Chiliz Price Forecast: CHZ risks drop as whales offload holdings amid fading market interest

- Chiliz price struggles to break above the $0.034 resistance level, signaling potential downside risks.

- On-chain data show that certain whale wallets are offloading CHZ tokens, alongside a drop in social dominance.

- Technical indicators point toward a possible correction, with bears eyeing the $0.025 mark.

Chiliz (CHZ) is trading around $0.032 at the time of writing on Thursday, after being rejected from the key resistance level earlier this week. On-chain data indicates that whale wallets are offloading their holdings while social dominance declines, suggesting fading investor interest. Meanwhile, the technical outlook hints at a potential correction, with bears eyeing lower support levels in the near term.

Whales reduce exposure to CHZ amid fading market interest

Santiment’s Supply Distribution data supports a bearish outlook for CHZ, as the number of large-wallet holders (whales) is reducing exposure.

The metric indicates that whales holding between 100,000 to 1 million (red line), 10 million to 100 million (blue line) CHZ tokens have shed a total of 101.54 million tokens since Sunday.

[08-1763006317300-1763006317302.30.02, 13 Nov, 2025].png)

Additionally, Santiment’s Social Dominance metric for CHZ further supports a bearish outlook. The index measures the share of CHZ-related discussions across the cryptocurrency media. It dropped sharply from 0.124% on Wednesday to 0.054% on Thursday, indicating waning investor interest and reduced community engagement around Chiliz, suggesting that market participants are shifting focus away from the token amid growing selling pressure.

[08-1763006343576-1763006343577.59.42, 13 Nov, 2025].png)

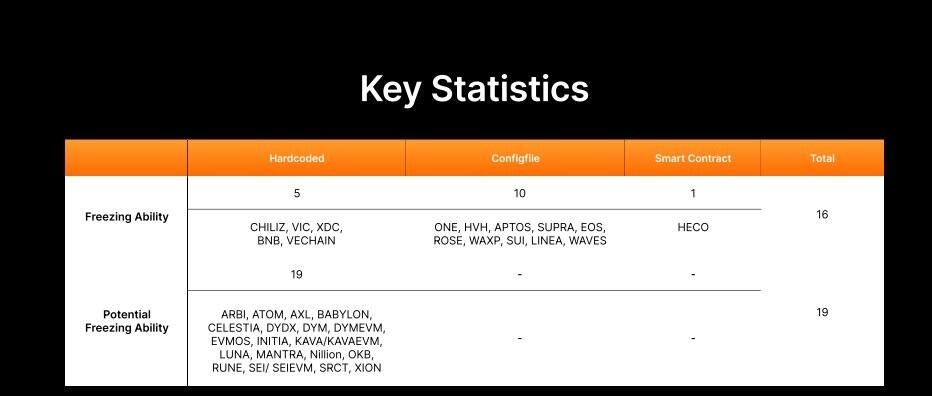

According to Bybit’s Lazarus Security Lab, a report has been released showing that, after reviewing 166 blockchain networks, 16 blockchains were found to have built-in fund-freezing capabilities. At the same time, another 19 could enable such features with minor protocol changes. The freezing mechanisms include hardcoded logic (e.g., CHZ and VeChain blockchains), configuration file controls (Sui and Aptos), and on-chain contract execution (HECO), as shown in the graph below.

These findings highlight a bearish outlook for CHZ and other mentioned blockchains as they indicate potential centralization risks and governance vulnerabilities across several blockchain ecosystems, raising concerns about trust, control, and censorship resistance in supposedly decentralized networks.

Chiliz Price Forecast: CHZ bears aiming for $0.025 mark

Chiliz price faced rejection around the 50-day Exponential Moving Average (EMA) at $0.034 on Saturday and declined 5% by Wednesday. This level coincides with the 61.8% Fibonacci retracement level at $0.034, making this a key resistance zone. At the time of writing on Thursday, CHZ hovers at around $0.032.

If CHZ continues its correction, it could extend the decline toward the 50% retracement level at $0.029. A successful close below this could extend losses toward the next support at $0.025.

The Relative Strength Index (RSI) on the daily chart reads 48, slipping below its neutral level of 50, indicating bearish momentum gaining traction.

On the other hand, if CHZ closes above $0.034 on a daily basis, it could extend the rally toward the next daily resistance at $0.038.