Nvidia Q2 Earnings Expectations: With Little Room for Error, Will China-Related Risks Be Magnified?

TradingKey - AI bellwether Nvidia (NVDA) will release its Q2 FY2026 earnings after the U.S. market close on August 27. Ahead of the report, multiple Wall Street firms have raised their price targets on Nvidia, reflecting strong confidence in AI demand. While analysts continue to forecast robust ~50% year-over-year growth in revenue and EPS, the China variable remains a major risk factor amid an environment of low tolerance for any earnings miss.

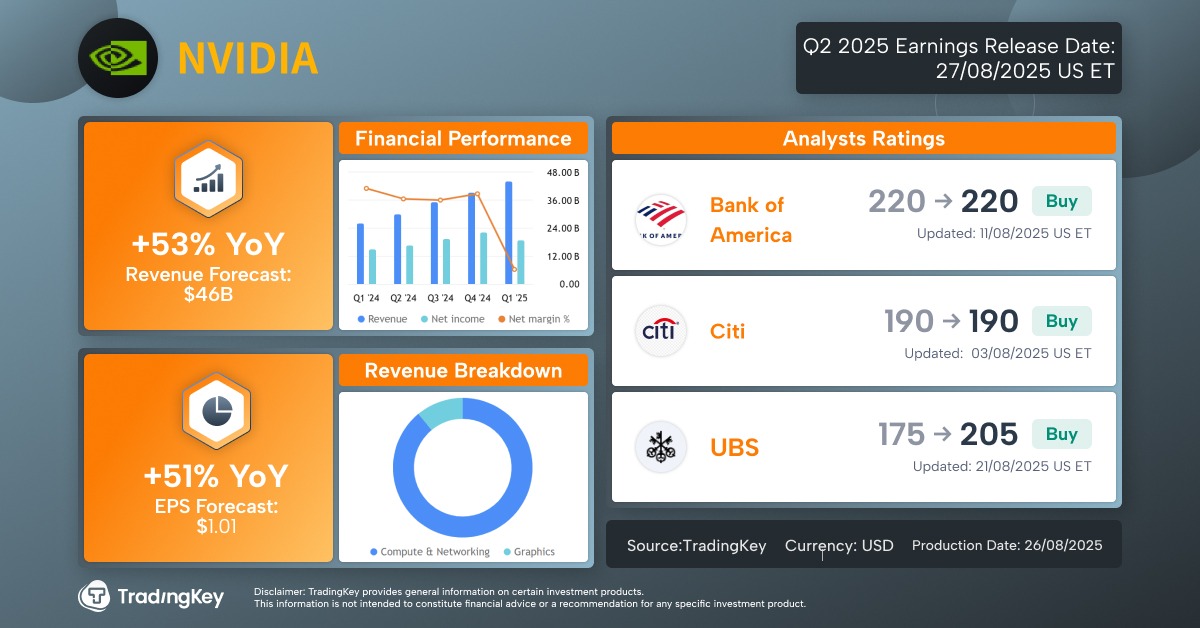

According to analyst consensus compiled by TradingKey, Nvidia’s Q2:

Revenue: $46.0 billion, up 53% YoY — slower than Q1’s 69% growth, but still above last quarter’s $44.1 billion

EPS: $1.01, up 51% YoY — surpassing Q1’s 33% growth and a significant jump from last quarter’s $0.81

Core Growth Engines Remain Strong

The data center segment, which contributed about 89% of revenue in Q1, is the focal point of this earnings report. With core customers — including Amazon, Microsoft, Google, and Meta — expanding their 2025 capital expenditures to over $360 billion, demand for Nvidia’s AI chips remains robust.

Additionally, AI infrastructure providers like CoreWeave, and AI labs such as OpenAI and xAI, continue to drive strong demand for cutting-edge chips to support compute expansion.

Analysts project:

Data center revenue: $41.3 billion, up 57% YoY from $26.3 billion a year ago

Morgan Stanley said demand for Nvidia’s products can be described as “significant, unmet, and massive,” with enterprise clients shifting focus from last year’s supply constraints to soaring inference demand.

TradingKey analyst Viga Liu noted that important areas include the rollout of the new Blackwell GPU architecture, expected to deliver up to 4x faster AI training. Insights about order visibility, supply chain status, and the transition from Hopper to Blackwell will shed light on growth sustainability.

Morgan Stanley highlighted that Blackwell’s production ramp-up is a core focus, with ODMs like Foxconn expected to double rack shipments by year-end.

