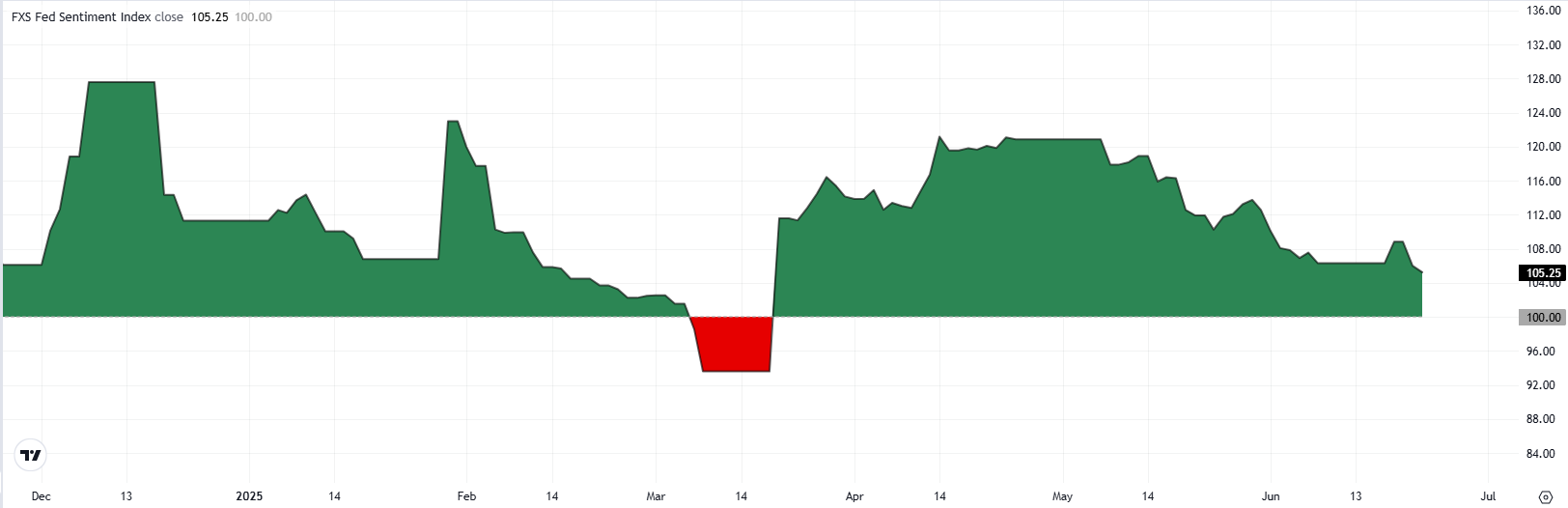

FXS Fed Sentiment Index drops to lowest level since March ahead of Powell testimony

Federal Reserve (Fed) Chairman Jerome Powell will testify before the US House Financial Services Committee on Tuesday. Investors will look for fresh hints on the timing of the next policy action after recent comments from Fed policymakers showed a difference of opinion.

FXStreet (FXS) Fed Sentiment Index rose to 108.84 following the June policy meeting, at which the US central bank decided to leave the policy rate unchanged at the range of 4.25%-4.5%. In the post-meeting press conference, Powell reiterated that they have to keep rates high to get inflation all the way down and noted that they need to see more data before taking policy steps.

On a dovish note, however, Fed Governor Christopher Waller told CNBC last Friday that the Fed is in a position to cut the policy rate as early as July, arguing that they should not wait for the job market to crash to start easing the policy. Similarly, Governor Michelle Bowman noted on Monday she would be in favour of lowering the policy rate at the next meeting if inflation pressures stay contained.

Following these comments FXStreet Fed Sentiment Index declined to its lowest level since March at 105.2. Although the Index remains above the neutral line at 100, it highlights a less hawkish Fed tone overall.

According to the CME FedWatch Tool, markets are currently pricing in about a 20% probability of a July rate cut and an 80% chance that the policy rate will be lowered by at least 25 basis points by September.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.