AI tokens dip before NVIDIA 2024 GTC AI conference: RNDR, FET, AGIX, AKT

- Prices of Artificial Intelligence tokens Render, Fetch.AI, SingularityNET and Akash Network declined on Tuesday.

- NVIDIA 2024 GTC AI conference is scheduled for March 18 to 21, fueling anticipation among AI token holders.

- AI tokens have yielded double-digit weekly and monthly gains, catalyzed by the euphoria surrounding AI.

The Artificial Intelligence (AI) narrative is likely to make a comeback with NVIDIA’s AI conference, which will be held in mid-March. The event will feature over 900 sessions and 300 exhibits, and has the potential to fuel the current AI-led narrative among crypto market participants.

Also read: Are there more AI growth opportunities to be priced into the markets? [Video]

AI tokens could offer traders “buy the dip” opportunity

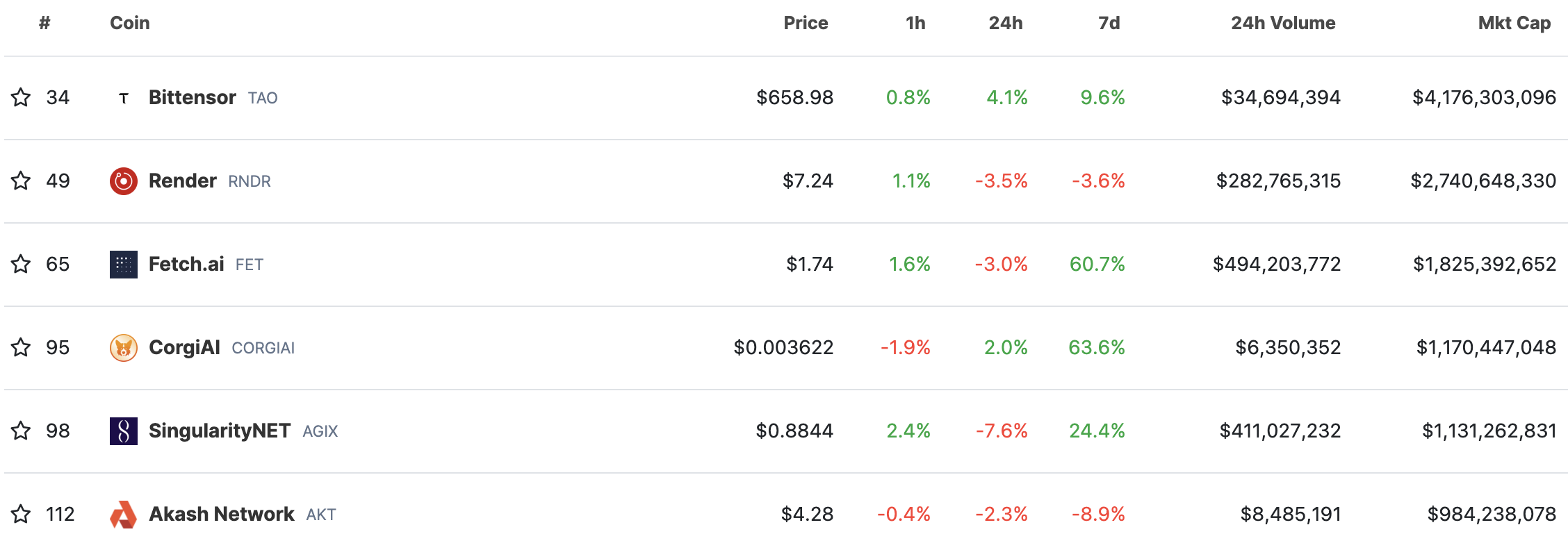

AI tokens Render (RNDR), Fetch.AI (FET), SingularityNET (AGIX) and Akash Network (AKT) have noted a decline in their prices on Tuesday. The recent correction, which goes from 2.3% to 7.6% depending on the token, could offer sidelined traders a “buy the dip” opportunity ahead of a key event in the ecosystem, the upcoming NVIDIA 2024 GTC conference in Silicon Valley. This is an important event since it is the largest AI conference hosted by NVIDIA, which is benefiting the most from the recent AI frenzy.

The conference will feature several technical workshops on generative AI and other segments within Artificial intelligence. The announcements or updates by projects involved at the NVIDIA conference could fuel a bullish sentiment among AI token holders. This could catalyze gains in AI assets. The event is scheduled to take place between March 18 and 21.

Prices of RNDR, FET, AGIX and AKT have dipped by 3.5%, 3%, 7.6% and 2.3% in the past 24 hours, respectively, according to data from CoinGecko. This correction could be followed by a rally in the coming weeks, provided that outcomes from the conference contribute to fuel the AI narrative.

AI token price change in the past 24 hours. Source: CoinGecko

Crypto analyst and trader behind the X handle, @MatthewHyland_ commented on RNDR price chart and noted that the AI token is in the same position it was before the recent double-digit monthly gains.

Assets like AGIX and FET have yielded nearly 25% and over 60% gains in a week, respectively.