GBP/USD climbs to 1.3690 as Dollar slumps on Yen intervention talk

- GBP/USD rises as intervention speculation weakens the Dollar despite strong US data.

- DXY slides to four-month lows after reports of Fed-New York inquiries on Yen exchange rates.

- Traders await the FOMC decision and Powell’s guidance for the next directional catalyst.

The Pound Sterling rises some 0.55% on Monday as the Greenback remains on the defensive on rumors of a possible intervention in the FX markets by Japanese authorities and the Federal Reserve. Solid US data was ignored by traders despite being solid, ahead of the January meeting by the Federal Open Market Committee (FOMC). The GBP/USD trades at 1.3690 after bouncing off daily lows of 1.3642.

Sterling advances as rumors of FX intervention hammer the Dollar ahead of the Fed’s policy decision

In last Friday, the financial markets dawned with news of a possible intervention to propel the Japanese Yen and weaken the US Dollar. in the afternoon a Bloomberg breaking news revealed that the desk of the Federal Reserve Bank of New York “contacted financial institutions to ask about the yen’s exchange rate.”

The markets saw those “inquiries” about a potential intervention, between the Japanese government and the US. Consequently, the US Dollar Index (DXY) which tracks the performance of the buck’s value versus a basket of six peers, is down 0.47%, at 97.01 after reaching four-month lows of 96.94.

US economic data revealed Durable Goods Orders for November, which crushed the previous month print, rose by 5.3% MoM, exceeding forecasts of 2.3%, nearly triple of October’s -2.1% contraction.

Core goods used by economists to gauge underlying investment rose 0.5% MoM, above forecast of 0.3% and up from the prior month’s 0.1% growth boosted by an increase in orders of communication equipment, computers, machinery and electrical equipment.

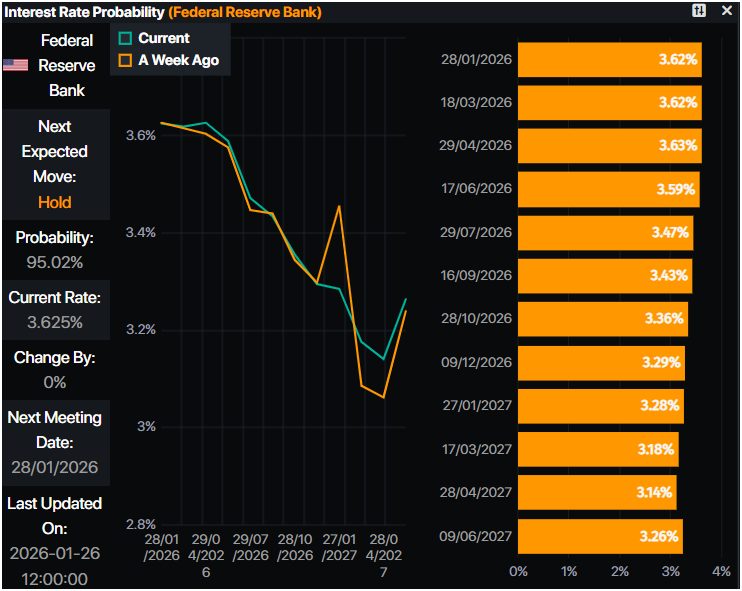

On Wednesday, the Fed is expected to hold rates at the 3.50%-3.75% range, but traders will be focused on comments of the Fed Char Jerome Powell. Despite this, money markets are still seeing at least 44 basis points of easing towards the year’s end, according to Prime Market Terminal.

Across the pond, solid UKK S&P Global Flash PMIs on Friday, boosted Sterling’s appeal, alongside with strong Retail Sales revealed by the Office for National Statistics (ONS).

US & UK economic docket

Ahead in the week, traders focus will be on the Federal Reserve’s monetary policy decision, along with US ADP Employment Change 4-week Average. On the UK, the schedule will be absent, leaving traders leaning into US Dollar related dynamics.

GBP/USD Price Forecast: Technical outlook

The GBP/USD technical picture shows that the pair is closer to extending its uptrend once buyers reclaim 1.3700. A breach of the latter will expose the July 1 swing high of 1.3788 ahead of challenging 1.3800. On further strength a move towards 1.3900 and 1.4000 is likely.

Conversely, if GBP/USD retreats below 1.3650, exposes the January 26 daily low of 1.3642, and the 1.3600 milestone.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.