EUR/GBP Price Forecast: Euro consolidaties gains around 0.8800

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

- Bitcoin Rebounds After Falling to $62,500 Low, Crypto Market Still Extremely Fearful

- Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH and XRP post cautious recovery amid downside risks

The Euro fluctuates around 0.8800 against the British Pound after rallying from last week's lows at 0.8670.

Positive comments by ECB speakers, dismissing further rate cuts, are supporting the pair.

The Pound remains vulnerable amid growing concerns about the UK's public finances.

The Euro appreciates for the fourth consecutive day against a weaker Pound, with price action showing consolidation around the 0.8800 area on Friday's early European session, on track for a 0.8% weekly rally. Positive comments from Fed officials are supporting the Euro ahead of the Eurozone's HICP release, while the Pound remains vulnerable on concerns about the UK's public finances.

The European Central Bank provided some support to the common currency on Thursday, keeping interest rates on hold and dismissing chances of a further rate cut in the near term. On Friday batch of ECB officials has endorsed President Lagarde's message, highlighting the improving economic outlook and showing no urgency to cut interest rates further.

The Pound, however, remains on its back foot after a report by the UK Office for Budget Responsibility (OBR) cut its productivity growth forecasts for the next five years by 0.3%, likely adding a GBP 20 billion hole to the already strained public finances. This news and the moderate September inflation figures have boosted expectations that the BoE might cut rates again before the year end

Technical analysis: A small triangle pattern suggests further appreciation

The technical picture shows price action forming a small symmetrical triangle around the 0.8800 level, as the 4-hour Relative Strength Index (RSI) retreats from oversold levels. Triangles are is considered a continuation pattern, which suggests that the pair is in a consolidation phase, before resuming its bullish bias.

The triangle top, at the 0.8810 area, is holding bulls for now, ahead of the October 29 high, near 0.8820. Further up the 61.8% extension of the October 21 - October 24 rally, at 0.8840 emerges as a potential target, ahead of the April 2023 highs, at the 0.8875 area.

A bearish reaction, below the triangle bottom, now at 0.8790, is likely to find some support at the 0.8775 intraday level ahead of a previous resistance area around 0.8745 (September 26, October 24 lows).

Pound Sterling Price This week

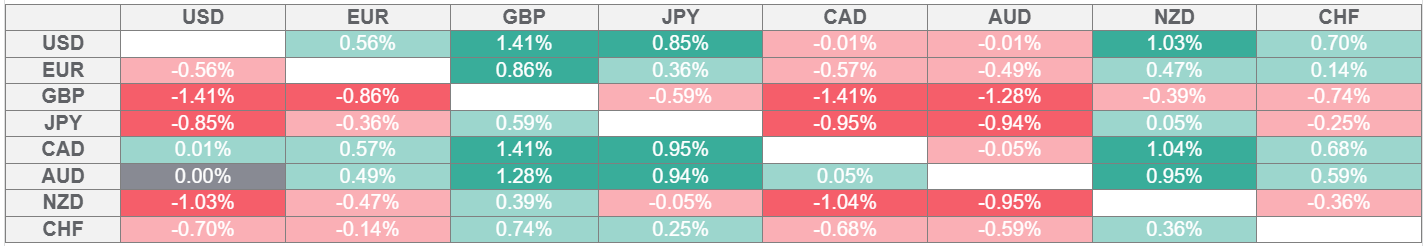

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.