AUD./JPY bounces off two-week low, keeps the red below 93.00 amid the anti-risk flow

AUD/JPY drifts lower for the third consecutive day amid a combination of negative factors.

Rising Middle East tensions and trade uncertainties benefit the JPY and weigh on the Aussie.

BoJ rate hike bets further underpin the JPY and further contribute to the intraday downfall.

The AUD/JPY cross attracts sellers for the third successive day on Friday and plummets to a nearly two-week low, around the 92.30 region during the Asian session. Spot prices, however, recovered a few pips in the last hour and currently trade just below the 93.00 mark, still down over 0.80% for the day.

The global risk sentiment takes a hit amid rising Middle East tensions and persistent trade-related uncertainties, which, in turn, weighs on the risk-sensitive Aussie and benefits the safe-haven Japanese Yen (JPY). In fact, Israel launched a pre-emptive attack against Iran, targeting nuclear and missile sites as well as military headquarters. Adding to this, US President Donald Trump expanded steel tariffs to a range of household appliances, which further weighs on investors' sentiment.

Furthermore, the growing acceptance that the Bank of Japan (BoJ) will stick to the path toward monetary policy normalization turns out to be another factor underpinning the JPY. Apart from this, some technical selling below the 93.00 mark contributed to the downfall. However, a slightly oversold Relative Strength Index (RSI) on the 1-hour chart holds back bears from placing fresh bets and assists the AUD/JPY cross to rebound around 50 pips from the daily swing low.

Nevertheless, the aforementioned fundamental backdrop suggests that the path of least resistance for spot prices remains to the downside and backs the case for an extension of the recent pullback from a four-week high touched on Wednesday. Hence, any attempted intraday recovery in the AUD/JPY cross could be seen as a selling opportunity and run the risk of fizzling out rather quickly.

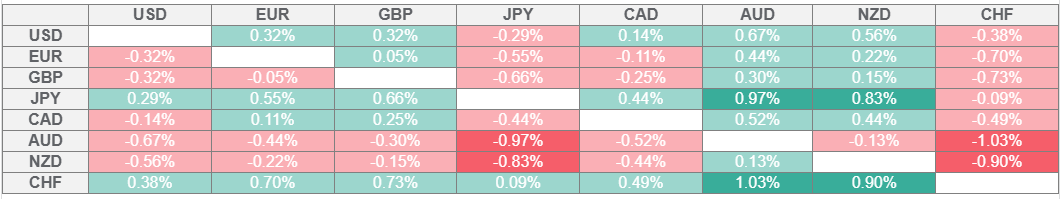

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Australian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.