This Artificial Intelligence (AI) Chip Stock Has Crushed Nvidia and Broadcom This Year. It Can Still Soar Higher.

Key Points

The demand for semiconductor manufacturing equipment is robust, and that's helping this company clock healthy growth.

The chip equipment supplier has delivered impressive results recently, and its solid earnings growth potential suggests further upside.

- 10 stocks we like better than Lam Research ›

Nvidia and Broadcom are the leading players in the artificial intelligence (AI) chip market, with both companies witnessing significant growth in revenue and earnings thanks to terrific demand.

While Nvidia is the dominant force in the AI data center graphics processing unit (GPU) market, Broadcom leads the custom AI processor space. Both types of chips are being deployed for AI model training and inference, which explains why both have been reporting outstanding growth in recent quarters.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Their impressive financial performance has translated into solid upside on the market as well. Nvidia stock has gained 42% this year as I write this, while Broadcom has registered a 56% increase. However, there's another semiconductor stock that has delivered much bigger gains than these giants. Lam Research (NASDAQ: LRCX) stock has shot up 117% in 2025 as of this writing.

Image source: Getty Images.

Lam Research's addressable market is getting bigger thanks to AI

Lam Research manufactures and sells semiconductor manufacturing equipment that's used for fabricating chips. The company also provides customer support services and upgrades. The industry in which Lam operates is enjoying healthy growth owing to the AI-fueled global chip boom.

Organizations and governments across the world are showing a massive appetite for semiconductors that power AI applications. This is evident from the multibillion-dollar deals struck by major AI companies and hyperscalers in recent months to build out more AI infrastructure. In fact, Nvidia projects that building AI infrastructure could require $3 trillion to $4 trillion worth of investment in the next five years.

Not surprisingly, consulting giant PwC estimates that a whopping $1.5 trillion could be spent on new chip fabrication facilities between 2024 and 2030. Lam Research is going to be one of the key beneficiaries of this massive outlay as foundries and chipmakers invest in more equipment to churn out more chips. The company released its fiscal 2026 first-quarter results (for the quarter ended Sept. 28) on Oct. 22, and its numbers were comfortably ahead of analysts' expectations.

Lam reported a year-over-year increase of 27.5% in revenue to $5.32 billion. Its non-GAAP (adjusted) earnings increased at a stronger pace of 46% from the year-ago period to $1.26 per share. CEO Tim Archer remarked on the latest earnings call with analysts that AI-driven semiconductor equipment requirements "play extremely well to Lam's product strengths."

Management estimates that every $100 billion worth of incremental data center investment is expanding Lam's addressable market by $8 billion. Also, the upgrading of existing facilities is likely to open a $40 billion addressable opportunity for Lam. As such, Lam is not only going to benefit from new fabrication plants, but also from the conversion of existing fabs so they can manufacture advanced chips, which should drive robust growth in the company's customer-service business.

The company's guidance for the current quarter suggests that it is on track to sustain its healthy growth. Lam is forecasting $5.2 billion in revenue in the current quarter, which would be an improvement of 19% from the year-ago period. Additionally, it is forecasting a 26% increase in its earnings to $1.15 per share. Importantly, Lam points out that it is expecting stronger growth in the second half of the current fiscal year.

So, there is a good chance that the company's growth rates could improve as the year progresses.

A simple reason why this stock could keep skyrocketing

It won't be surprising to see Lam Research outpacing analysts' growth expectations. Consensus estimates are projecting an increase of 15% in Lam's top line in the current fiscal year to $21.2 billion. However, its Q1 performance, the current quarter's guidance, and expectations of a stronger second half suggest that it could exceed that mark.

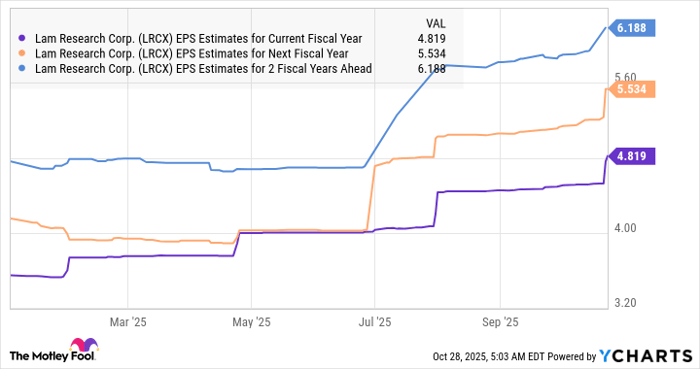

Similarly, analysts are expecting an increase of just 16% in Lam's earnings in the current fiscal year to $4.82 per share. Lam's on track to beat that as well. And analysts are scrambling to raise their earnings targets following Lam's latest report.

LRCX EPS Estimates for Current Fiscal Year data by YCharts

Don't be surprised to see Lam exceeding the updated estimates in the future considering the healthy state of the semiconductor equipment market. Throw in the fact that Lam stock can be bought at an attractive 33 times forward earnings estimates right now, in line with the tech-laden Nasdaq-100 index's forward earnings multiple, it is easy to see why it is a no-brainer investment right now.

Should you invest $1,000 in Lam Research right now?

Before you buy stock in Lam Research, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lam Research wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $603,392!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,241,236!*

Now, it’s worth noting Stock Advisor’s total average return is 1,072% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Lam Research and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.