TrendForce forecasts that the global AI server market will grow 46.1% YoY in 2025 to $300 billion, driven by new HGX and GB Rack models based on Nvidia’s Blackwell platform — which is expected to capture 70% market share. AI servers will account for 72% of total server market value. Despite tariff and geopolitical headwinds, global AI server shipments are still expected to grow 24.3% in 2025.

However, recent concerns about an AI bubble — including warnings from OpenAI CEO Sam Altman and an MIT report showing 95% of firms see zero return from generative AI — have added pressure. Meta’s pause in AI hiring has further fueled skepticism.

With such high expectations, the market has very low tolerance for any earnings miss — especially given one critical wildcard: China.

The China Wildcard

Although the Trump administration lifted in early August the April restrictions on AI chip exports to China, Nvidia’s China operations face dual pressures:

U.S. government demands for a cut of China sales revenue

Chinese clients reducing adoption of Nvidia chips

Earlier this month, President Donald Trump confirmed that Nvidia and AMD agreed to remit 15% of their China chip sales revenue to the U.S. government in exchange for renewed export licenses.

Analysts note this de facto export tax is unprecedented and may raise constitutional concerns. Preliminary estimates suggest Nvidia could lose around $3 billion in revenue.

Due to security concerns over the “backdoor” issue, the Chinese government has urged tech giants like Alibaba and Tencent to avoid using Nvidia’s AI chips. In recent days, Nvidia has gradually halted production of its China-specific H20 chip.

Nvidia did not include H20 sales in its Q2 guidance, and the market expects a conservative approach. KeyBanc analysts estimate that if H20 were included, it could add $2–3 billion in revenue.

However, Nvidia is accelerating development of its next-generation B30A chip, with samples expected as early as September.

Meanwhile, Chinese domestic chipmakers are advancing rapidly. Industry insiders say local GPUs have made significant progress, with some already surpassing the H20 in hardware performance, though software and ecosystem maturity still lag behind Nvidia.

Market Sentiment Remains Bullish

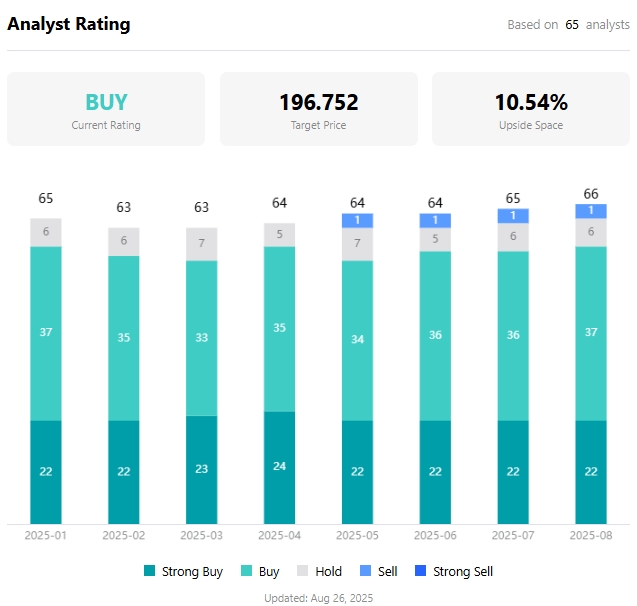

According to TradingKey, the average analyst price target for Nvidia is $196.75, a new high, implying over 10% upside from the latest close. Buy ratings overwhelmingly outnumber sell ratings.

Nvidia Analyst Price Target, Source: TradingKey

Last week, several Wall Street firms raised their targets:

Cantor Fitzgerald: $240

TD Cowen: $235

Wedbush: $210

Morgan Stanley: $206

Nvidia’s latest closing price was $179.81, having hit a record high of $184.48 on August 12. Its market cap stands at approximately $4.4 trillion. Investors near this all-time high are seeking new catalysts — and Jensen Huang’s commentary will be key.

Pepperstone noted the main risk is that earnings beat expectations but fail to impress a market already braced for a rally. Huang must deliver an encouraging outlook, or traders may rotate out of Nvidia and into Chinese/HK-listed AI names.

Overall, the report is expected to be solid. If the stock pulls back post-earnings, unless there is a sharp deterioration in the macro environment or a surge in cross-asset volatility, the decline may be limited — offering a buying opportunity.

Options markets imply a ±5.8% move in Nvidia’s stock on earnings day — potentially the smallest implied volatility for a Nvidia earnings release in years. A move of this magnitude would impact the S&P 500 by ±0.4% and the Nasdaq 100 by ±0.8%.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.