AUD/JPY jumps to near 96.80 as Yen underperforms ahead of Japan’s elections

- Crypto Meltdown. 240,000 Liquidated, $100 Billion Wiped Off Crypto Market Cap.

- Trump’s Greenland Tariff Suspension: Crypto Prices Rebound as Investors Weigh Rally Longevity

- When is the US President Trump’s speech at WEF in Davos and how could it affect EUR/USD

- Gold nears $4,700 record as US–EU trade war fears ignite haven rush

- Gold Price Forecast: XAU/USD surges to all-time high above $4,650 amid Greenland tariff threats

- US-Europe Trade War Reignites, Bitcoin’s $90,000 Level at Risk

AUD/JPY advances to near 96.80 as uncertainty surrounding Japan’s elections has weighed on the Japanese Yen.

Inflation in Japan grew at a moderate pace in June.

Weak Australian employment data paves the way for interest rate cuts by the RBA.

The AUD/JPY pair climbs to near 96.80 during the European trading session on Friday. The cross demonstrates strength as the Japanese Yen (JPY) underperforms across the board amid uncertainty surrounding elections in Japan on Sunday.

Japanese Yen PRICE Today

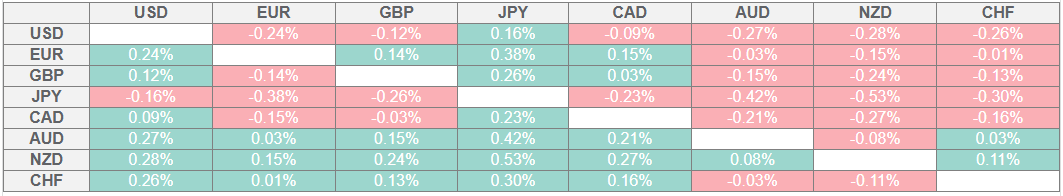

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the weakest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Market sentiment has been spooked towards the Japanese currency amid fears that Japan’s Liberal Democratic Party (LDP) could lose its majority, a scenario that will bring political uncertainty into the economy.

This comes at a time when the United States (US) has imposed 25% tariffs on imports from the Asia-Pacific nation, which are separate from sectoral levies.

Additionally, an expected slowdown in Japan’s National Consumer Price Index (CPI) growth for June has also weighed on the Japanese Yen. The inflation report showed earlier in the day that the National CPI decelerated to 3.3% from 3.5% in May. National CPI excluding Fresh Food, which is closely tracked by Bank of Japan (BoJ) officials, grew at a slower pace of 3.3%, as expected, against the prior reading of 3.7%.

Moderate Japan’s inflation growth could derail BoJ’s ambitions of raising interest rates again this year.

Meanwhile, the Australian Dollar (AUD) trades firmly even as Australian labor market conditions have cooled down. The employment report showed on Thursday that the Unemployment Rate came in higher at 4.3%, against expectations and the prior reading of 4.1%. The number of fresh workers added in June was 2K, while economists anticipated fresh hiring of 20K job-seekers. In May, the Australian labor force was reduced by 1.1K.

Cooling labor market expectations have prompted traders to raise bets supporting interest rate cuts by the Reserve Bank of Australia (RBA) in the policy meeting in August.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.