Gold consolidates near three-week high as risk-on mood offsets dovish Fed bets

- Silver Price Forecast: XAG/USD surges to record high above $56 amid bullish momentum

- Fed Chair Candidate: What Would a Hassett Nomination Mean for U.S. Stocks?

- After the Crypto Crash, Is an Altcoin Season Looming Post-Liquidation?

- The 2026 Fed Consensus Debate: Not Hassett, It’s About Whether Powell Stays or Goes

- U.S. PCE and 'Mini Jobs' Data in Focus as Salesforce (CRM) and Snowflake (SNOW) Report Earnings 【The week ahead】

- AUD/USD holds steady below 0.6550 as traders await Australian GDP release

Gold consolidates in a range near a three-week high amid mixed fundamental cues.

The USD struggles amid economic concerns and Fed rate cut bets, lending support.

The prevalent risk-on environment acts as a headwind for the safe-haven commodity.

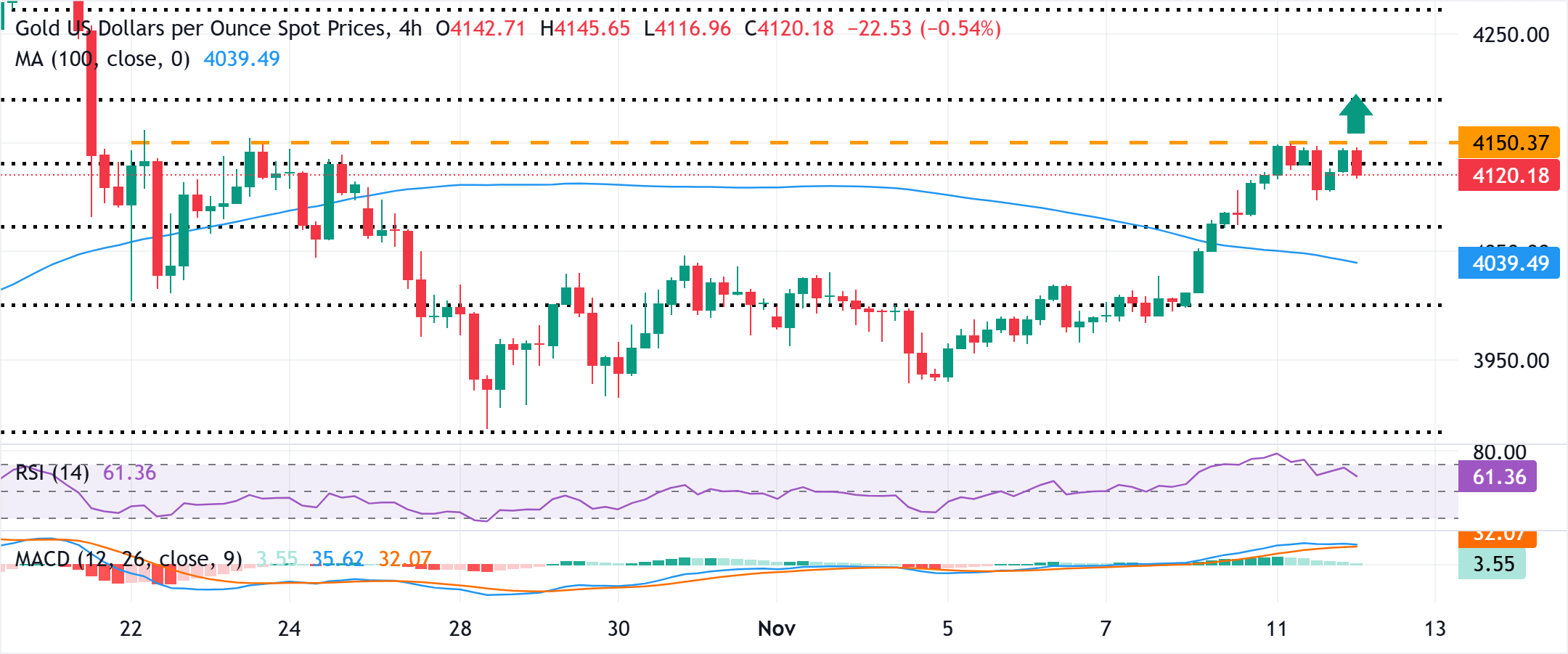

Gold (XAU/USD) is seen hovering near a three-week high during the Asian session on Wednesday, with bulls awaiting a move beyond the $4,150-4,155 horizontal barrier before positioning for any further appreciating move. Investors seem convinced that the delayed US macro data will show some weakness in the economy amid a prolonged US government shutdown and prompt the US Federal Reserve (Fed) to lower borrowing costs further in December. The dovish outlook keeps the US Dollar (USD) close to a nearly two-week low, touched on Tuesday, and turns out to be a key factor acting as a tailwind for the non-yielding yellow metal.

Meanwhile, a positive development towards reopening the US government triggers a fresh wave of the global risk-on trade and is holding back bulls from placing fresh bets around the safe-haven Gold. Investors also opt to wait for speeches from a slew of influential FOMC members later this Wednesday for more cues about the Fed's future rate-cut path. This, in turn, will play a key role in driving the USD demand and providing some meaningful impetus to the XAU/USD pair. Nevertheless, the fundamental backdrop suggests that the path of least resistance for the bullion is to the upside, and any corrective pullback is likely to get bought into.

Daily Digest Market Movers: Gold bulls turn cautious amid receding safe-haven demand

The reopening of the US government shifts market focus back to the deteriorating fiscal outlook and concerns about weakening economic momentum. Economists estimate that the prolonged government closure might have already shaved approximately 1.5 to 2.0% off quarterly GDP growth.

The resumption of normal data flow would reinforce that expectation — especially after last week’s weaker-than-expected US employment and consumer sentiment indicators. Moreover, traders continue to assign a meaningful probability for a rate cut by the US Federal Reserve next month.

Data from workforce analytics company Revelio Labs showed last week that 9,100 jobs were lost in October, and government payrolls fell by 22,200 positions. Moreover, the Chicago Fed estimated that the unemployment rate edged up last month, pointing to a deteriorating labor market.

This reaffirmed dovish Fed expectations and dragged the US Dollar to a nearly two-week low on Tuesday, assisting the non-yielding Gold to build on its breakout momentum beyond the $4,100 mark. However, the upbeat market mood acts as a headwind for the safe-haven commodity.

Gold might continue to attract some dip-buyers and find decent support near $4,100

From a technical perspective, the XAU/USD pair seems to struggle to build on its strength beyond the 50% retracement level of the recent sharp corrective decline from the all-time peak, touched in October. However, positive oscillators on daily/4-hour charts favor bullish traders. Some follow-through buying beyond the $4,150-4,155 zone will reaffirm the constructive outlook and allow the Gold price to reclaim the $4,200 mark. The said handle nears the 61.8% Fibonacci retracement level, which, if cleared decisively, should pave the way for a further near-term appreciating move.

On the flip side, the overnight swing low, around the $4,100-4,095 region, could offer immediate support ahead of the $4,075 region, or the 38.2% Fibo. retracement level. A convincing break below the latter might prompt some technical selling and drag the Gold price to the $4,025 region en route to the $4,000 psychological mark. Some follow-through selling might shift the near-term bias in favor of bearish traders. The XAU/USD pair might then accelerate the fall towards the $3,936-3,935 region before eventually dropping to the $3,900 round figure.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.