had been building for a positive inflection after the end of the government shutdown. In theory, liquidity should’ve returned. In reality, quite the opposite.

The Fed’s reverse repo facility (RRP)—a key gauge of excess liquidity—has been declining steadily, falling below $1 trillion for the first time in months on November 18. That suggests system liquidity is deteriorating, not recovering.

Against that backdrop, U.S. Treasury yields actually drifted lower on Thursday—suggesting a flight-to-quality bid.

In Asia, Japan and South Korea stocks fell overnight. Europe opened weaker as well.

The much-discussed “November rally” is now facing pressure from all sides—seasonality may not be enough to override renewed macro risk.