Forex Today: US Dollar stabilizes ahead of housing data, Powell's second day of testimony

Here is what you need to know on Wednesday, June 25:

Financial markets remain relatively quiet early Wednesday following the volatile action seen on Tuesday. In the second half of the day, New Home Sales data for May will be featured in the US economic calendar. Additionally, Federal Reserve (Fed) Chairman Jerome Powell will speak before the Senate Banking Committee in the second day of his testimony.

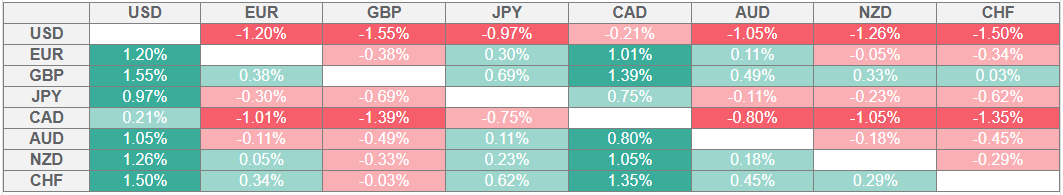

US Dollar PRICE This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the British Pound.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

News of Iran and Israel accepting a ceasefire triggered a risk rally on Tuesday and caused the US Dollar (USD) to weaken. During the American trading hours, comments from Chairman Powell helped the USD limit its losses. Powell reiterated that they are not in a rush to cut the policy rate, adding that they need more time to confirm that inflation pressures caused by tariffs will remain contained. After ending the day marginally lower, the USD Index fluctuates in a tight channel at around 98.00 in the European morning on Wednesday.

Meanwhile, US stock index futures trade little changed after Wall Street's main indexes capitalized on risk flows to post strong gains on Tuesday.

EUR/USD rose about only 0.3% on Tuesday as it lost its bullish momentum in the second half of the day. The pair stays in a consolidation phase and moves sideways at around 1.1600 early Wednesday.

GBP/USD extended its rally and touched its highest level in over three years near 1.3650 on Tuesday. Following a short-lasting technical correction, the pair holds steady above 1.3600 in the European morning on Wednesday. While testifying before the Lords Economic Affairs Committee on Tuesday, Bank of England (BoE) Governor Andrew Bailey noted that they are starting to see a softening in the labor market.

USD/JPY dropped to 144.50 and lost nearly 1% on Tuesday. The pair stages a rebound on Wednesday and trades above 145.00.

Gold dropped below $3,300 for the first time in two weeks on Tuesday, pressured by easing geopolitical tensions. XAU/USD corrects higher on Wednesday and trades at around $3,330.

USD/CAD fell below 1.3700 on Tuesday but managed to recover from daily lows to close virtually unchanged. The pair moves sideways near 1.3730 in the European session. Inflation in Canada, as measured by the change in the Consumer Price Index (CPI), remained unchanged at 1.7% on a yearly basis in May, Statistics Canada reported on Tuesday.

Are you looking to stay ahead of market trends? Join Mitrade’s WhatsApp channel now to unlock endless trading opportunities!

By following Mitrade on WhatsApp, you’ll gain:

Leading Edge: Real-time market updates to track price movements in forex, commodities, and indices.

Professional Insights: Expert analysis and trading strategies to boost your performance.

Global Perspective: Stay informed on central bank policies, geopolitical events, and macroeconomic trends.

Scan the QR code to join instantly and receive timely notifications, ensuring you never miss critical market insights.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.