ASTER Token Buybacks Kick In As Price Drops 12% to Record Low

ASTER price token slid more than 12% on Monday, hitting a fresh all-time low even as the Aster protocol moved to activate a long-planned token buyback strategy.

The initiative aims to stabilize prices and restore market confidence, with token buybacks known to influence supply forces.

Buybacks Begin as ASTER Hits Record Low and Market Pressure Intensifies

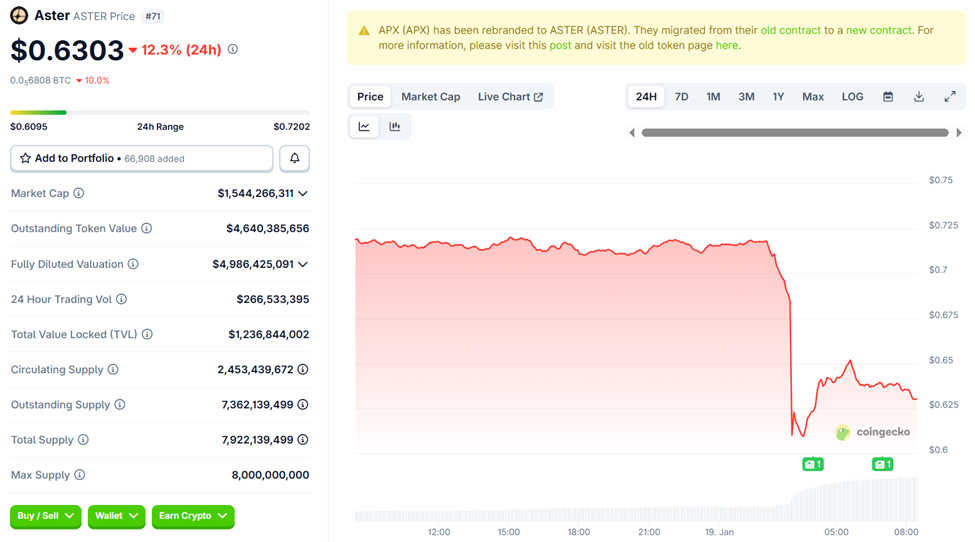

According to CoinGecko data, the ASTER token was trading for $0.63 as of this writing, down by over 12% in the last 24 hours.

Aster Price Performance. Source: CoinGecko

Aster Price Performance. Source: CoinGecko

The downturn coincided with the start of Aster’s strategic repurchase program. ASTER launched its strategic token buybacks on Monday during the early hours of the Asian session after the price hit a new record low of $0.61.

“We’re now actively deploying our Strategic Buyback Reserve for $ASTER token repurchases automatically. Building on our Stage 5 Buyback Program announced last month, this activation allocates 20-40% of daily platform fees into targeted buybacks, responding dynamically to market conditions to maximize value and reduce circulating supply,” Aster said in a post.

The move highlights the tension between short-term price weakness and longer-term tokenomics interventions.

Aster’s price decline comes amid continued pressure on smaller DEX tokens amid broader market uncertainty.

However, fee-driven buybacks could meaningfully absorb sell-side momentum, with ASTER’s latest move suggesting the team is accelerating its response amid intensifying volatility.

Accordingly, Aster has begun deploying capital from its Strategic Buyback Reserve, activating automatic repurchases tied directly to platform revenue.

Stage 5 Buyback Program Puts Aster’s Fee-Backed Tokenomics to the Test

With execution already underway, initial repurchases are automatically made from the reserve wallet 0x5E4969C41ca9F9831468B98328A370b7AbD5a397, on-chain and verifiable.

Meanwhile, the latest activation is part of Aster’s broader Stage 5 Buyback Program, unveiled in late December. The team presented it as a structured approach to supporting the ASTER token through protocol-generated fees rather than discretionary interventions.

At the time, Aster outlined a two-track mechanism that combined predictability with flexibility.

“Stage 5 Buyback Program: Structured Support for $ASTER We’re implementing a systematic buyback program designed to strengthen $ASTER tokenomics and create sustainable value for our community,” Aster wrote on December 22.

The protocol had said it would allocate up to 80% of daily platform fees to buybacks starting December 23, 2025.

Under the framework, “Automatic Daily Buyback (40% of fees)—Executed each day automatically, providing consistent on-chain support and gradual supply reduction.

This creates a predictable foundation for token value, with transactions routed through a dedicated wallet.

In parallel, Strategic Buyback Reserve (20%-40% of fees) is allocated for targeted buybacks based on market conditions. This reserve achieves the flexibility to respond to volatility and maximize value creation when opportunities arise.

It aligns with what Lighter DEX did recently, but the market reaction for the LIT token was different as the altcoin rallied nearly 20%.

Therefore, ASTER’s continued slide may be the aftermath of protocol-driven buybacks in bearish or thinly liquid markets. Hence, the token is now trading near record lows.