What's Really Inside the AI Bubble? Decoding the Core Controversies Over Scale, Reliance and Valuation

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Gold slumps below $5,100 as US Dollar gains

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

- US Dollar Index gathers strength to near 99.00 on Middle East tensions, robust US services data

- WTI climbs to $76.00, eyes one-year high amid rising tensions in the Middle East

- How to Survive Bitcoin Winter? Will It Still Fall Below $60,000 in 2026?

TradingKey - As ChatGPT nears its three-year anniversary, the AI boom has fueled a three-year U.S. equity rally. However, growing AI bubble concerns and investor fatigue now threaten to derail market momentum.

This comes as the artificial intelligence fervor, which ChatGPT ignited, has propelled U.S. equities, positioning the S&P 500 index for a third consecutive year of over 20% gains. Yet, at this crucial juncture in Q4 2025, an increasingly vocal AI bubble narrative and investor fatigue could undermine the market's trajectory.

Technology analyst Scott Galloway points out that AI has contributed 80% of stock market returns since ChatGPT's launch in late 2022. Some observers contend that AI is now the fundamental force sustaining both the stock market and the broader economy, with OpenAI at the core of this narrative.

Reviewing U.S. equity performance since 2025, the S&P 500 — which has already recorded its first consecutive two years of gains exceeding 20% since the 1990s — demonstrated a distinct "V-shaped" trend around April. Donald Trump's tariff policies were a central factor in shaping this market pattern, while the significant rebound post-April was primarily driven by expectations of Federal Reserve rate cuts and robust AI-related trading activity.

Year-to-date, the S&P 500 has risen approximately 15%. As the index continues its upward trajectory, new catalysts appear to be scarce. Furthermore, both the Federal Reserve's rate cut path and the monetization capabilities of AI are undergoing renewed scrutiny from investors.

What exactly are the concerns surrounding an AI bubble? Broadly, the AI bubble thesis centers on several key anxieties: Firstly, whether the massive AI infrastructure build-out is supported by sufficient genuine demand. Secondly, whether the tech giants' increasing reliance on AI business models creates a more precarious market balance. Lastly, whether the current, often astounding, valuation levels can be adequately justified.

Is Data Center Construction Becoming Excessive?

When discussing AI development, the immediate thought often turns to the "heavy investment" by major tech giants in AI data centers, built with record capital expenditure. These facilities are high-performance computing and storage infrastructures specifically designed to support intensive AI tasks.

From Silicon Valley to Wall Street, the divergence in opinions among AI market participants regarding AI computing power demand has intensified. Nvidia CEO Jensen Huang, a key supplier of AI hardware, has indicated extremely strong demand for his company's advanced Blackwell chips. He has even personally visited foundry manufacturer TSMC to urge additional production expansion plans.

AMD, at its recent Analyst Day, also offered an optimistic outlook. The company projects that the AI data center market will exceed $1 trillion by 2030, with its data center business potentially achieving an average annual growth rate of 80%.

In stark contrast to these hardware giants, closely watched firms like CoreWeave and Nubius tempered high market expectations for AI cloud computing demand during their third-quarter earnings releases. This has exposed underlying operational and financial pressures within their businesses.

The Verge described CoreWeave as the "core of the AI bubble," raising questions about its unconventional financing methods and an unusual reliance on Nvidia. There are growing concerns that if future AI computing power demand fails to meet past or anticipated levels, these companies' prospects could face significant pressure.

From an AI industry chain perspective, the most pressing concern lies with the AI end-demand, largely represented by OpenAI. OpenAI, which is not projected to achieve profitability until at least 2029, is sinking deeper into a cash-intensive cycle. Moreover, it has yet to provide the market with a sufficiently clear and actionable path to profitability.

Tech blogger Ed Zitron has warned that OpenAI's cash burn rate may have been three times higher than publicly available data, with the disparity between its escalating costs and revenue growth being wider than commonly believed.

Should the principal players driving this "AI Circularity" fail to fulfill their future commitments to procure vast computing resources, a substantial amount of data centers and other infrastructure could become idle assets. Consequently, companies like Oracle, which rely on nominally "future revenue," might face a severe backlash from overly optimistic capital market expectations.

The application of AI technology within the enterprise sector also presents a less optimistic picture. Stuart Mills, a senior researcher at LSE, observes a widening gap between AI's promise and the actual value it delivers to businesses. While many are using it, AI is not directly contributing to value-producing tasks, he says.

Even assuming positive development trajectories, a critical question remains: are investors willing to maintain an optimistic outlook and wait another three years, or even longer, to ascertain whether data center demand needs to be rationalized or expanded?

