- Gold Price Forecast: XAU/USD slumps to near $4,000 on US-China trade progress

- Gold holds gains near $3,950 ahead of Trump-Xi meeting

- Australian Dollar maintains position due to US-China trade optimism

- Bitcoin, cryptos fail to rally as Fed Chair sparks cautious sentiment

- Fed’s October Rate Cut: Easing Cycle Continues, Gold Likely to Keep Rising

- Silver slips below $47.00 due to optimism over US-China trade deal

Here is what you need to know on Monday, November 3:

The US Dollar (USD) starts the new week in a relatively calm manner after outperforming its major rivals in the previous week. In the second half of the day, the Institute for Supply Management (ISM) will publish the US Manufacturing Purchasing Managers' Index (PMI) data for October.

US Dollar Price Last 7 Days

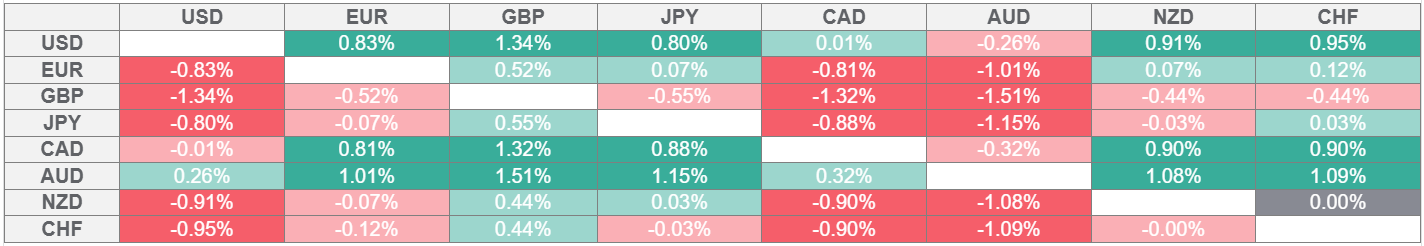

The table below shows the percentage change of US Dollar (USD) against listed major currencies last 7 days. US Dollar was the strongest against the British Pound.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Following Federal Reserve (Fed) Chairman Jerome Powell's cautious comments on policy-easing earlier last week, several Fed policymakers echoed his tone by noting that it might not be easy to cut rates again in December. In turn, the USD Index preserved its bullish momentum and climbed to its highest level since early August above 99.80 on Friday. Early Monday, the index stays in a consolidation phase at around 99.70. Meanwhile, US stock index futures trade mixed in the European morning after Wall Street's main indexes registered small gains on Friday.

The data from China showed earlier in the day that the business activity in the manufacturing sector expanded at a modest pace in October, with the RatingDog Manufacturing PMI coming in at 50.6. This reading missed the market expectation of 50.9.

After closing in negative territory for three consecutive days, EUR/USD finds a foothold on Monday and fluctuates in a narrow band below 1.1550.

AUD/USD clings to small recovery gains near 0.6550 after ending the previous week virtually unchanged. In the Asian session on Tuesday, the Reserve Bank of Australia (RBA) will announce monetary policy decisions. Markets expect the RBA to keep its policy rate unchanged at 3.6%.

USD/JPY climbed to its highest level since February near 154.50 last week. With Japanese officials verbally intervening by noting that they continue to closely monitor in foreign exchange markets, the pair stabilized toward the end of the week. Early Monday, USD/JPY moves sideways, slightly above 154.00.

GBP/USD lost more than 1% last week and briefly dipped below 1.3100 on Friday. The pair struggles to gather recovery momentum on Monday and trades near 1.3150.

Gold remained relatively calm on Friday but ended up losing more than 2% on a weekly basis. XAU/USD holds steady above $4,000 to start the new week.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.