Gold smashes $4,750 record as trade war, bond rout weigh on US assets

- Gold rockets to a record-high of $4,766 as US–EU trade-war fears and geopolitical escalation drive haven demand.

- Rising global bond yields and weak US debt auctions accelerate the broader 'Sell America' trade.

- European retaliation threats and Trump’s stance on Greenland deepen market anxiety across assets.

Gold (XAU/USD) price rallies past $4,750 to a new record high near $4,766 on Tuesday amid escalating geopolitical tensions, including the trade war between the US and the European Union, along with the sudden jump of global bond yields, following a “tepid 20-year debt auction earlier in the day,” according to Bloomberg. At the time of writing, XAU/USD trades at $4,758, up by more than 3.50% on the day.

Bullion surges over 3.5% on extreme risk aversion

Risk aversion pushed the precious metals space to record highs, with Silver also soaring to $95.86 a troy ounce amid a time of high US Treasury yields. The narrative of the ¡Sell America' trade is driving the US Dollar and equities down, and US yields up as money markets seem to continue to lose confidence in the US.

A Danish Pension Fund is exiting its US Treasuries position by the end of the month “amid concerns that policies of President Donald Trump have created credit risks too big to ignore,” it said in a Bloomberg article.

Developments over the weekend revealed that US President Donald Trump threatened to impose tariffs on eight European nations if they don’t get an agreement over annexing or purchasing Greenland.

European nations retaliated, and according to a Financial Times article, the European Union “readies €93bn tariffs in retaliation for Trump’s Greenland threat.” Earlier, France’s President Emmanuel Macron said, “Europe would not give in to bullies or be intimidated,” as he escalated his criticism of US President Donald Trump.

Daily digest market movers: Gold shrugs off high US yields, boosted by risk aversion

- US Treasury yields continued to soar on Tuesday. The US 10-year Treasury note is surging 6.5 basis points to 4.291%, the highest level since September 2025. At the same time, the US Dollar Index (DXY), which tracks the American currency's performance versus six peers, plummets 0.46% to 98.58.

- US President Donald Trump said the United States will impose 10% tariffs on eight countries—Denmark, Norway, Sweden, France, Germany, Finland, the Netherlands and the UK—starting February 1. He added that the levies would increase to 25% on June 1 if no agreements are reached, tying the measure to US ambitions to annex or acquire Greenland.

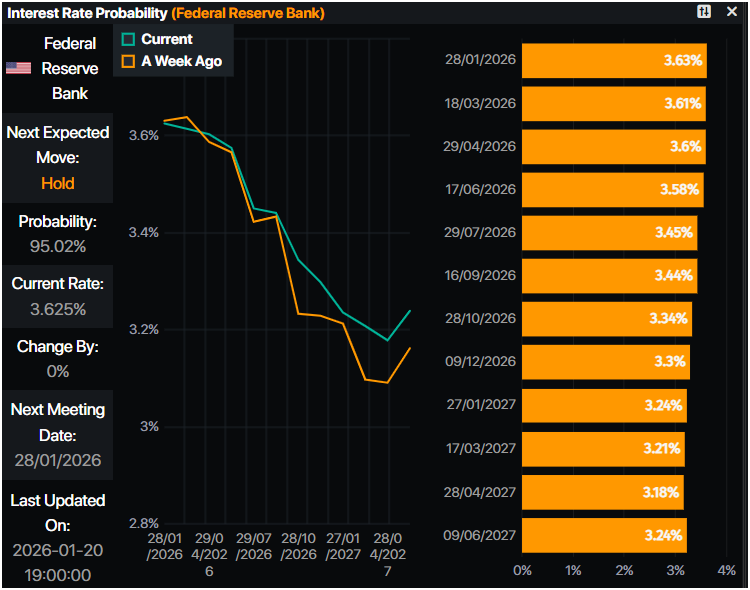

- The US economic docket revealed the ADP Employment Change 4-week average, which came at 8,000, below the previous week's 11,750 people added to the workforce. Although the data was soft, traders remain skeptical that the Federal Reserve would cut rates at the January meeting.

- Data by Prime Market Terminal shows that the swaps markets are expecting 46 basis points of Fed easing towards the end of the year.

Technical analysis: Gold price refreshes record high past $4,750

Gold price had printed a new all-time high at $4,766 during the North American session, with bulls eyeing the $4,800 mark. Although the yellow metal registered higher-highs and higher-lows, the Relative Strength Index (RSI) continues to show that the rally is overextended as it turns overbought, yet it has failed to clear the most recent higher high.

If XAU/USD climbs above $4,800, the next resistance would be $4,900, ahead of the $5,000 milestone. Otherwise, if Bullion tumbles below $4,700, the first support would be $4,600, followed by the January 16 low of $4,536

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.