What Crypto Whales are Buying For May 2025

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold slumps below $5,100 as US Dollar gains

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

Crypto whales are making bold moves heading into May 2025, and three tokens are standing out: Ethereum (ETH), Artificial Superintelligence Alliance (FET), and Onyxcoin (XCN). All three have seen a noticeable uptick in large-holder accumulation over the last week, signaling growing interest from big players despite recent volatility.

While ETH and XCN are both coming off sharp corrections, whale buying suggests confidence in a potential rebound. Meanwhile, FET is riding renewed momentum in the AI sector, with whale activity accelerating alongside rising prices.

Ethereum (ETH)

The number of Ethereum crypto whales—wallets holding between 1,000 and 10,000 ETH—has been steadily climbing since April 15. Back then, there were 5,432 such addresses.

That number has now risen to 5,460, the highest count since August 2023. At the same time, the concentration of ETH held by these whales is also hitting new highs, signaling growing accumulation by large holders.

While this can be interpreted as confidence in Ethereum’s long-term value, it also raises concerns about centralization and potential selling pressure if whales decide to take profits.

Number of Addresses Holding Between 1,000 and 10,000 ETH. Source: Santiment.

Ethereum price is currently down more than 19% over the last 30 days. If the correction continues, the price could retest support at $1,535. Losing that level might send ETH toward deeper support at $1,412 or even $1,385.

However, if the trend reverses, key resistance zones lie at $1,669 and $1,749—with a potential push toward $1,954 if bullish momentum builds.

In this context, the growing dominance of whales could act as either a stabilizing force or a looming risk, depending on how they respond to market shifts.

Artificial Superintelligence Alliance (FET)

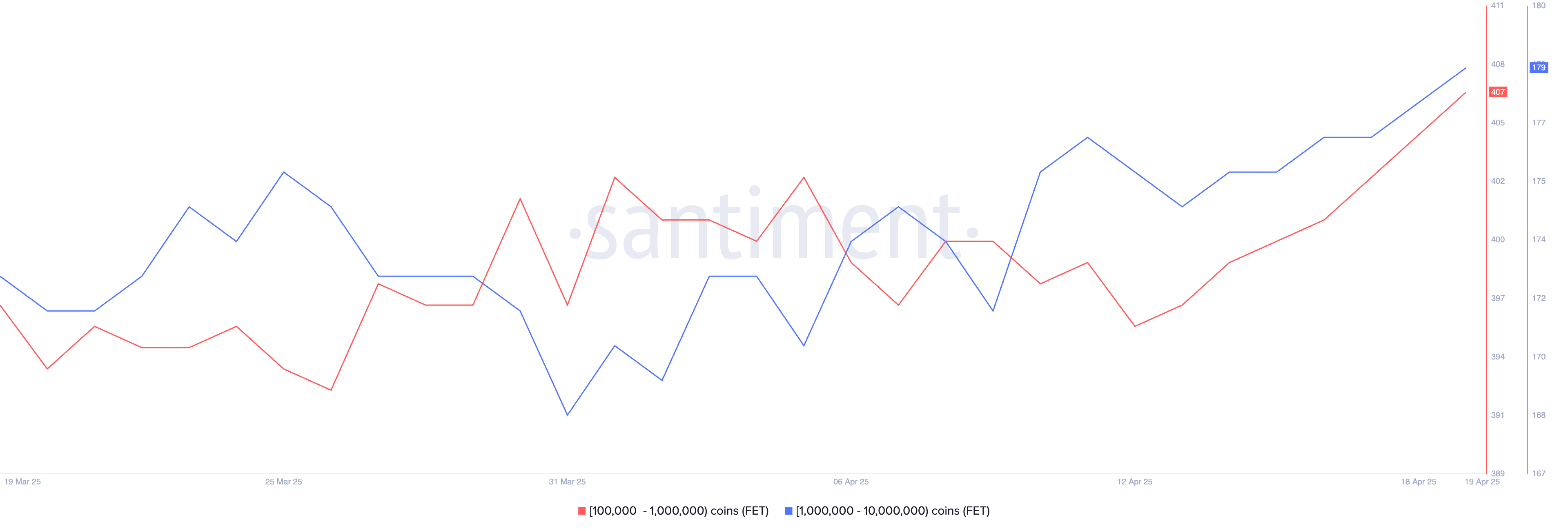

The number of FET whales—wallets holding between 10,000 and 1,000,000 tokens—increased from 572 on April 13 to 586 by April 19.

This steady growth in large holders points to rising confidence among bigger players. It comes at a time when the broader AI crypto narrative is showing signs of a rebound.

Key AI coins like FET, TAO, and RENDER have all increased over 9% in the last seven days, with FET itself gaining more than 8% in the past 24 hours and 13.5% over the week. This suggests a possible comeback for the artificial intelligence narrative in crypto.

Number of Addresses Holding Between 100,000 and 1,000,000 FET. Source: Santiment.

If this momentum continues, FET could push toward resistance at $0.659. A clean breakout from that level could open the door to further gains, with $0.77 and $0.82 as the next potential targets.

On the flip side, if the rally stalls, FET might drop back to test support at $0.54. A breakdown below that could send it as low as $0.44.

With whale activity heating up and the AI sector showing renewed strength, FET’s next move could be a key signal for where the narrative heads next.

Onyxcoin (XCN)

Onyxcoin was one of the standout performers in January, but its momentum has faded in recent months. After a strong bounce—up of over 57% in the last 30 days, the token is now correcting, down 19% in the past seven days.

Despite this pullback, accumulation continues. The number of crypto whales holding between 1 million and 10 million XCN has grown from 528 on April 16 to 541, suggesting some large holders may be buying the dip.

Number of Addresses Holding Between 1,000,000 and 10,000,000 XCN. Source: Santiment.

If the correction deepens, XCN could lose support at $0.0165. A drop below that may open the door to further declines toward $0.0139 and $0.0123.

But if the trend flips back upward, the token could first test resistance at $0.020. A strong breakout from there might lead to a move toward $0.027. With whale activity on the rise and volatility returning, XCN’s next move could be decisive.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.