MYX Finance Price Forecast: MYX takes off amid WLFI listing, token unlock

- The MYX token extends Sunday's triple-digit surge as open interest hits a record high.

- The listing of the Trump-backed World Liberty Financial token on the MYX exchange fuels the rally.

- MYX's sharp rally fuels speculation over market manipulation.

MYX Finance (MYX) appreciates 75% at press time on Monday, extending the 167% rise from the previous day. The price surge of MYX, the native token of the MYX Exchange, comes after the announcement on Friday that the World Liberty Financial (WLFI) token, affiliated with Donald J. Trump and certain of his family members, would be listed on the MYX exchange.

MYX trades at record high levels amid record high Open Interest, but there are increasing concerns that the recent surge could result in a pump and dump scenario.

MYX Exchange enters the top 100 cryptocurrency list

MYX Exchange emerged as one of the finalists in the Binance Chain Awards on August 27 among rising decentralized exchanges (DEXs). The DEX listed the US President Donald Trump’s World Liberty Financial token (WLFI/USDT pair) on Friday.

Catering to the trend of WLFI, the newfound demand boosted MYX market capitalization above $800 million, supported by the 24-hour trading volume of $637 million. With this boost in valuation, MYX has entered the list of top 100 cryptocurrencies based on market capitalization.

MYX Finance data. Source: CoinMarketCap

Risks involved in the MYX rally

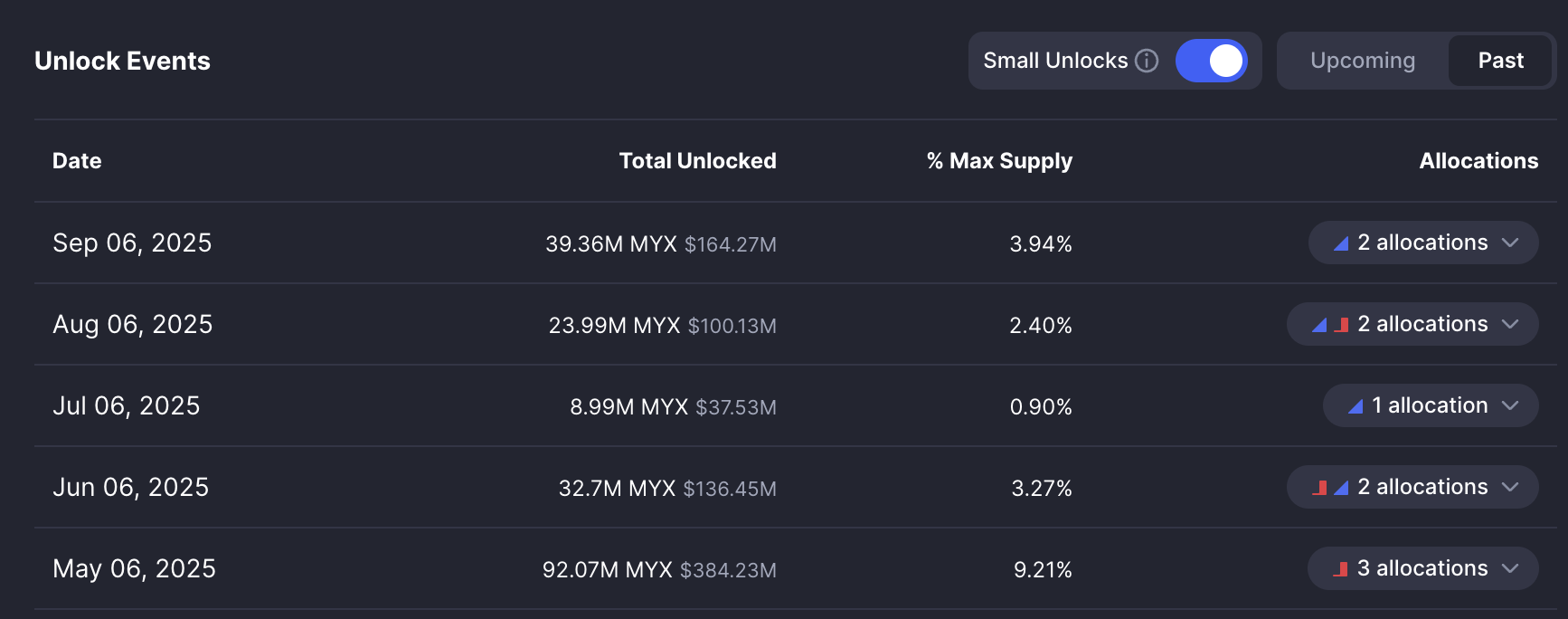

CoinMarketCap data shows 39.36 million MYX tokens unlocked on Saturday, which accounted for 3.94% of the supply. Following the unlock, the token recorded a triple-digit surge, which added to doubts of a bullish trap set by large investors to dump their unlocked tokens at higher prices.

