Ethereum Price at Risk: Selling Pressure Signals Possible Drop Below $3,000

ETH is starting to roll over after failing to hold above key resistance, and the tape is turning heavy. Price has broken back down after an early-month push higher, putting a bearish structure back in play.

While longer-term holders are still providing some support, growing sell-side pressure and weak broader market conditions are putting that bid to the test.

Can Ethereum LTHs Prevent A Breakdown?

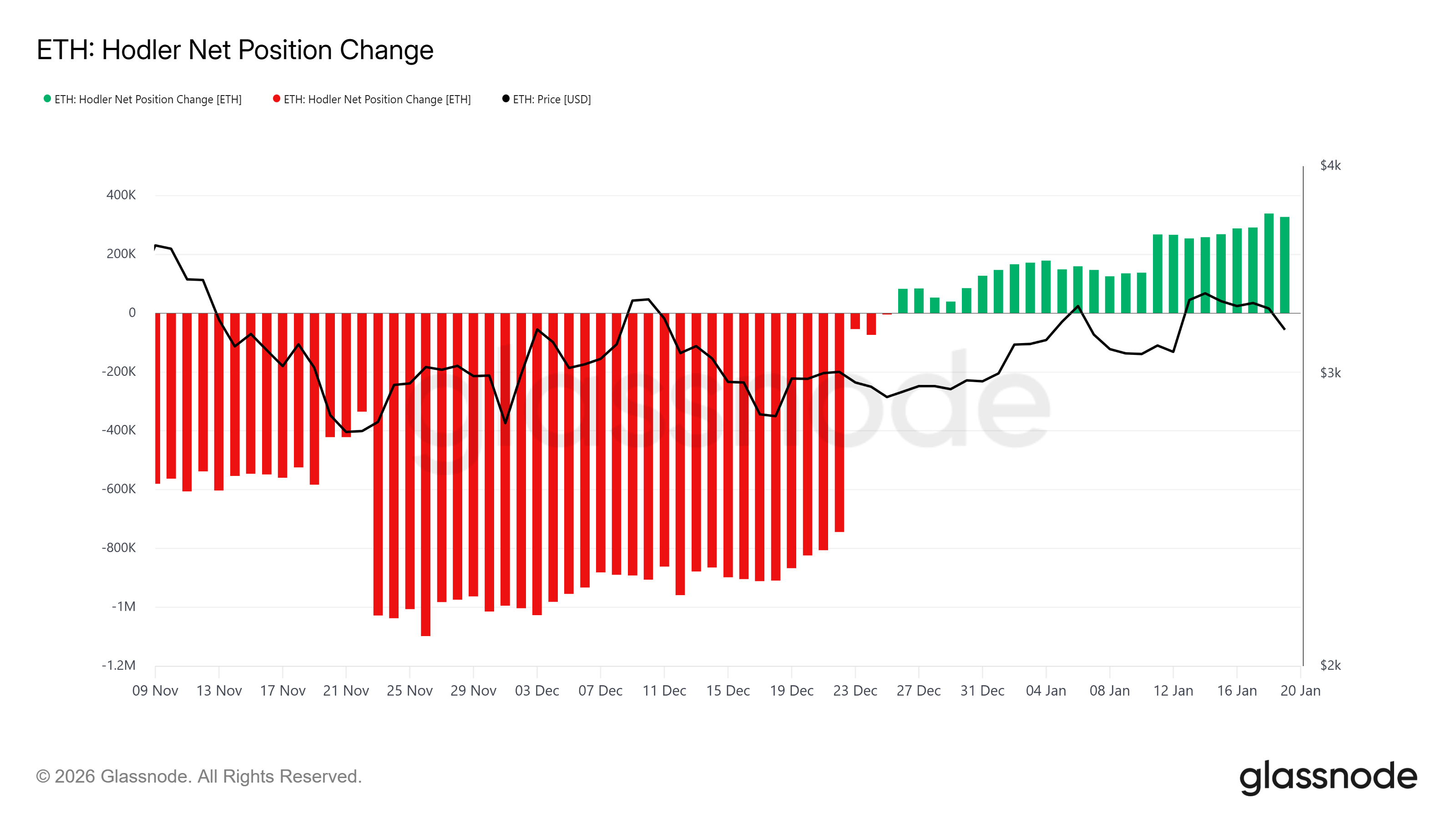

On-chain data shows long-term Ethereum holders are still largely in accumulation mode. The HODLer Net Position Change has printed steady green bars since late December, signaling reduced distribution and continued accumulation from stronger hands. This behavior has helped cushion recent pullbacks and slow downside momentum.

