Bittensor Price Forecast: TAO targets 60% rise as subnets shape a bullish narrative

- Bittensor extends recovery on Monday as the broader crypto market bounces back after a volatile weekend.

- The technical outlook remains optimistic, anticipating a bullish pattern breakout for a 60% gain.

- Subnets' data and rising open interest support the upside potential in Bittensor's price.

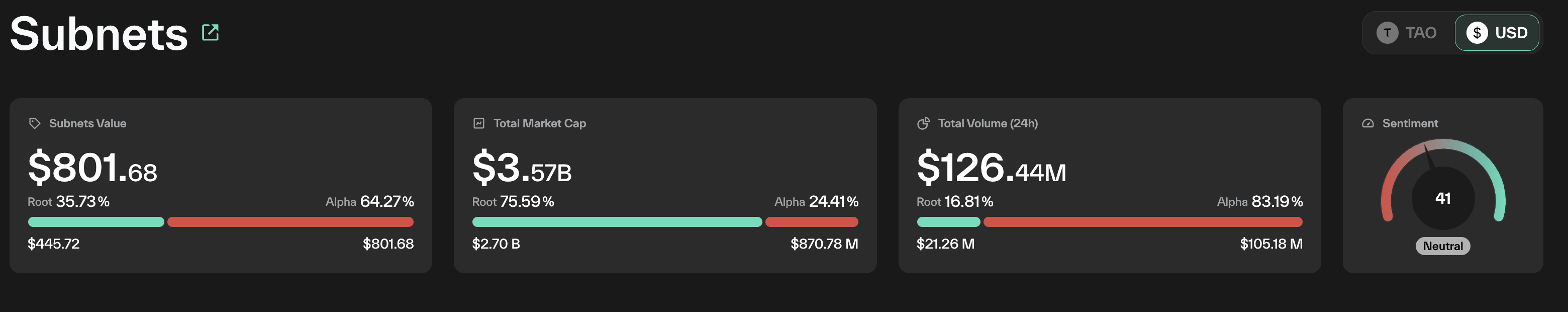

Bittensor (TAO) extends recovery and jumps above $450 at press time on Monday as the crypto market capitalizes on US President Donald Trump’s pause on 50% tariffs over the European Union till July 9. The technical outlook shares a potential rounding bottom pattern breakout opportunity in TAO as the subnets market capitalization reaches $3.57 billion, shaping a rapid network expansion narrative and leading to heightened bull run anticipation in the derivatives market.

TAO prepares for a 60% breakout rally

Bittensor forms a bullish candle with a price surge of over 5% on Monday, attempting to outshine the 10% bearish engulfing candle formed on Friday. The price recovery aims to challenge the $480 supply zone, acting as a neckline of a rounding bottom pattern, formed by a U-shaped reversal in the daily chart shared below.

Within the pattern, TAO has surged near 170% from the $167 low on April 7, fueling a positive trend in the 50-day Exponential Moving Average (EMA) at $379, crossing above the 200-day EMA at $374, triggering a golden crossover. This marks a key trend reversal signal as the 50-period price action overcomes the 200-period trend.

Additionally, the Relative Strength Index (RSI) at 60 points upside suggests a growth in bullish momentum and room for growth. However, the RSI line declines as the price action remains stable within $410 and $480, signaling a hidden bearish divergence, warning of a steeper correction if the consolidation prolongs.

The Moving Average Convergence/Divergence (MACD) and its signal line move close, teasing a potential crossover. Further up, the red histograms decline in intensity, projecting a drop in selling pressure.

Based on the rounding bottom bullish pattern, the 60% breakout target at $778 is calculated by extrapolating the pattern’s height from the neckline. However, the price action suggests minor hurdles at $562 (January’s peaks) and $712 (December 9 high).

TAO/USDT daily price chart. Source: Tradingview

On the other hand, a potential drop under $410 support could retest the 200-day EMA at $374 and invalidate the rounding bottom pattern.

TAO staking trend reflects rising need for subnets

The network expansion of Bittensor supports market optimism, as the market cap of subnets reaches $3.57 billion. Subnets are specialized independent networks supporting the main Bittensor blockchain, designed to perform specific AI services, drawing a similarity to Polkadot’s Parachains, but AI-specific rather than full-fledged blockchains like parachains.

Bittensor subnets data. Source: taostats

Out of the total $3.57 billion market cap, the Root network (base layer) holds 75% worth $2.70 billion, with the Alpha network (specialized networks) holding $870 million. However, the total TAO staked over time trend on the Root chain declines to 5.55 million TAO tokens as Alpha rises to 562K TAO tokens. While the staking indifference is crystal clear, the staking trend in Alpha vs Root reflects a rising confidence in the former.

TAO staking data on subnets over time. Source: taostats

Additionally, the rising staking trend in Alpha reflects a surge in demand for specific value AI services as the base layer remains stagnant.

Optimism soars in the derivatives market

Concurrent with the spot price rally, the TAO derivatives market witnesses an optimism spike. Coinglass data shows TAO Open Interest holding above $200 million over the last three weeks, with the recent 5% jump hitting $242 million, reflecting increased traders’ activity.

Bittensor (TAO) derivatives data. Source: Coinglass

The spike in the OI-weighted funding rate to 0.0056% reveals the bullish intent of the derivatives traders. Additionally, the recent recovery in TAO wiped out $67.9K worth of short positions in the last 12 hours, compared with the $7.3K in longs. However, the 24-hour data maintains a bearish bias with $153K long positions liquidated, compared to $81.2K in shorts.