Deeper, Broader Reliance

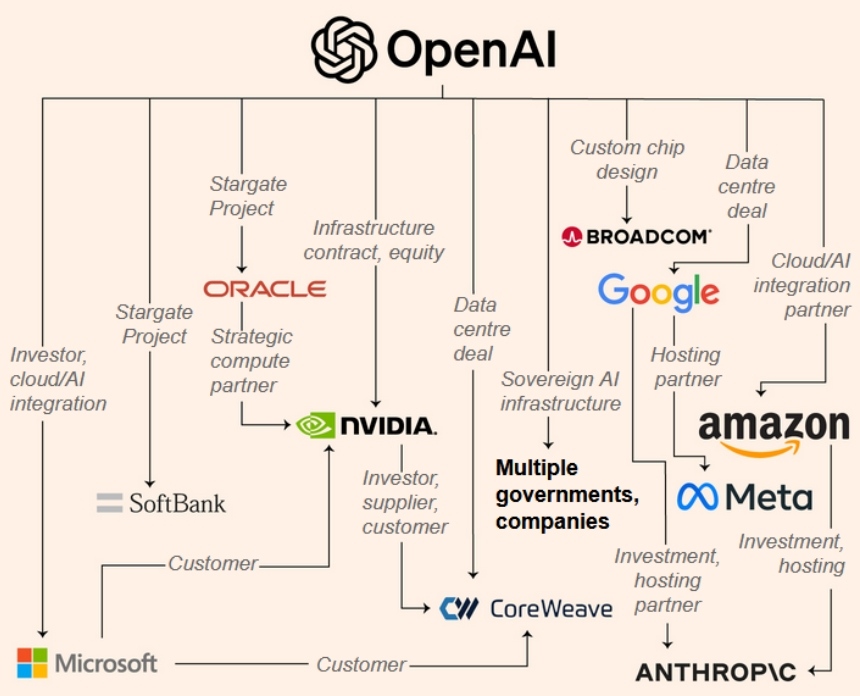

Unlike the relatively straightforward supply and demand dynamics of past industry chains, today's AI ecosystem has evolved into an "ecological closed-loop" or "circularity." This intricate web, characterized by cross-shareholdings, further complicates the AI landscape.

【Source: Financial Times】

Cooperative relationships, such as Nvidia's stake in OpenAI or AMD granting shares to OpenAI, superficially create a "community of shared destiny" based on mutual interdependence. However, increased substitutability for one party or a surge in unilateral business risk could disrupt any link at any moment, thereby breaking this circularity.

For instance, Oracle might struggle to secure sufficient funding for infrastructure development, or OpenAI's flagship models could become less popular.

Carl-Benedikt Frey, an AI-focused professor at Oxford University, notes that massive bets on AI infrastructure are predicated on expectations of a surge in usage. Yet, multiple U.S. surveys indicate that actual adoption rates have declined since this summer.

Therefore, unless new and sustainable application scenarios emerge rapidly, the market will inevitably face an adjustment, and the potential for a bubble to burst increases.

The growing tendency of tech giants to expand their corporate debt financing is drawing a broad base of bond investors into the AI ecosystem.

According to JPMorgan Chase, over $5 trillion in AI-related spending over the next five years will necessitate participation from every public capital market, private credit, alternative capital provider, and even government entities.

Moody's, a prominent rating agency, commented on the relationship between Oracle and OpenAI. It stated that an over-reliance on a limited number of AI companies and the expanded use of debt markets to build capacity pose significant risks to Oracle's credit rating. This concern is particularly acute given that Oracle's largest customer to date is a venture capital-funded startup.

The Need for Clear AI Valuation Justification

For many investors, the bursting of the dot-com bubble at the turn of the century remains a stark memory; it took 16 years for technology company valuations to recover from that speculative fervor.

The fundamental question defining a bubble is whether revenue growth can keep pace with stock prices, which are often inflated by a massive influx of capital.

Optimistic Wedbush analyst Dan Ives, however, stated he is not concerned about the risks of circular financing. He asserts that companies' investments are yielding substantial real returns, with every dollar invested recouping an estimated $12 to $15.

Conversely, according to JPMorgan Chase's projections, achieving even a 10% return on AI investments by 2030 would necessitate the continuous generation of $650 billion in annual revenue. This is an astonishing scale, equivalent to 58 basis points of global GDP.

Industry insiders point out that after a prolonged period of hype, companies are becoming more discerning about AI investments. The focus is shifting from grand promises to a demand for clear, demonstrable impact, ensuring measurable returns on investment.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.