EUR/USD clings to gains on US Dollar weakness amid easing geopolitical tensions

The Euro remains steady near over three-year highs against the US Dollar, supported by a moderate risk appetite.

Weak US data and higher hopes of Fed interest rate cuts are weighing on the US Dollar.

EUR/USD maintains its positive tone with resistance at 1.1630-1.1640 and 1.1700.

The EUR/USD is trading practically flat on Wednesday, just below a multi-year high near 1.1640, last seen in November 2021, consolidating gains after a nearly 1.40% rally in the previous two days. A moderate appetite for risk continues to drive markets, despite the fragility of the ceasefire between Israel and Iran, and is keeping the safe-haven US Dollar (USD) on its back foot.

Oil prices have ticked up from Tuesday's lows butt remain well below the highs seen last week. Iran's Oil and Natural Gas facilities seem to have been little affected by the bombings, and Oil traffic through the strategic Strait of Hormuz does not seem under threat, at least for now. The relatively low Crude prices are an additional support to the Euro (EUR) as they ease inflationary pressures on the Eurozone economy.

In the US, on Tuesday, the Federal Reserve (Fed) Chairman Jerome Powell reiterated that the central bank is in no rush to cut interest rates at the Semiannual Monetary Policy Report to Congress. Pressure from US President Donald Trump and the growing dissension among Fed officials does not seem to have scratched Powell's hawkish stance.

The market, however, keeps betting on a rate cut in September, especially after the downbeat Consumer Confidence reading released on Tuesday. Increasing concerns about employment are limiting US consumers' purchasing decisions and increasing pressure on the central bank to adopt a less restrictive monetary policy.

Powell will testify again on Wednesday, but he is unlikely to change his views. The economic calendar is thin on Wednesday, with only US New Home sales data for May. News about Middle East developments will continue driving markets.

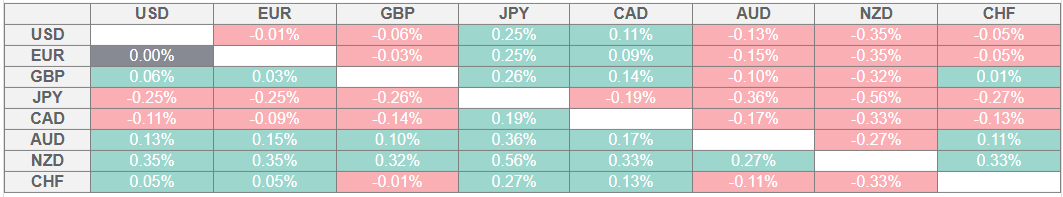

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Risk appetite and hopes of Fed cuts keep the USD on the defensive

The Euro (EUR) is being buoyed by the US Dollar's weakness. The US Dollar Index (DXY), which measures the value of the Greenback against six major currencies, remains depressed near three-year lows, at 97.60, weighed by the positive risk sentiment triggered by the frail peace agreement in the Middle East and higher hopes that the Fed will be forced to cut interest rates, probably in September.

The ceasefire between Israel and Iran announced by US President Trump on Monday seems very fragile but is holding, at least for now. This is feeding a moderate risk appetite on Wednesday, keeping the Euro buoyed, and weighing on demand for safe-haven assets like the US Dollar.

Reports from US intelligence, however, are casting doubt on the durability of the truce. According to a preliminary assessment, the US bombing on Iran's nuclear sites might have set back their program by only one or two months, rather than "obliterated" it as Trump affirmed following the strikes. It is hard to assure that this new context guarantees a long-lasting peace.

On the macroeconomic front, Eurozone data revealed on Tuesday that the German IFO Business Climate Index increased to 88.4 in June from 87.5 in May, slightly above the 88.3 expected. Business Expectations index also improved, to 90.7 from the previous 88.9, beating expectations of a 90.0 reading. The impact on the Euro, however, was marginal.

In the US, the Conference Board's Consumer Confidence deteriorated against expectations in June, with the index falling to 93.0 from 98.4 (upwardly revised from 98.0) in May, instead of the increase to the 100.00 level forecasted by market analysts. The poll revealed a deterioration in both the current situation assessment and economic perspectives, due to heightened concerns about job availability, according to the report.

These figures did not affect the Fed Chairman Powell's cautious stance on monetary policy, who reiterated that the central bank is "well positioned to wait" as, he said, price rises due to higher tariffs are expected to increase inflationary pressures and weigh on economic activity.

Investors, however, are keeping their bets on further Fed rate cuts over the coming months. Data from the CME Group's Fed Watch shows an 18% chance of a rate cut in July and 85% in September, up from 14% and 65% respectively, in the previous week.

EUR/USD remains positive with 1.1630 capping bulls for now

EUR/USD resumed its broader bullish trend after breaching the top of the last few weeks' corrective channel, boosted by investors' optimism following Trump's announcement of a ceasefire in the Middle East conflict.

Immediate resistance is at the June 12 high, at 1.1630, but the break of the trendline resistance at 1.1540 highlights a bullish flag formation with a measured target at the 1.1700 area. This coincides with the 127.2% Fibonacci extension of the June 10-12 rally.

On the downside, a bearish reaction from current levels might seek support at the broken trendline, now around the 1.1535 previous resistance area. A pullback to retest that level is not discarded. A confirmation below that level would cancel the bullish view and bring the Thursday and Monday lows at 1.1445 back into focus.

Are you looking to stay ahead of market trends? Join Mitrade’s WhatsApp channel now to unlock endless trading opportunities!

By following Mitrade on WhatsApp, you’ll gain:

Leading Edge: Real-time market updates to track price movements in forex, commodities, and indices.

Professional Insights: Expert analysis and trading strategies to boost your performance.

Global Perspective: Stay informed on central bank policies, geopolitical events, and macroeconomic trends.

Scan the QR code to join instantly and receive timely notifications, ensuring you never miss critical market insights.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.