Why Bitcoin Could Be Vulnerable to the Yen Carry Trade’s Impact on Global Markets

An expert has cautioned that the reverse yen carry trade is currently unfolding, albeit at a slower and more controlled pace.

This could have significant implications not only for traditional financial markets but also for cryptocurrencies like Bitcoin (BTC).

Why Investors Should Pay Attention to the Yen Carry Trade?

For context, the yen carry trade is a strategy in which investors borrow yen at low interest rates and invest the funds in higher-yielding assets, such as the US dollar or technology stocks. The goal is to profit from the difference in interest rates.

Nonetheless, this strategy’s risk arises from currency fluctuations. If the yen appreciates, investors converting the investment back to yen to repay the loan may see reduced or eliminated profits.

According to Michael A. Gayed, this scenario appears to be materializing now.

“The problem today is that those borrowing costs are starting to get more expensive. Traders who were able to access virtually free capital for years are now finding themselves sitting on costly margin positions that they’re potentially being forced to unwind,” he said.

In his recent report, Gayed explained that rising borrowing costs compel traders to offload dollar-denominated assets. This, in turn, heightens market volatility and depresses the prices of risk assets.

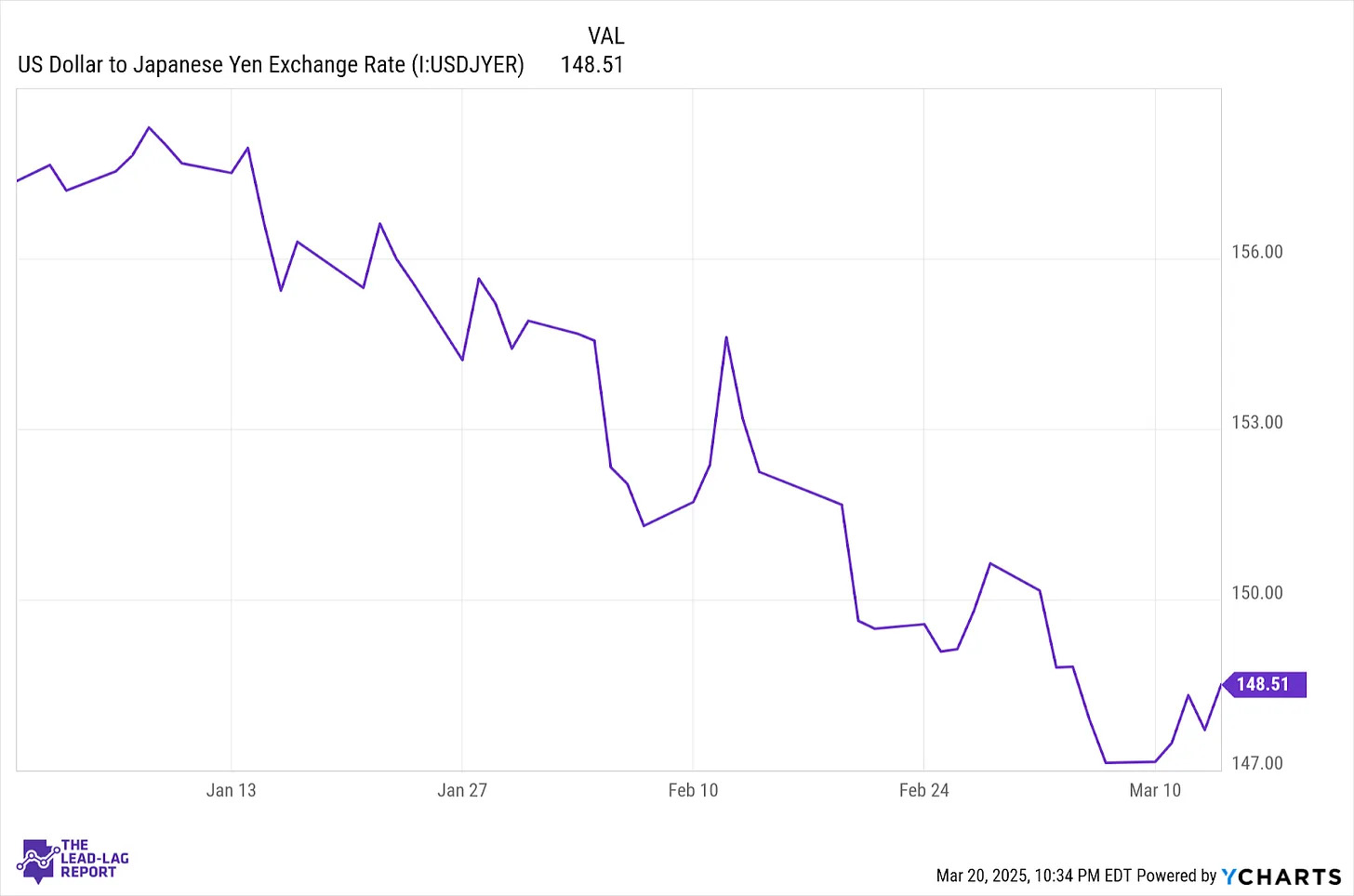

Dollar to Yen Exchange Rate. Source: The Lead-Lag Report

Dollar to Yen Exchange Rate. Source: The Lead-Lag Report

Notably, this happened last year as well. Gayed pointed out that in August 2024, the Bank of Japan’s decision to raise interest rates twice sparked a significant rally in the yen. Yet, at the same time, the S&P 500 saw an approximate 10% correction.

He added that the subsequent rebound alleviated investor concerns. Nevertheless, he believes the real issue is that the situation was never fully resolved.

“Big carry trade unwinds don’t just last a couple of weeks, and conditions are suddenly normalized,” Gayed stressed.

He added that the current market conditions resemble a similar situation. Notably, the Japanese 10-year yield has surged to 1.56%, the highest since 2008. As these yields climb, the yen strengthens, and the carry trade dynamics begin to shift.

