BlackRock’s Bitcoin ETF Marks the Greatest Launch in Stock Exchange History

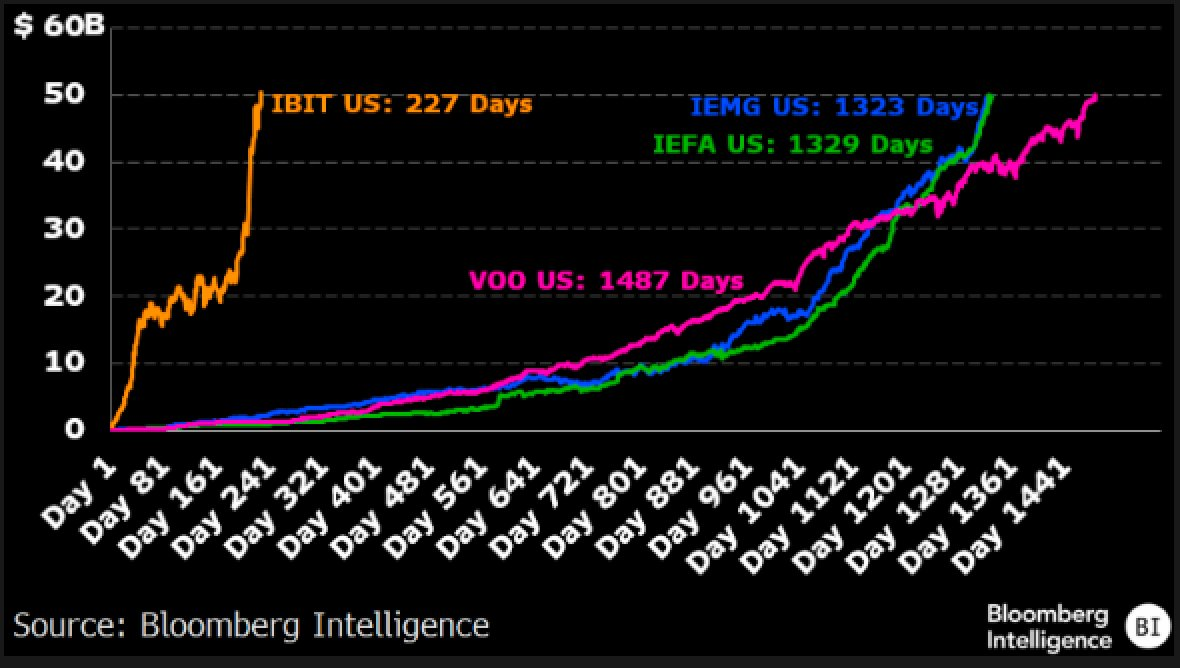

Due to its speedy and monumental rise in 2024, BlackRock’s Bitcoin ETF ‘IBIT’ is reportedly the “Greatest Launch in ETF History.”

IBIT is a winner in several key aspects, raking in billions of dollars faster than any competing ETF. It has outpaced products that have been on the market for decades, propelling BlackRock’s status as a leading Bitcoin holder.

BlackRock Smashes ETF Records

After the SEC granted approval to the Bitcoin ETF in early 2024, BlackRock has been leading this massive market. With IBIT, its BTC-based offering, the firm has consistently led this new and dynamic market.

However, IBIT’s most impressive attribute has been its blinding speed, which Bloomberg ETF analyst Eric Balchunas noted in mid-December.

BlackRock Bitcoin ETF Performance. Source: Eric Balchunas

BlackRock Bitcoin ETF Performance. Source: Eric Balchunas

With IBIT, BlackRock didn’t just grow faster than competing Bitcoin products; it shot up more quickly than any ETFs across the global markets.

For example, it surpassed all regional ETFs in the European Union, some of which were 20 years old, in December. Due to this spectacular performance, Nate Geraci proclaimed IBIT the greatest of all ETF launches today.

“IBIT’s growth is unprecedented. It’s the fastest ETF to reach most milestones, faster than any other ETF in any asset class. At the current asset level and an expense ratio of 0.25%, IBIT can expect to earn about $112 million a year,” claimed James Seyffart, another leading ETF analyst.

In several critical metrics, BlackRock is indisputably the ETF leader. After the OCC approved Bitcoin ETF options trading in November, IBIT options sales surpassed $425 million on the first day.

Additionally, BlackRock has been buying huge amounts of Bitcoin, even exceeding the other ETF issuers. Because of this, the firm is one of the leading BTC holders worldwide.

At the moment, the price of Bitcoin is seeing notable corrections, and BlackRock will have to deal with this market reality.

However, the firm has been bullish on Bitcoin for most of the last decade, and some of its executives expect that the market will grow to trillions. The company’s investment into the crypto space has paid off, and BlackRock is in a great position to move forward.