3 Altcoins Analysts Say Could Ignite ‘God Candles’ in 2025

“God Candle” is a technical term used to describe a massive green candlestick on a price chart, indicating a sudden and sharp price surge within a short time.

In 2025, several altcoins are considered strong candidates to form God Candles. Ethereum (ETH), XRP, and Pi Network are the most anticipated.

Why Are Analysts Expecting God Candles for ETH, XRP, and PI?

The “God Candle” phenomenon often attracts investors due to its potential for outsized returns, especially when triggered by positive news, whale movements, or shifts in market sentiment.

1. Ethereum

Ethereum, the second-largest cryptocurrency by market cap, is drawing attention due to heavy accumulation by publicly listed companies. Analysts forecast that institutional demand could absorb the newly issued ETH following The Merge.

This strong demand is key to predicting a potential god candle for Ethereum.

“ETH is so ready to go absolutely vertical,” crypto expert Michaël van de Poppe said.

Analyst Alek predicted that ETH could rise to $4,000 in August.

Ethereum God Candle Prediction. Source: Alek

Ethereum God Candle Prediction. Source: Alek

“ETH right now is in consolidation phase and getting ready for the god candle,” Alek predicted.

2. XRP

XRP is the next contender. It’s a unique altcoin in the current market, attracting retail and institutional investors. The XRP community believes that ProShares launching an XRP futures ETF is a stepping stone to a spot ETF.

On Polymarket, the odds of a successful spot ETF approval have reached as high as 90%. A spot ETF could attract up to $100 billion into XRP, sparking a sharp price rally and potentially creating a god candle.

Because of this, some analysts are comparing XRP’s past price surges to anticipate a similar breakout. Historical charts show that XRP often forms monthly candles with large upward ranges.

Ethereum God Candle Prediction. Source: Mikybull

Ethereum God Candle Prediction. Source: Mikybull

“ANOTHER god CANDLE LOADING FOR XRP,” analyst Mikybull predicted.

Some investors are even more optimistic. They expect a July god candle for XRP to kick off a rally to $10 by 2025.

3. Pi Network

Despite being a controversial project, Pi Network still boasts one of the most loyal and active communities among altcoins.

Recent analysis shows that Pi’s price has stabilized, while exchange transfers have increased. Positive project news has come and gone, but Pioneers are now waiting for a bigger announcement: a Pi listing on Binance.

“Binance is one of the biggest exchanges in the world. If $Pi officially gets listed there, it could be a game-changer for price, volume, and adoption!” Pi UpdatesDaily said.

Pioneers believe this listing could push Pi to $10—or even as high as $314.

While it remains uncertain whether Binance will list Pi, the community has spotted some signs pointing in that direction. Binance has also previously surveyed users about the potential listing.

“There is no doubt that PI will have its biggest green candle soon,” Pi News predicted.

Altcoins Are Riskier Than Bitcoin in the Current Market

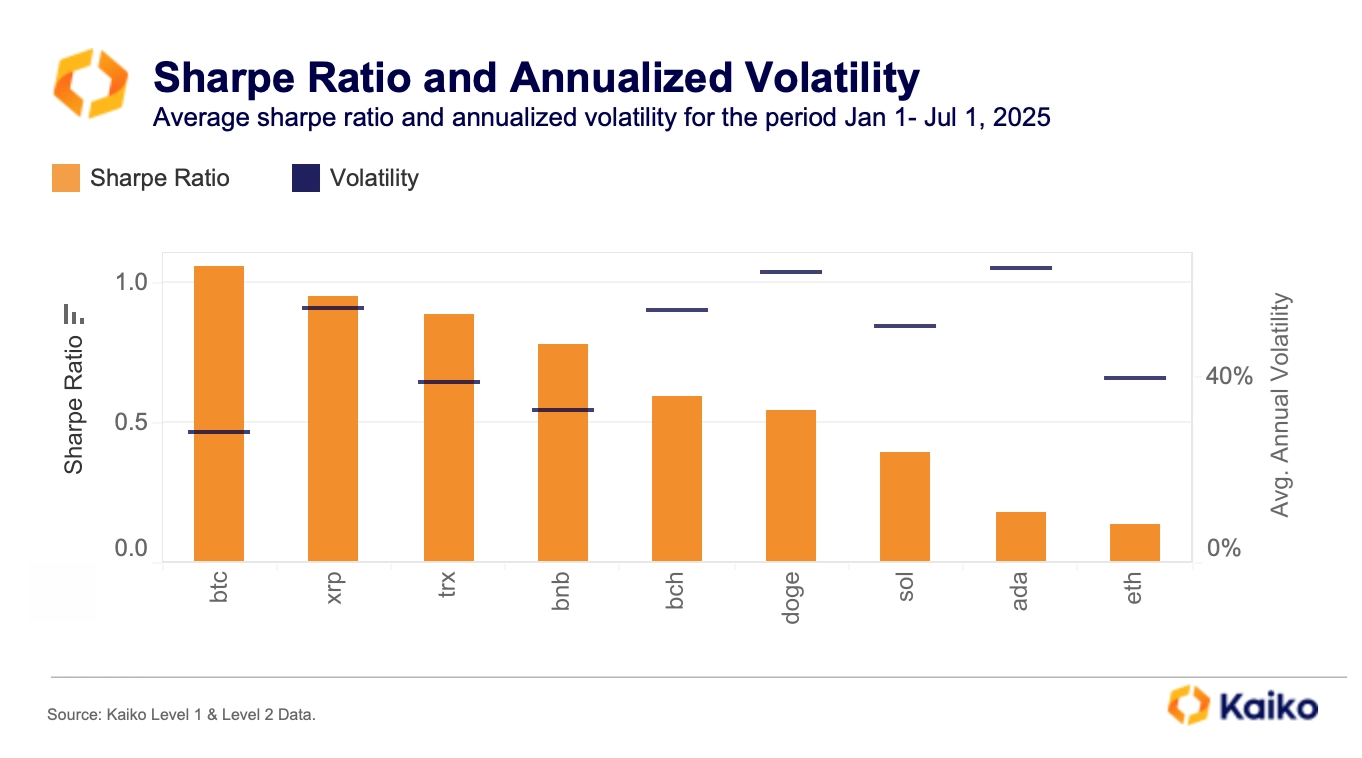

Although Ethereum, XRP, and Pi Network offer significant upside potential with the possibility of god candles, a report from Kaiko highlights a growing gap between Bitcoin and altcoins. Bitcoin continues to lead in both performance and stability.

Bitcoin vs Altcoin Sharpe Ratio And Annualized Volatility. Source: Kaiko.

Bitcoin vs Altcoin Sharpe Ratio And Annualized Volatility. Source: Kaiko.

“Bitcoin’s risk-adjusted returns now outpace most altcoins, with its Sharpe ratio surpassing high-flyers like SOL and XRP,” the Kaiko report stated.

This suggests that while altcoins might break out, they remain highly speculative and more prone to volatility in the current cycle.