Cardano Price Forecast: ADA slips below $0.36 as trade tensions weigh on sentiment

- Cardano price trades below $0.36 on Monday, following a close below the key support level the previous day.

- Market sentiment weakens amid escalating US–EU trade-war tensions and negative funding rates for ADA.

- The technical outlook suggests a pullback, as momentum indicators signal early bearish signs.

Cardano (ADA) price dips 3% on Monday, trading below $0.36 after failing to hold a key support level the previous day. The price correction was further fueled by rising trade-war tensions between the European Union (EU) and the United States of America (US). In addition, both the technical outlook and derivatives markets suggest further correction, as momentum indicators flash early bearish signals while funding rates turn negative.

Cardano dips, escalating EU–US trade war triggers risk-off sentiment

Cardano begins the week on a negative note, extending its decline, sliding 3% on Monday after dropping 5.41% in the previous day. The escalating trade tensions between the US and the EU are dampening broader market sentiment and weighing on risky assets, wiping out over $800 million in liquidations.

US President Donald Trump said he would slap tariffs on eight European nations that have opposed his plan to take Greenland. Trump announced a 10% tariff on goods from countries including Denmark, Sweden, France, Germany, the Netherlands, Finland, the United Kingdom (UK), and Norway, starting on February 1, until the US is allowed to buy Greenland.

In response, EU capitals are considering imposing tariffs of €93 billion ($101 billion) on the US or restricting American companies' access to the bloc’s market, the Financial Times reported on Sunday. These growing trade tensions triggered risk-off sentiment among traders, which does not bode well for risky assets such as Cardano.

Cardano’s derivatives market shows a bearish bias

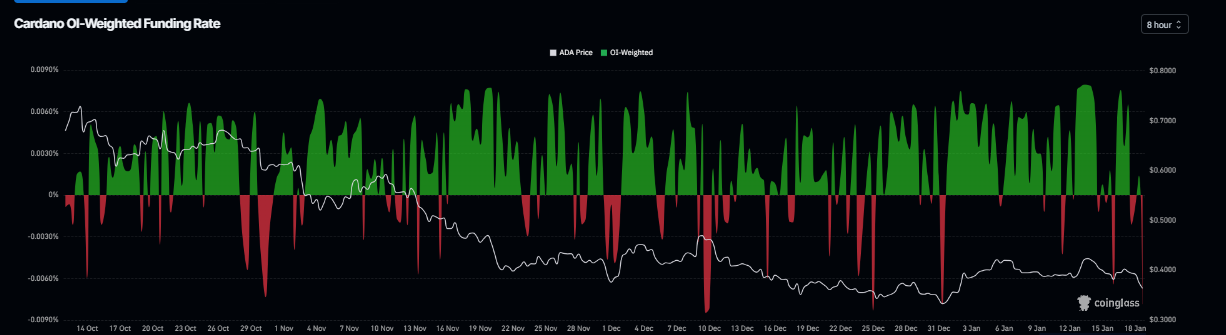

Coinglass’s OI-Weighted Funding Rate data shows that the number of traders betting that the price of ADA will slide further is higher than those anticipating a price increase.

The metric has flipped to a negative rate, reading -0.0079% on Monday, the lowest level since December 10. This negative rate, indicating shorts are paying longs, suggests bearish sentiment toward ADA.

Cardano Price Forecast: ADA closes below key daily support at $0.38

Cardano price was rejected from the 50-day Exponential Moving Average (EMA) at $0.41 on Wednesday and declined nearly 7% the next day. On Friday, ADA retested the daily support at $0.38 and rebounded slightly the next day. However, Cardano corrected more than 5% and closed below this support level on Sunday. As of Monday, Cardano is trading around $0.36.

If ADA continues its correction, it could extend the decline toward the December 31 low of $0.32. A close below this level could extend the pullback toward the October 10 low of $0.27.

The Relative Strength Index (RSI) on the daily chart reads 40, below the neutral level of 50, indicating bearish momentum gaining traction. The Moving Average Convergence Divergence (MACD) indicator showed a bearish crossover on Sunday, further supporting the negative outlook.

However, if ADA recovers, it could extend the recovery toward the 50-day EMA at $0.41.