That said, even sticky LTH demand can get overwhelmed if macro and derivatives pressure keep building. If risk-off sentiment persists, long-term support alone may not be enough to prevent a deeper flush.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum HODLer Position Change. Source: Glassnode

Ethereum HODLer Position Change. Source: Glassnode

Ethereum Bulls Face Further Losses

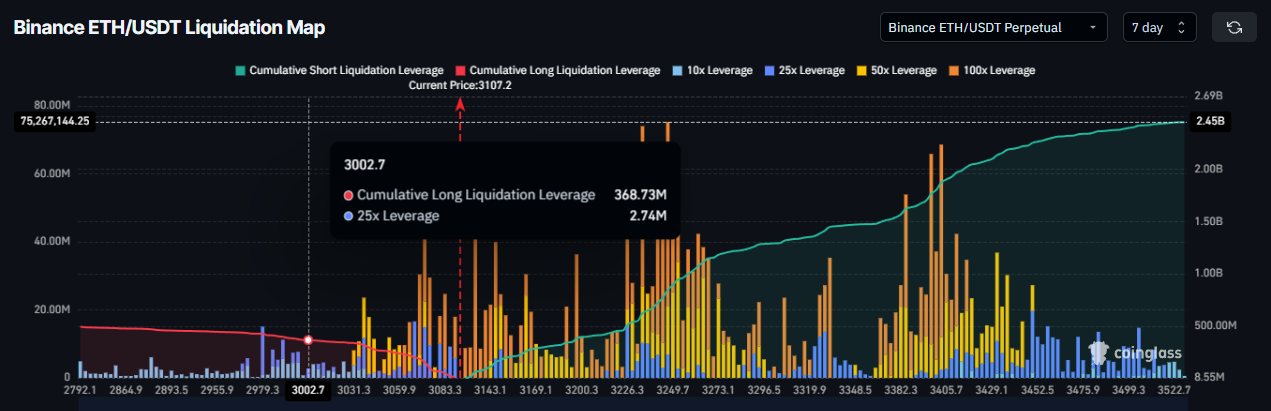

The ETH derivatives market is flashing warning signs. Futures positioning is heavily skewed short, with over 83% of open exposure leaning bearish. This kind of imbalance tends to amplify volatility once the price starts moving, especially near major psychological levels.

Liquidation data shows a clear danger zone around $3,000. A push into that area could trigger roughly $368 million in long liquidations. If those get forced, downside momentum could accelerate quickly as bullish positioning gets wiped out.