MYX Finance token unlock. Source: CoinMarketCap

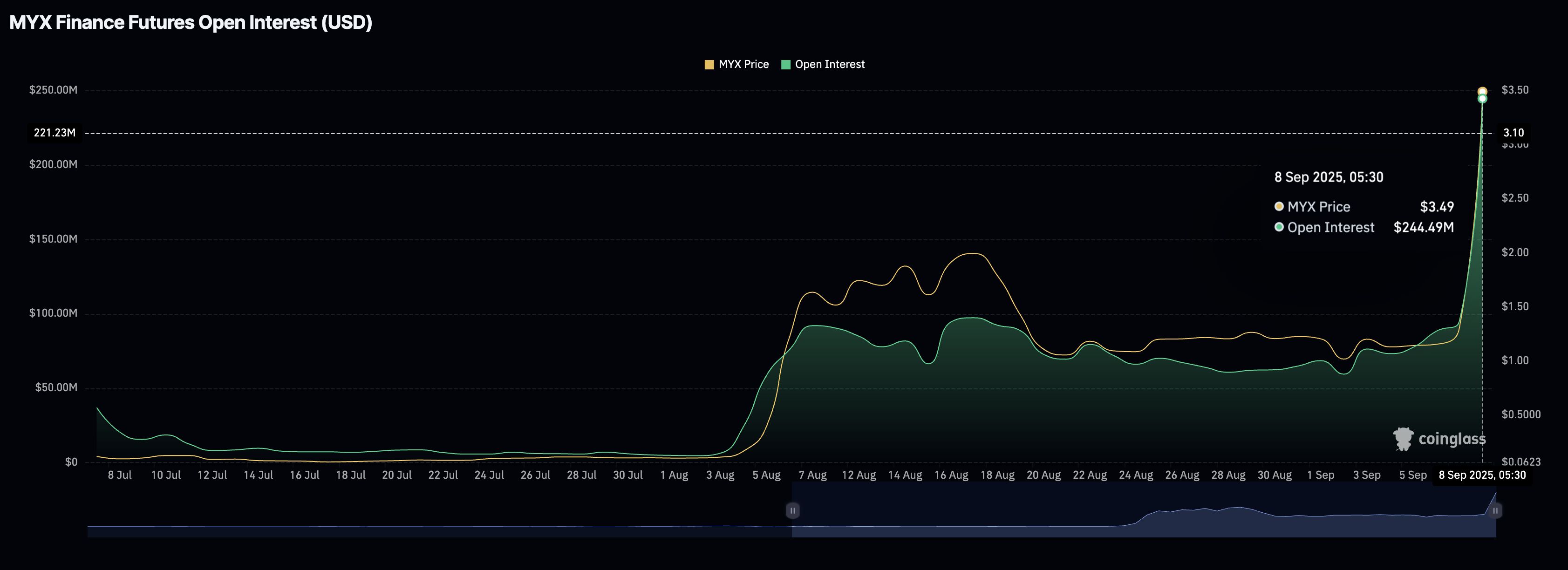

CoinGlass data displays the MYX Open Interest (OI) at a record high of $244.49 million, up sharply from $95.15 million on Sunday. This increase not only suggests a boost in traders' interest but also a possible inflation that could trap small investors.

MYX Open Interest. Source: CoinGlass

Web3 influencer Dominic said in its X account that the recent moves of the MYX token could be a potential pump and dump method in action, reporting small purchases converging to a central wallet from exchanges such as PancakeSwap, Bitget, and Binance.

MYX rally shifts to price discovery mode

The MYX token trades near $6 with a 75% surge at press time on Monday after retracing from the daily high of $8.00. The DEX token rally targets the R5 pivot resistance at $7.15 as the trend momentum gains strength.

Looking up, a potential close above this level could extend the rally into double digits, targeting the $10.00 milestone.

The Moving Average Convergence Divergence (MACD) and its signal line on the daily chart skyrocket after a crossover on Saturday, accompanied by heightened green histogram bars, indicating a boost in bullish momentum. Additionally, the Relative Strength Index (RSI) reads 91 on the same chart, indicating overbought conditions.

MYX/USDT daily price chart.

On the contrary, a reversal below the R2 pivot level at $3.65 could result in a decline to the R1 level at $2.42.