Bitcoin Market Shows HODLing Shift: 1 Million Coins Mature Into LTH Group

Data shows a massive amount of Bitcoin has transitioned into the long-term holder group, a sign that HODLing sentiment is becoming stronger.

Bitcoin Supply Has Moved From STHs To LTHs Over Past Month

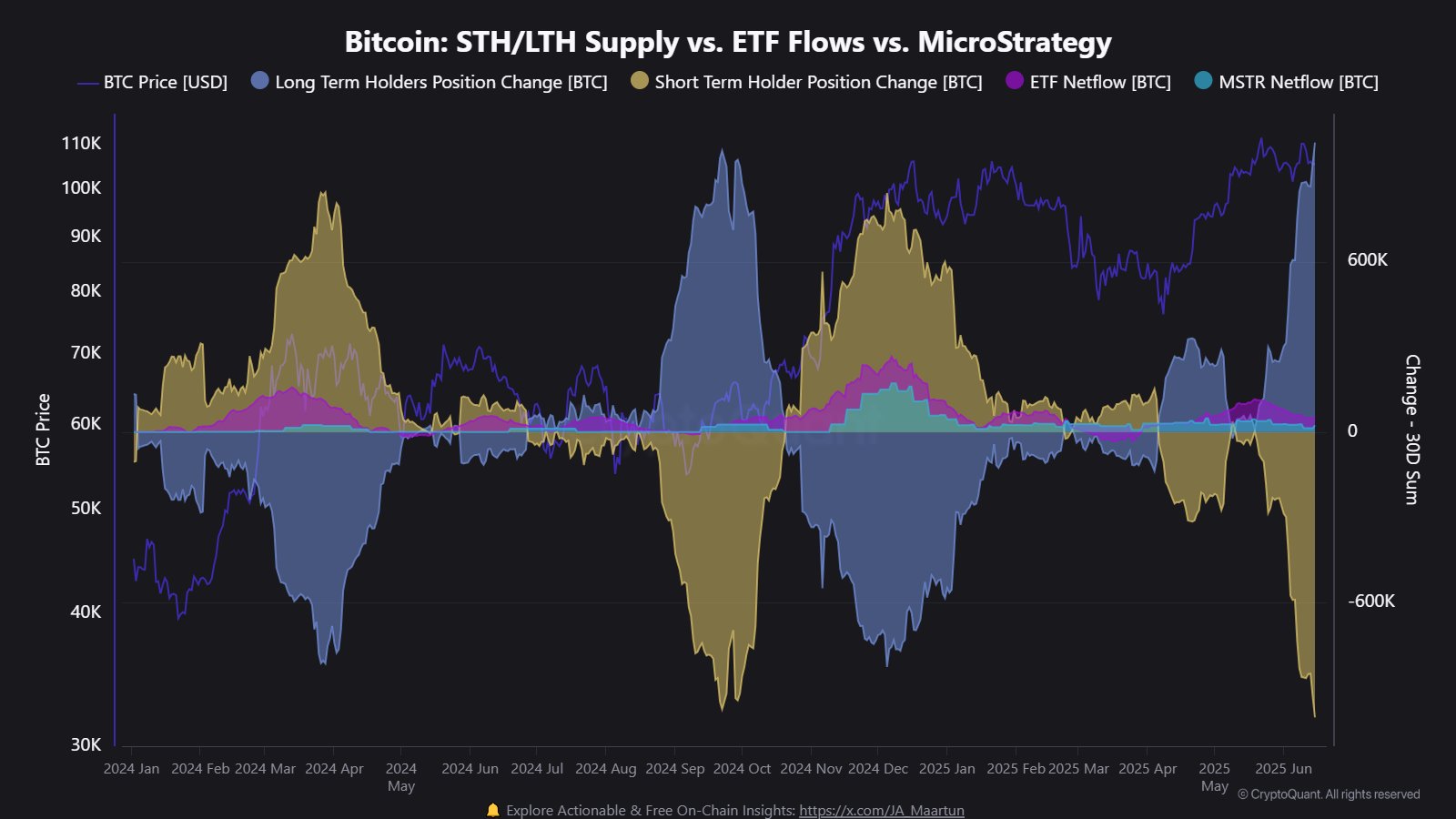

In a new post on X, CryptoQuant community analyst Maartunn has talked about how the Bitcoin supply held by the short-term holders and long-term holders has changed.

The short-term holders (STHs) and long-term holders (LTHs) make up for one of the two main divisions of the BTC market done on the basis of holding time. The cutoff between the two cohorts is 155 days, with investors holding for less than this period falling in the former. When STHs hold past the 155-day mark, they are promoted into the LTHs.

There are several ways to track the behavior associated with these groups, with one such being the Position Change metric, keeping track of the 30-day change occurring in the supply held by these traders.

Below is the chart shared by the analyst that shows the trend in the Bitcoin STH and LTH Position Change over the past year:

As is visible in the graph, the Bitcoin LTH Position Change has recently seen a sharp rise inside the positive territory, which suggests the supply held by this cohort has gone through a rapid increase. More specifically, the LTH supply has increased by 1.019 million over the past month. Naturally, the STH supply has gone down by the same amount.

Statistically, the longer investors hold onto their coins, the less likely they become to participate in selling. As such, the STHs with their low holding time are considered the weak hands of the market, while the LTHs the diamond hands.

Considering that there has recently been a trend of STHs maturing into the LTHs, it would appear that investor conviction in the cryptocurrency has been strengthening.

From the chart, it’s apparent that the last time this trend appeared was in the consolidation phase of 2024. What followed this sideways period with HODLer accumulation was the Bitcoin rally to new all-time highs (ATHs).

The rise in the dominance of the LTHs isn’t the only signal that’s hinting at increased long-term conviction among the holders. As the on-chain analytics firm CryptoQuant has pointed out in an X post, the Accumulator Addresses have recently been showing accelerating demand for the asset.

These are the addresses that have zero history of selling so far. That is, they have only made incoming transactions, no outgoing ones. As displayed in the chart, these ‘permanent’ holders have seen their demand follow a parabolic curve lately. “This signal often precedes Bitcoin rallies and reflects long-term conviction,” notes CryptoQuant.

BTC Price

At the time of writing, Bitcoin is floating around $108,500, up more than 3% over the last 24 hours.