“The 10-year yield continues to climb higher and close the interest rate differential on comparable 10-year US Treasury yields. That’s going to continue fueling strength in the yen that may continue into the later stages of 2025. And as long as the yen continues to strengthen, whether it’s quickly and slowly, that’s going to keep unwinding any outstanding carry trade that’s still out there. And it’s probably a lot,” he stated.

Moreover, Gayed suggested that the Bank of Japan will likely continue raising rates. Meanwhile, the Fed might possibly lower them in the coming months, further solidifying his outlook.

He also focused on the correlation between the S&P 500 and the yen. Gayed noted that the yen’s rise preceded the recent S&P 500 pullback by several weeks.

The correction could also be linked to an anticipated US growth slowdown and potential tariffs. Yet, he emphasized that the reverse carry trade is particularly risky due to its potential to escalate quickly, especially in the current macroeconomic climate.

“The market is plenty capable of correcting on its own, given the fears associated with tariffs and slowing economic growth. If you add people being forced to sell their US equity holdings in order to close out their short yen positions on top of that, it’s easy to see how a bad situation quickly becomes worse. And it’s already happening. Japan is still the real risk,” he claimed.

Now, the question is, why will this impact Bitcoin? Given its close correlation with the S&P 500, a correction in the latter could spell trouble for BTC. Analyst Lark Davis pointed out that Bitcoin and the S&P 500 have been closely linked since 2023.

Bitcoin and S&P 500 correlation. Source: X/LarkDavis

Bitcoin and S&P 500 correlation. Source: X/LarkDavis

“So as we’re trying to determine where Bitcoin goes from here, the unfortunate truth is that it all probably depends on what happens to the major stock indices,” he noted

Davis also advised crypto investors to monitor the broader economy, the stock market, and the M2 money supply, both in the US and globally.

For now, the largest cryptocurrency continues to navigate volatility ahead of President Trump’s tariff announcement. In fact, BeInCrypto reported that spot Bitcoin ETFs have recorded outflows for three consecutive days.

Bitcoin Price Performance. Source: BeInCrypto

Bitcoin Price Performance. Source: BeInCrypto

On the price front, Bitcoin has dipped 3.1% over the past week. At press time, the coin was trading at $85,042, representing small gains of 0.8% over the past day.