Litecoin Price Prediction: What to expect as SEC opens public comments for Canary’s LTC ETF

- The SEC has opened a 21-day public comment period for Canary Capital's proposed Litecoin ETF, ending May 26.

- The market briefly dipped after ETF delays affecting SOL, LTC, DOGE, XRP, AVAX, APT, and others.

- LTC price hovers near $85, down 1.5% amid a broader market pullback on Monday.

Litecoin price hovers near $85 as the SEC delays ETF approval and opens a public comment period on Canary's LTC proposal.

SEC opens pubic comment window on Canary’s Litecoin ETF application

The US Securities and Exchange Commission (SEC) has officially opened a public comment request on the proposed spot Litecoin ETF filing by Canary Capital.

The SEC’s latest move follows the regulator’s decision to delay verdicts on active altcoin ETF filings until June 17.

During the formal comment period, the SEC seeks to obtain public input on whether listing the ETF complies with regulatory standards.

The Commission is particularly focused on evaluating the ETF’s ability to prevent fraudulent and manipulative practices.

Public comments are due by May 26, with rebuttals to follow by June 9, before the final verdict date on June 17.

Altcoin ETFs remain in regulatory limbo amid market volatility

The agency previously designated May 5 as the final date for acting on the LTC proposal, before opting last week to extend the timeline to June 17.

This SEC’s delay triggered short-term price dips across top altcoin markets with ETF filing under review, including Solana (SOL), Dogecoin (DOGE), Avalanche (AVAX), XRP, and Aptos (APT).

The public comment window announcement from the SEC allays fears regulatory skepticism, as many investors initially feared.

Amid the uncertainty, Bloomberg ETF analyst James Seyffart had maintained in March that the SEC's delay do not change "relatively high" approval odds, referencing the SEC’s typical review process under Rule 19b-4.

This rule allows the Commission to extend review periods or request additional data before finalizing ETF decisions.

What’s next for Litecoin price and ETF prospects?

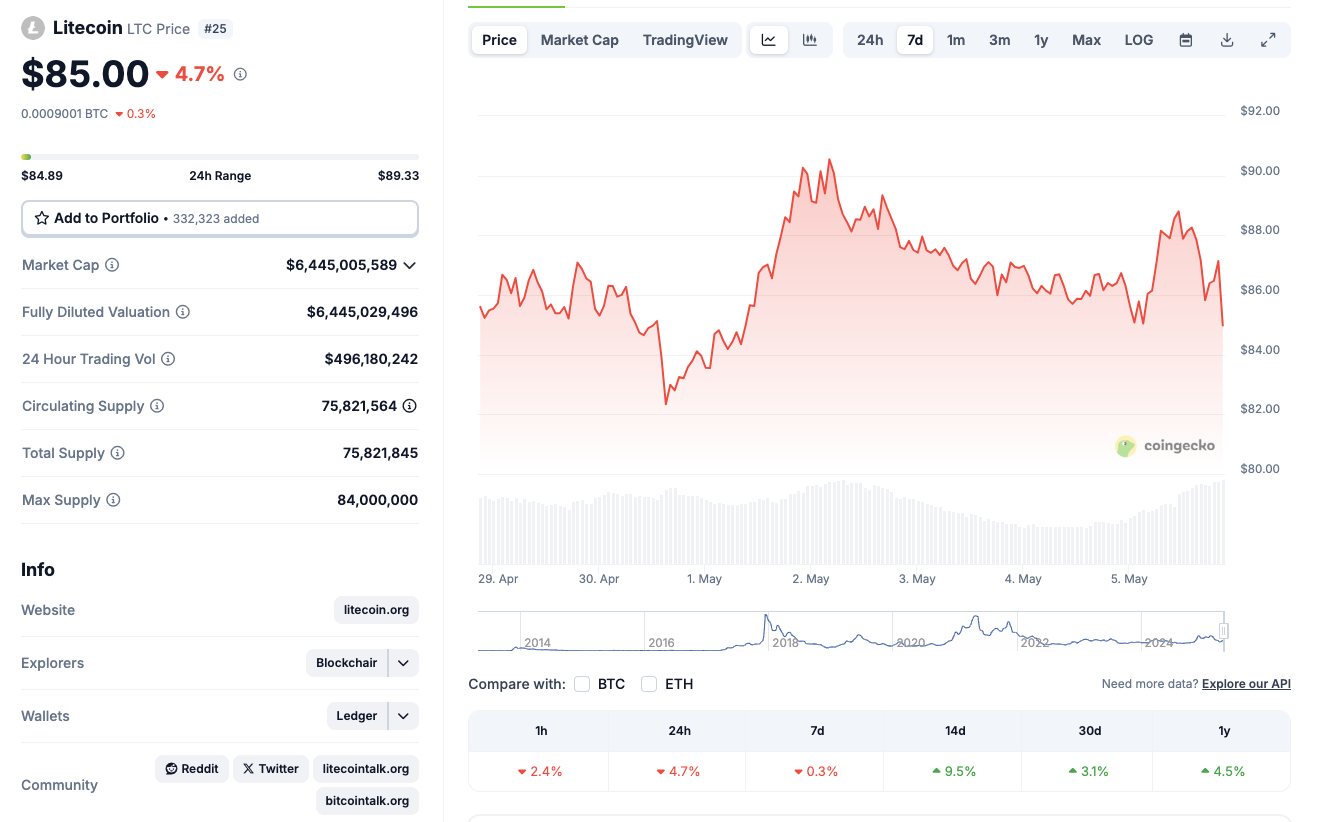

At press time on Monday, Litecoin (LTC) price was trading down 4.7%, tumbling below the $85 level. Zooming out to longer-time frames, LTC remains relatively resilient, showing a 3.1% gain over the past 30 days and a 4.5% increase year-over-year.

Litecoin price action, May 5, 2025 | Source: Coingecko

The intense LTC price volatility is expected to continue as the ETF comment period begins.

Should public commentary remain favorable and no significant objections arise, the SEC may approve the rule change after June 9.

Until then, strategic investors will likely track both LTC price fluctuations and regulatory developments closely, as ETF approval could emerge as a catalyst for the next major directional move.

LTC Price Forecast Today: ETF update could spark rebound toward $91 zone

Litecoin (LTC) price hovers around $83.16 following a modest pullback, yet signs of a potential rebound are quietly forming.

Despite a 2.22% decline on the day, the technical setup suggests bulls may soon regain momentum, particularly if sentiment around the ETF comment period improves.

The optimistic LTC price outlook is currently supported by the 50-day simple moving average (SMA) at $82.32, with a key resistance target near the 100-day SMA at $83.49.

These levels are converging, creating a short-term decision point for traders as the SEC's public commentary window for the Canary LTC ETF approaches.

Litecoin (LTC) Price Forecast Today | Source: Coingecko

On the momentum side, the Moving Average Convergence Divergence (MACD) shows a weakening bullish crossover, but histogram bars are still in positive territory. This signals that while upward momentum has paused, it hasn’t reversed decisively.

A bullish resurgence in MACD above the 1.00 mark would likely confirm a renewed uptrend, placing $89 to $91 as immediate upside targets. Conversely, if MACD declines below the signal line at 0.61, sellers could push LTC toward the next support at $80.

The stochastic signal on the chart flashed a sell trigger two sessions ago, aligning with the recent retracement, but if Litecoin can close back above $84.00, the signal may be short-lived.