The Australian Dollar rises as investor sentiment wavered following renewed criticism from President Trump targeting Federal Reserve Chair Jerome Powell.

White House’s Hassett stated that Trump is considering whether he has the authority to remove Powell from his position.

China continues to stand its ground against Trump’s hardline tariff approach, adding to global market uncertainty.

The Australian Dollar (AUD) extends its gains against the US Dollar (USD) on Tuesday. The AUD/USD pair appreciates as investor sentiment took a hit following renewed criticism from US President Donald Trump directed at Federal Reserve (Fed) Chair Jerome Powell, raising fresh concerns about the Fed’s independence.

White House economic advisor Kevin Hassett told on Friday that Trump is exploring whether he has the authority to dismiss Powell. Trump also warned in a Truth Social post that the economy could slow down unless Powell acts swiftly to lower interest rates.

Adding to the market jitters was the ongoing deadlock in global trade negotiations. China has remained firm in the face of Trump’s aggressive tariff strategy, further weighing on investor confidence.

Nonetheless, tensions remained as the White House imposed tariffs on Chinese ships docking at US ports, risking disruption to global shipping routes. However, late Thursday, Trump noted that China had made several overtures and stated, “I don't want to go higher on China tariffs. If China tariffs go higher, people won't buy.” He also expressed optimism that a trade deal could be reached within three to four weeks.

Australian Dollar appreciates as US Dollar may struggle due to concerns about the Fed’s independence

Federal Reserve (Fed) Chair Jerome Powell warned that a sluggish economy paired with persistent inflation could challenge the Fed’s objectives and raise the risk of stagflation.

The US Department of Labor reported on Thursday that Initial Jobless Claims fell to 215,000 for the week ending April 12, below expectations and down from the previous week's revised figure of 224,000 (originally 223,000). However, Continuing Jobless Claims rose by 41,000 to 1.885 million for the week ending April 5.

The US Consumer Price Index (CPI) inflation eased to 2.4% year-over-year in March, down from 2.8% in February and below the market forecast of 2.6%. Core CPI, which excludes food and energy prices, rose 2.8% annually, compared to 3.1% previously and missing the 3.0% estimate. On a monthly basis, headline CPI dipped by 0.1%, while core CPI edged up by 0.1%.

Australia’s Unemployment Rate rose to 4.1% in March, slightly below the market forecast of 4.2%. Meanwhile, Employment Change came in at 32.2K, against the consensus forecast of 40K.

Australia’s Westpac Leading Index’s six-month annualised growth rate, which forecasts economic momentum relative to the trend over the next three to nine months, eased to 0.6% in March from 0.9% in February.

Reserve Bank of Australia's (RBA) March 31–April 1 Meeting Minutes indicated ongoing uncertainty around the timing of the next interest rate adjustment. Although the Board considered the May meeting a suitable point to review monetary policy, it stressed that no decisions had been made in advance. The Board also pointed to both upside and downside risks facing Australia's economy and inflation trajectory.

China’s economy grew at an annual rate of 5.4% in the first quarter of 2025, matching the pace seen in Q4 2024 and surpassing market expectations of 5.1%. On a quarterly basis, GDP rose by 1.2% in Q1, following a 1.6% increase in the previous quarter, falling short of the forecasted 1.4% gain.

Meanwhile, China’s Retail Sales surged 5.9% year-over-year, beating expectations of 4.2% and up from February’s 4%. Industrial Production also outperformed, rising 7.7% compared to the 5.6% forecast and February’s 5.9% print.

Australian Dollar breaks above 0.6400 toward four-month highs

The AUD/USD pair is trading near 0.6420 on Tuesday, with technical indicators on the daily chart suggesting a bullish outlook. The pair remains above the nine-day Exponential Moving Average (EMA), while the 14-day Relative Strength Index (RSI) stays above the neutral 50 level—both pointing to sustained upward momentum.

On the upside, immediate resistance is seen at the four-month high of 0.6408, last tested on February 21. A decisive break above this zone could pave the way for a move toward the five-month high at 0.6515.

The initial support is located at the nine-day EMA around 0.6408, with further downside protection near the 50-day EMA at 0.6292. A break below these levels may undermine the short-term bullish bias and expose the AUD/USD pair to deeper losses toward the 0.5914 area—its lowest level since March 2020.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

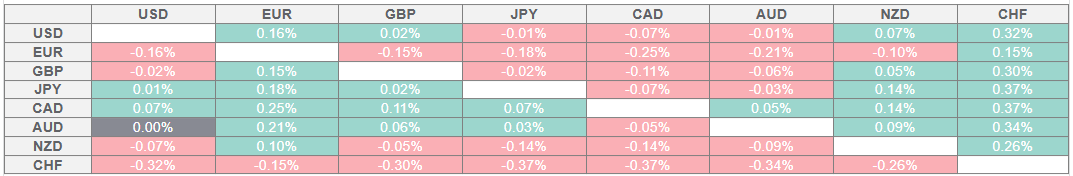

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.