Tron Has Plenty Of Room For A 2025 Bull Run, Risk Metric Signals

The Tron (TRX) Sharpe Ratio suggests the cryptocurrency’s price may be far from overheating, a sign that the coin could have more upside potential.

Tron Sharpe Ratio Is Still Significantly Below Overheating Zone

In a CryptoQuant Quicktake post, an analyst has talked about the latest trend in the Sharpe Ratio of Tron. The “Sharpe Ratio” refers to an indicator that compares the returns of an asset against the risk associated with it.

The numerator in the ratio, the ‘returns’ portion, is defined as the difference between the average return of the coin and the risk-free return (that is, the theoretical return involved with an asset carrying zero risk) over a given period. The denominator, the ‘risk’ part, is the asset’s standard deviation of returns over the same window (in other words, its volatility).

When the value of this metric is greater than 1, it means the cryptocurrency is printing returns that outweigh its risk. On the other hand, it being under the threshold suggests the asset’s performance has been lackluster compared to its volatility.

Now, here is a chart that shows the trend in the Tron Sharpe Ratio over the last few years:

As displayed in the above graph, the Tron Sharpe Ratio fell below the 1 level earlier, but its value has since returned above the mark. According to the quant, the metric being above the level has historically accompanied bullish price action.

An extremely high value, however, has proven to be an overheating signal, with the asset tending to arrive at a top. “Whenever the Adjusted Sharpe Ratio climbs above 40, it often signals a market that’s overheating,” explains the analyst. “In the past, readings over 40 have lined up well with local tops.”

So far since its return above 1, the Tron Sharpe Ratio has only managed to reach a high of 8.3, which is clearly significantly below this cutoff. This trend could mean that TRX hasn’t been too overheated.

“With TRX’s Sharpe Ratio still far from historical peaks, the data suggests there’s plenty of upside room for a potential bull run in 2025,” says the quant. It now remains to be seen how the coin will develop in the near future, given this pattern.

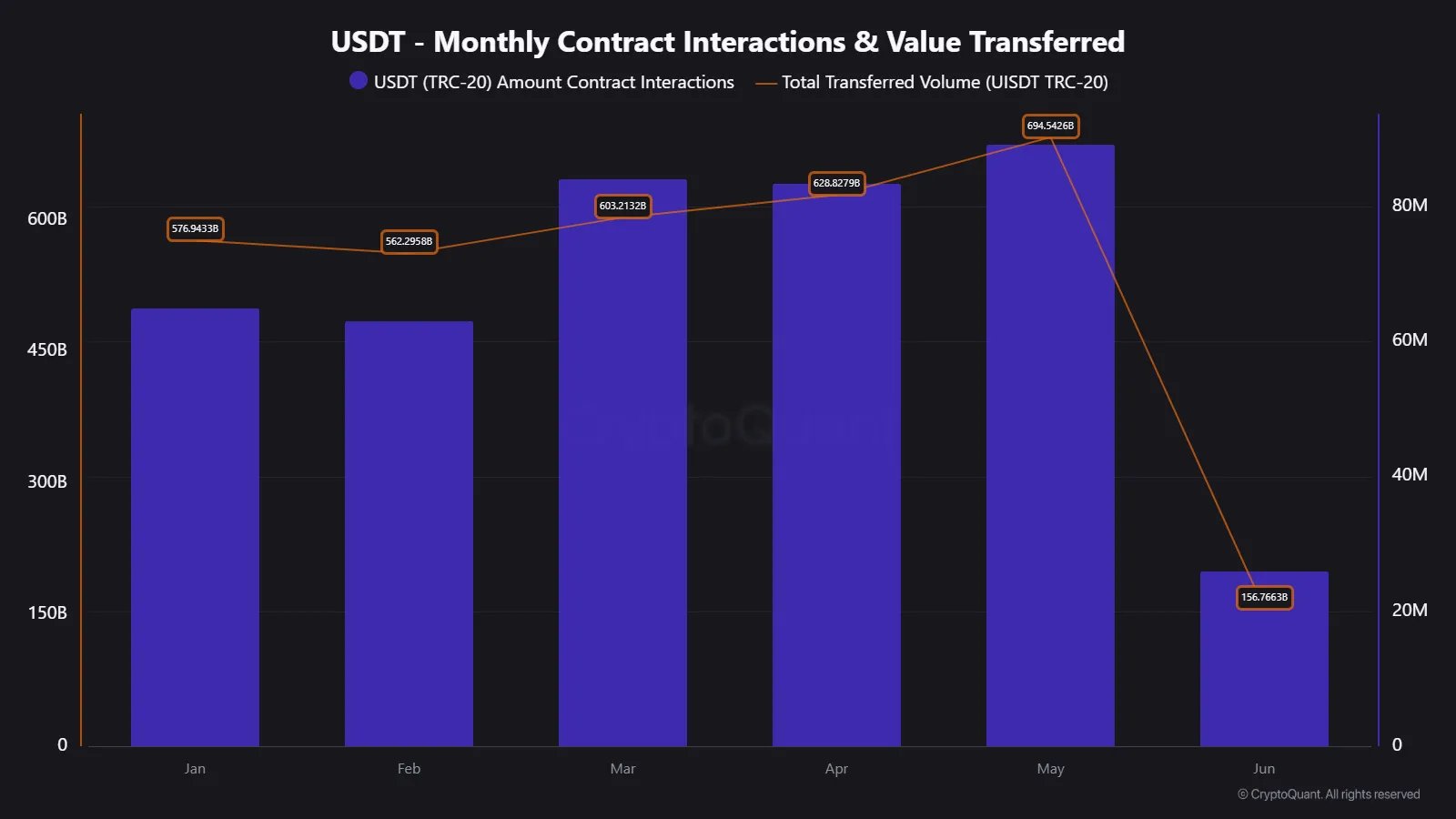

In some other news, the Tron network set a new record in USDT transaction volume last month, as CryptoQuant community analyst Maartunn has pointed out in an X post.

In total, the month of May saw over $694 billion in USDT transaction volume on the Tron network. Around $411 billion of these transfers were of a size that’s generally associated with the whales.

TRX Price

At the time of writing, Tron is trading around $0.272, down 1% in the last week.