Zcash Price Forecast: ZEC bulls eye $580 upon breakout as market cap tops $8 billion

- Zcash price trades in the green on Thursday after rallying more than 17% so far this week.

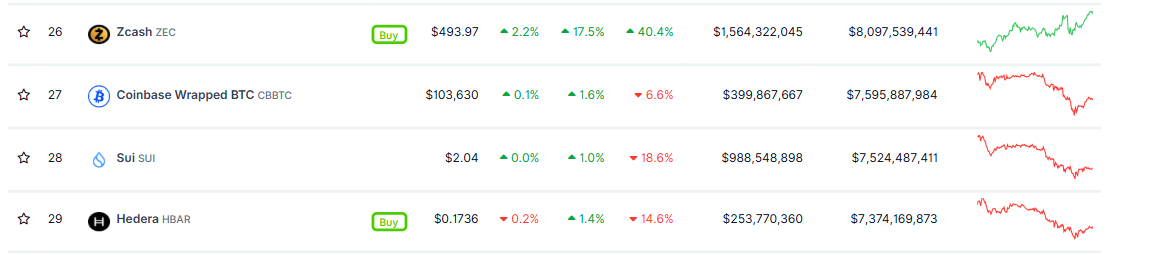

- The privacy-focused cryptocurrency’s market capitalization surpasses $8 billion, overtaking SUI and HBAR.

- The technical outlook suggests further gains with bulls aiming for the next target at $578.

Zcash (ZEC) price continues its upward trend, trading above $490 at the time of writing on Thursday, having rallied over 17% so far this week. The privacy-focused cryptocurrency’s market capitalization has climbed above $8 billion, surpassing popular altcoins such as Sui (SUI) and Hedera (HBAR). With bullish momentum strengthening, technical indicators suggest ZEC could target the next major resistance level at around $578.

Zcash’s market capitalization surpasses $8 billion, open interest hits new all-time high

Zcash soared more than 17% so far this week and is nearing the $500 mark at the time of writing on Thursday. CoinGecko data shows that ZEC’s market capitalization has surged above $8 billion, putting it in the 26th spot in the overall crypto market and surpassing popular altcoins such as SUI and HBAR.

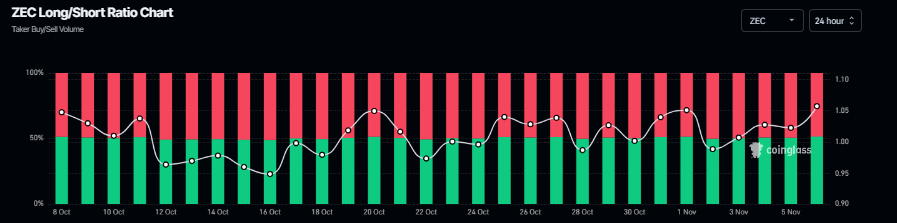

Still, when examining its derivatives data, the outlook for Zcash suggests a further rally ahead. CoinGlass’ data shows that ZEC futures OI at exchanges rose to a new all-time high of $773.84 million on Thursday. Rising OI represents new or additional money entering the market and new buying, which could fuel the current ZEC price rally.

Additionally, the long-to-short ratio for the privacy-focused cryptocurrency stood at 1.05 on Thursday, nearing its monthly high. This ratio, above one, reflects bullish sentiment in the markets, as more traders are betting on the ZEC to rally.

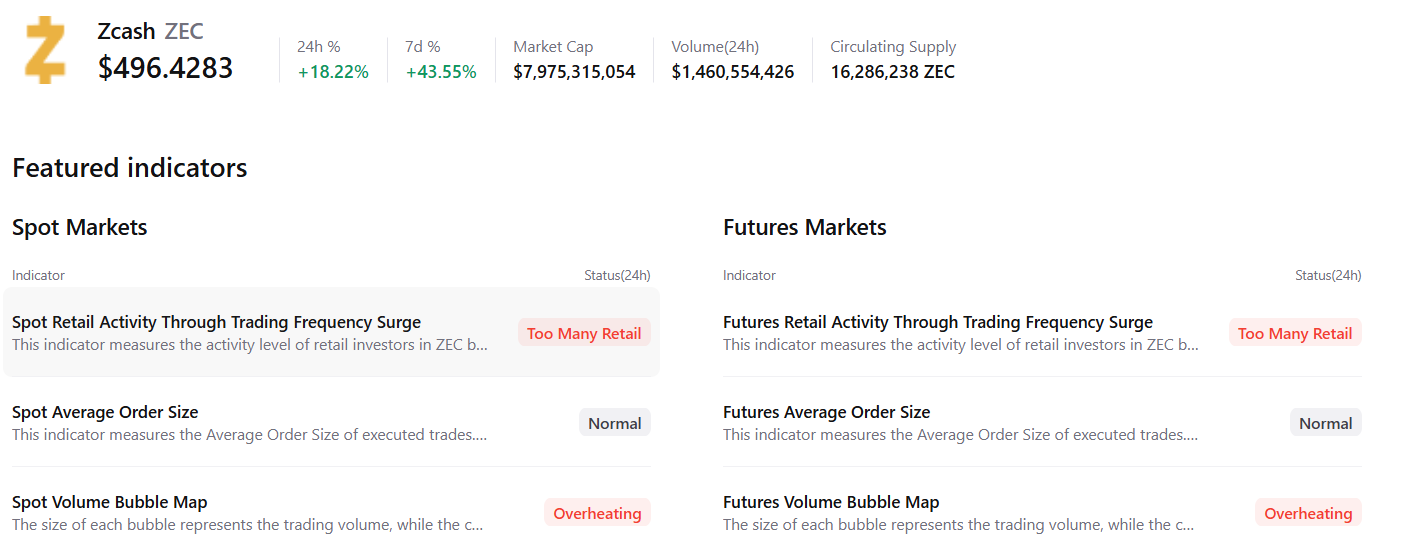

Some signs of concern

Despite the bullish outlook for ZEC, CryptoQuant’s summary data shows some signs of concern to watch for. Both the spot and futures markets are showing signs of retail activity potentially overheating.

Zcash Price Forecast: ZEC bulls aiming for $580 mark

Zcash price found support around the daily support level at $372 on Tuesday and rose more than 10% the next day. At the time of writing on Thursday, ZEC is trading higher at $490.

If Zcash continues its upward trend, it could extend the rally toward the 161.80% Fibonacci extension level at $578.53.

The Relative Strength Index (RSI) on the daily chart is 82, above the overbought threshold, indicating strong bullish momentum. Additionally, the Moving Average Convergence Divergence (MACD) showed a bullish crossover that remains intact, with rising green histograms above the neutral level, indicating the continuation of an upward trend.

On the other hand, if ZEC faces a correction, it could extend the decline toward the daily support level at $372.