FX Today: Markets maintain their course as investors await US government reopening

The US Dollar (USD) remains under pressure as investors tilt into a risk-on stance ahead of an expected vote to re-fund the US government on a short-term basis. A vote on a short-term funding solution on the floor of the lower US House of Representatives is expected during the overnight session. A successful vote will likely see risk appetite reignite, and push investors to immediately pivot into waiting for the resumption of official datasets that are expected to encourage the Federal Reserve (Fed) to resume cutting interest rates into the end of the year.

Here’s what to watch on Thursday, November 13:

Investors are poised to resume stepping into riskier assets, weakening the US Dollar Index (DXY) in the process, if the US government is able to pass a short-term funding solution for itself. A successful stopgap funding bill will see official data sources begin the messy process of catching up on delayed datasets, promising additional volatility in the weeks to come as key inflation and labor metrics get published out-of-cycle.

EUR/USD is treading water at the top end of a five-day winning streak, but bullish Euro (EUR) momentum remains limited and the major pair is stuck just south of the 50-day Exponential Moving Average (EMA) near 1.1625. An ongoing pattern of lower highs limits bullish potential, but the 1.1500 handle remains nearby as a firm technical floor if bidders step back into the markets.

GBP/USD is stuck on the wrong side of the 1.3200 handle, testing 1.3100 as Cable traders struggle to find a reason to bid up the Pound Sterling (GBP) despite broad-market weakness behind the US Dollar. UK economic data has missed the mark recently, and UK Gross Domestic Product (GDP) growth figures due on Thursday are not expected to buck the trend.

USD/JPY is testing nine-month highs above 154.00, and is poised to chalk in a third straight bullish month as long as trends remain unchanged to the end of November. A general improvement in global market sentiment is seeing the Japanese Yen (JPY) shed weight against the US Dollar, pushing the Greenback higher following an extended consolidation period through the midpoint of 2025.

West Texas Intermediate (WTI) Crude Oil prices fell back below $60.00 per barrel on Wednesday, skidding into three-week lows near $58.40 as energy traders brace for the latest round of American Petroleum Institute (API) inventory counts, which are expected to show an ongoing buildup in US Crude Oil stocks.

Despite an overall improvement in global market sentiment, an undercurrent of apprehension remains, keeping Gold prices on the high side as investors keep one foot in the hedging commodity. XAU/USD toyed with intraday bids above $4,200 per ounce on Wednesday, and price action is hung across the 50% retracement level of Gold’s last swing low into the $3,900 region and record bids posted near $4,400 in mid-October.

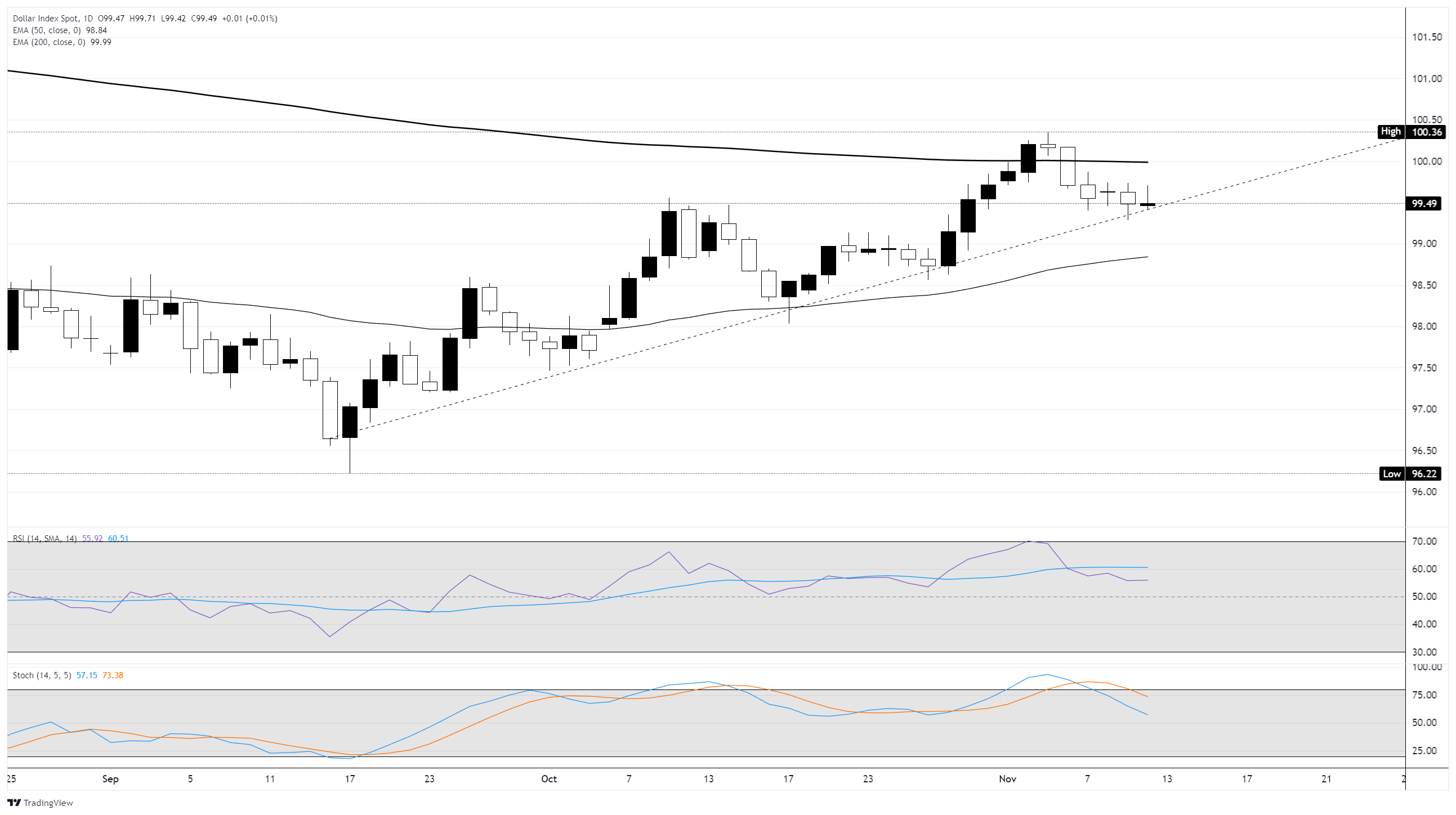

US Dollar Index daily chart