Stacks Price Forecast: STX extends rally ahead of SIP-031 improvement proposal voting

- Stacks trades in the green for the third consecutive day as the SIP-031 buzz grows.

- The SIP-031 could boost the Bitcoin layer-2 ecosystem with improved dApp funding mechanisms and infrastructure support.

- The technical outlook indicates a bullish bias as Stacks' Open Interest jumps by 17%.

Stacks (STX) extends the gains for the third session with a 10% intraday jump at press time on Wednesday. The voting on the SIP-031 improvement proposal to improve the network infrastructure is scheduled to begin on Wednesday, which could have fueled the recovery this week. In line with rising community optimism, the derivatives market witnesses a spike in Open Interest, a sign of bullish anticipation among traders.

Stacks’ SIP-031 voting begins

In a recent blog, Stacks announced the commencement of SIP-031 voting on June 25, estimated to occur at Bitcoin block 902,677. The voting will end on July 9, after a two-week period. The proposal will be approved if 80 million stacked STX or 80% of the stacked STX is in favour.

If approved, it will create an ecosystem endowment similar to Sui, Avalanche, or Near Protocol, increasing Stacks’ total annual emissions to 5.75% from 3.52% over the next five years. The treasury is designed to help facilitate the capital required for ecosystem needs such as rewards, liquidity, and marketing programs.

Optimism surrounding Stacks increases amid proposal voting

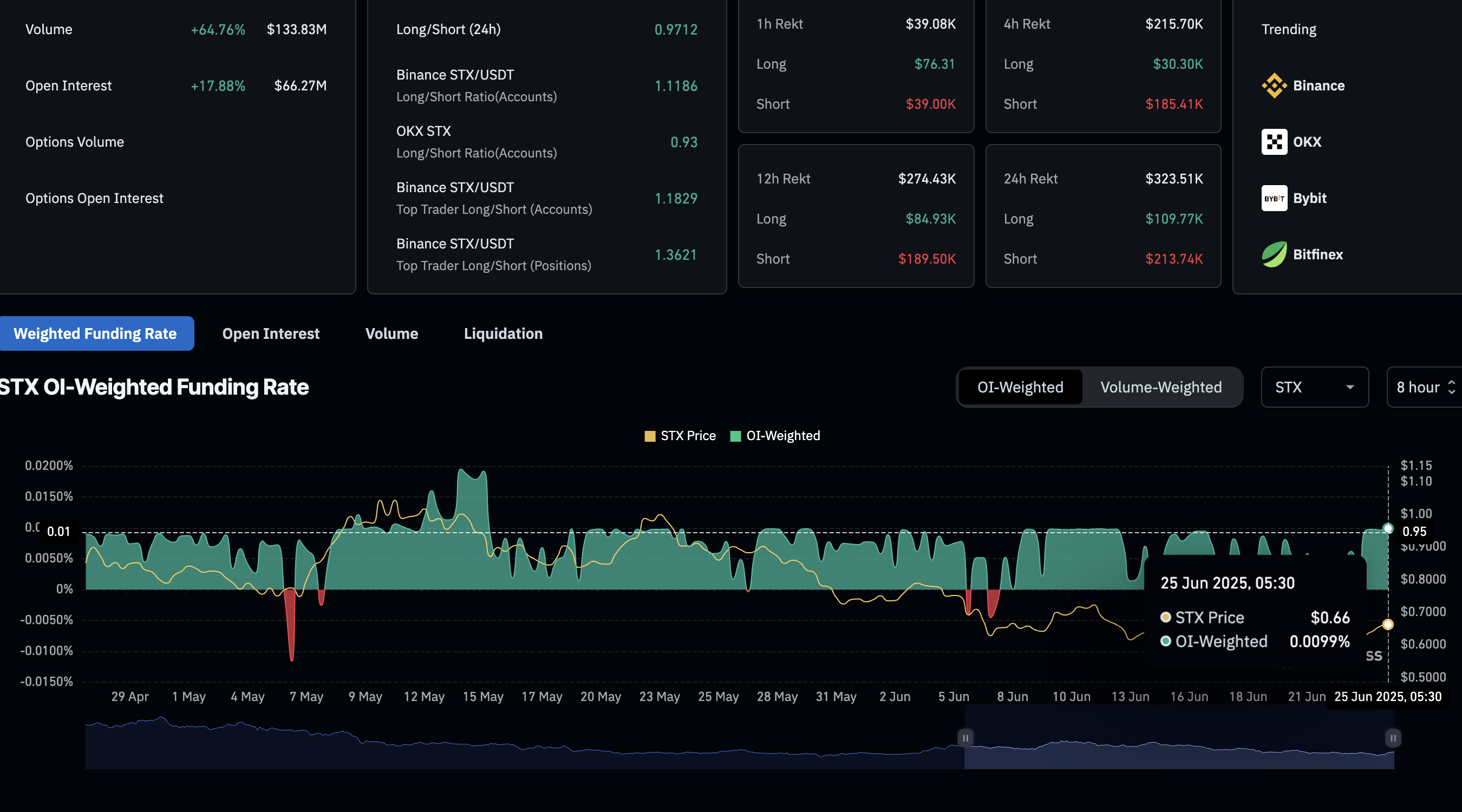

Coinglass data indicates a surge in investor confidence, with Open Interest (OI) increasing 17% to reach $66.27 million. Typically, a boost in buying activity leads to increased capital inflow and a surge in OI.

While OI edges higher, the OI-weighted funding rate hits 0.0099% a level that remains constant, indicating a dominant and stable buying activity throughout May. Funding rates, when positive, indicate increased buying as bulls pay a premium to keep spot and swap prices aligned.

Stacks derivatives data. Source: Coinglass

Stacks' extended rally targets the monthly high

Stacks’ 10% jump at press time on Wednesday extends the weekly growth to 30% so far. STX bounces off $0.50 support zone marked by the green band on the daily chart shared below, surpassing the previous week’s high at $0.725.

The recovery rally targets the monthly high at $0.802 as the immediate resistance. A successful daily close above this level could extend the uptrend towards the $1.00 psychological level.

The Moving Average Convergence/Divergence (MACD) indicator manifests a crossover between the MACD and signal lines. Concurrent with a surge in green histogram bars from the zero line, it flashes a buy signal for sidelined traders.

The Relative Strength Index (RSI) at 53 crosses above the halfway line, indicating a boost in buying pressure.

STX/USDT daily price chart.

However, if STX fails to sustain a bullish closing on Wednesday, a reversal to $0.50 support zone is possible, erasing the weekly gains.