Ethereum Liquidation Map. Source: Coinglass

Ethereum Liquidation Map. Source: Coinglass

Ethereum Selling Pressure Continues To Strengthen

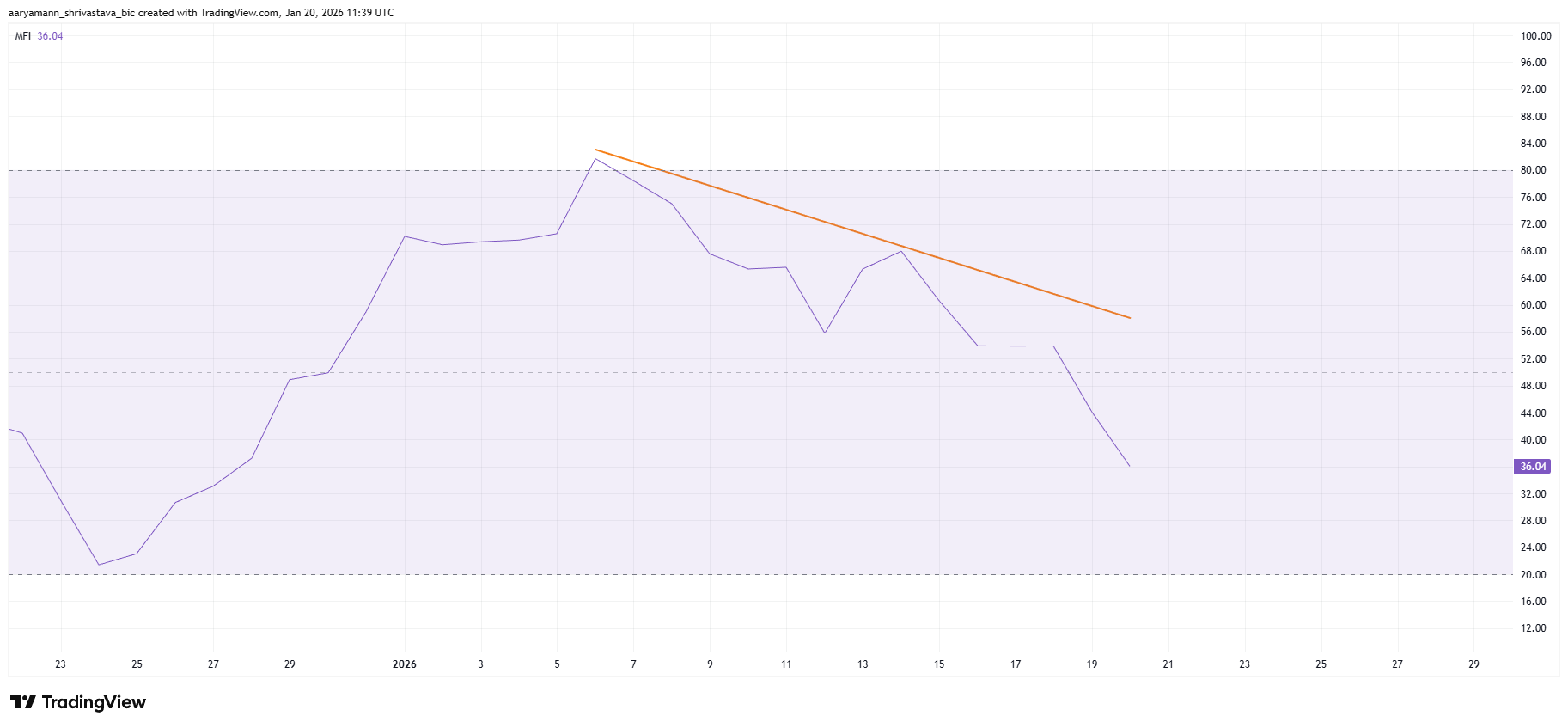

Momentum indicators back up the bearish read. The Money Flow Index has slipped below the 50 midline, signaling capital is rotating out. After briefly tagging overbought earlier this month, ETH has seen buying pressure fade steadily.

A declining MFI usually means sellers are in control until proven otherwise. Until flows stabilize or flip back positive, Ethereum’s price remains vulnerable to further downside.

ETH MFI. Source: TradingView

ETH MFI. Source: TradingView

ETH Price Crash Below $3,000 Likely

Ethereum price trades near $3,109 at the time of writing. The 12-hour chart shows a developing double top pattern, a bearish formation. This setup projects a potential 7.5% decline, targeting a move toward the $2,900 level if confirmed.

Technical and on-chain factors support this downside scenario. Losing the $3,085 support would confirm the breakdown. Selling pressure could intensify once ETH slips below the $3,000 psychological level, where liquidation risk rises sharply, and bullish defenses weaken.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingView

A bullish reversal remains possible if long-term holders maintain control. A successful bounce from $3,085 could restore confidence. Under that scenario, Ethereum may attempt a recovery toward $3,287. Reclaiming that level would invalidate the bearish thesis and signal renewed demand.