Gold Price Forecast: XAU/USD tumbles to near $3,950 on Fed's hawkish comments, trade optimism

- Silver Price Forecast: XAG/USD surges to record high above $56 amid bullish momentum

- Fed Chair Candidate: What Would a Hassett Nomination Mean for U.S. Stocks?

- After the Crypto Crash, Is an Altcoin Season Looming Post-Liquidation?

- The 2026 Fed Consensus Debate: Not Hassett, It’s About Whether Powell Stays or Goes

- U.S. PCE and 'Mini Jobs' Data in Focus as Salesforce (CRM) and Snowflake (SNOW) Report Earnings 【The week ahead】

- AUD/USD holds steady below 0.6550 as traders await Australian GDP release

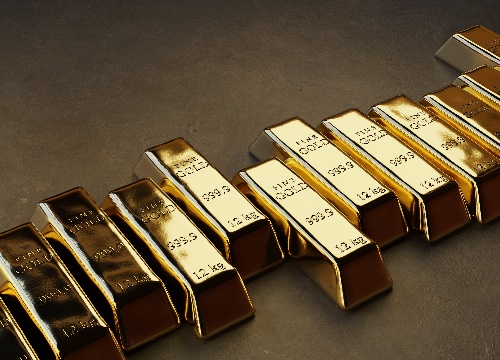

Gold price falls to around $3,965 in Monday’s early Asian session.

Trump said he would trim tariffs on China to 47% from 57%.

Cooling US-China trade tensions and the Fed’s hawkish tone weigh on the precious metal.

Gold price (XAU/USD) slumps to near $3,965 during the early Asian session on Monday. The precious metal extends the decline as a constructive US-China outcome reinforces global risk appetite. Traders await the release of the US ISM Manufacturing Purchasing Managers' Index (PMI) data for October, which is scheduled for release later on Monday.

US President Donald Trump and Chinese President Xi Jinping agreed to avoid escalation in their trade war last week. Trump decided to lower his tariff from 57% to 47% in exchange for China suspending export controls on its rare earths and increasing purchases of American soya beans. Positive developments surrounding the US-China trade deal could reduce the demand for safe-haven assets and undermine the Gold price

Additionally, the hawkish remarks from the Federal Reserve (Fed) officials contribute to the yellow metal’s downside. The US central bank lowered its benchmark overnight borrowing rate at its October meeting last week to a range of 3.75%-4.0%.

Fed Chair Jerome Powell said during the press conference that a further reduction in the policy rate at the December meeting is not a foregone conclusion. The markets are discounting a 63% odds that the Fed will cut the fed funds target range by 25 basis points (bps) at the December meeting. The markets are discounting an overall 82 bps rate reduction by the end of 2026 to 3.06% from the current effective federal funds rate of 3.88%.

The US ISM October Manufacturing PMI data could offer some hints about the US economic outlook. If the report shows a weaker-than-expected outcome, this could drag the US Dollar (USD) lower and provide some support to the USD-denominated commodity price in the near term.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.