BNB Price Forecast: BNB rebounds above $1,000 as stablecoin market cap hits record high

- BNB trades above $1,000 on Monday after rebounding from key support zone last week.

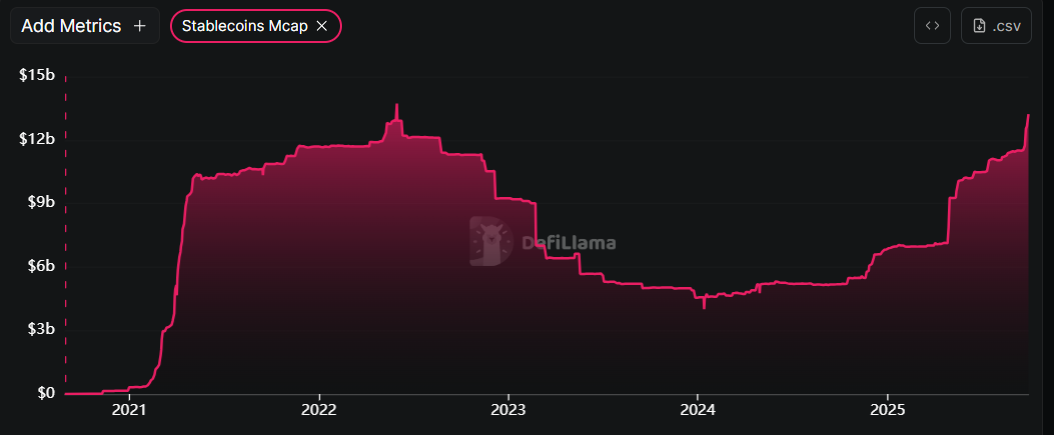

- On-chain data shows the BNB stablecoin market cap reaches a record high of $13.22 billion.

- The technical outlook suggested BNB could rally toward the record high of $1,083.

BNB (BNB), formerly known as Binance Coin, trades in green above the $1,000 mark at the time of writing on Monday, after rebounding from a key support zone last week. The recovery is further supported by record-breaking growth in its stablecoin market cap, and favorable technicals point to the possibility of a fresh rally that could retest BNB’s all-time high.

BNB’s stablecoin market cap hits record high

DefiLlama data shows that BNB's stablecoin market capitalization currently stands at $13.22 billion, a new all-time high, and has steadily risen since early 2025. Such stablecoin activity and value increase on the BNB project suggest a bullish outlook, as it boosts network usage and can attract more users to the ecosystem, driven by Decentralized Finance (DeFi), meme coins, and payment use cases.

BNB stablecoin market capitalization chart. Source: DefiLlama

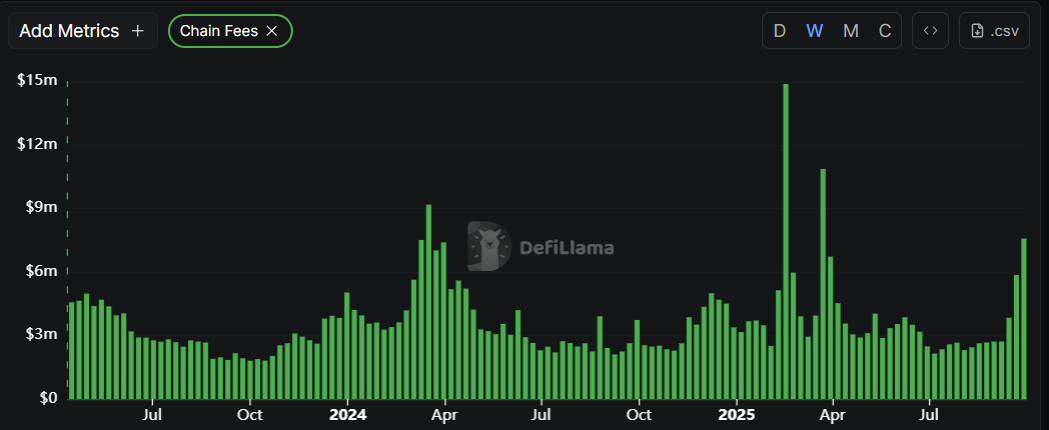

Apart from the rising stablecoin market capitalization, according to DefiLlama data, BNB weekly fee collection spiked to $7.58 million last week, the highest weekly collection since April, indicating a growing interest among traders and liquidity in the BNB chain.

BNB fees chart. Source: DefiLlama

BNB Price Forecast: BNB bulls aiming for record highs

BNB price declined nearly 10% since September 22 till Thursday, revisiting a key accumulation zone between $900.71 (daily support level) and $948.45, the 61.8% Fibonacci retracement level (drawn from the August 3 low of $730.01 to the all-time high of $1,083.47). BNB bounced back on Friday after finding support around $948.45, recovering 4.78% by Sunday. At the time of writing on Monday, it continues to trade higher at above the $1,000 mark.

If BNB continues its upward momentum, it could extend the rally toward its all-time high of $1,083. A successful close above this level could extend the gains to test the 141.4% Fibonacci extension level at $1,229.80.

The Relative Strength Index (RSI) on the daily chart reads 61 after rebounding from its neutral level of 50 last Thursday, suggesting bullish momentum is gaining traction.

BNB/USDT daily chart

However, if BNB faces a correction, it could extend toward the 61.8% Fibonacci retracement level at $948.45.