USD/JPY Price Forecast: Bulls are taking control, aiming for 145.35 and 146.00

USD/JPY appreciates for the third consecutive day, approaching 145.35 resistance.

The Yen is trimming gains after a positive reaction to the BoJ's decision.

Technical indicators suggest a trend shift with a potential target above 147.00.

The US Dollar is trading with minor gains against the Japanese Yen on Tuesday, on track to complete a three-day winning streak. The intra-day RSI has consolidated within bullish territory, which, together with the higher low posted last week, suggests that a potential bottoming at the late May lows at 142.00

The Bank of Japan kept rates unchanged after its monetary policy meeting but warned about the increasing uncertainty about global trade to avoid committing to new rate hikes. The Yen picked up immediately after the decision, but has been losing ground ever since.

Investors, however, are wary of placing large US Dollar bets ahead of Wednesday’s Fed decision. The bank will, highly likely, leave rates unchanged but might tone down its hawkish rhetoric in light of the weak macroeconomic figures seen recently. This outcome might cap the US Dollar’s recovery.

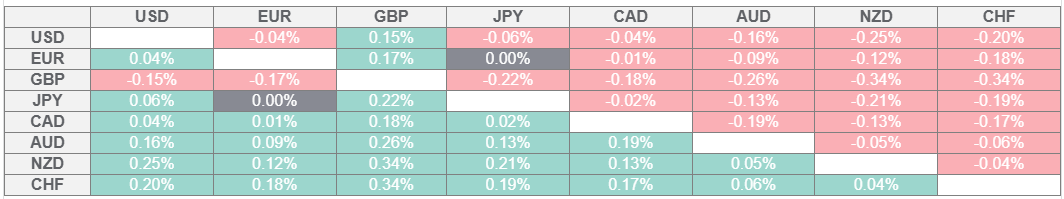

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the British Pound.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Technical analysis: In a bullish trend towards 145.35 and higher

The pair’s reversal from June 11 highs has been contained above the late-May lows at 142.15, and the pair is trending higher this week. The higher low hints at a potential trend shift.

Harmonic patterns suggest that the pair might be in the C-D leg of a Butterfly formation heading to levels above the mentioned June 11 high, at 145.35, and the May 29 high, at 146.00. The 78.6% Fibonacci retracement of the late May sell-off, at 127,25, is a potential target for corrections.

On the downside, immediate resistance is at the 144.45 intra-day level and the 16 June low, at 143.65. A break of 142.80 cancels this view.

USD/JPY 4-hour Chart

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.