The US Dollar Index may regain its ground improving US yields could attract foreign capital.

President Trump announced the dismissal of Fed Governor Lisa Cook over allegations of mortgage fraud.

Trump warned to impose a 200% tariff on Chinese goods if Beijing refused to supply magnets to the United States.

The US Dollar Index (DXY), which measures the value of the US Dollar (USD) against six major currencies, is steadying after recovering daily losses and trading around 98.40 during the European hours on Tuesday. The Greenback may appreciate further as United States (US) yields could attract foreign capital into US bonds and other USD-denominated assets. The 2- and 10-year yields on US Treasury bonds stand at 3.70% and 4.30%, respectively, at the time of writing.

However, the US Dollar struggled as US President Donald Trump’s comments raised concerns over Federal Reserve (Fed) independence. Trump posted a letter on social media early Tuesday, noting that he was removing Cook from her position on the Fed's board of directors. However, Cook said that she will not resign and will continue to carry out duties, per Reuters.

Fed Governor Cook’s exit will allow Trump to tap a replacement, helping him to exert more control over Fed policy. Moreover, Fed Chair Jerome Powell said at the Jackson Hole symposium last week that risks to the job market were rising, but also noted inflation remained a threat and that a policy decision wasn't set in stone. Traders will likely await the upcoming release of the Q2 US Gross Domestic Product Annualized and July Personal Consumption Expenditures Price Index data, the Fed's preferred inflation gauge.

Trump also threatened to impose a 200% tariff on Chinese goods if Beijing refuses to supply magnets to the United States (US). Moreover, he warned of potential additional tariffs and export restrictions on advanced technology and semiconductors in retaliation against digital services taxes targeting American tech companies.

US Dollar Price Today

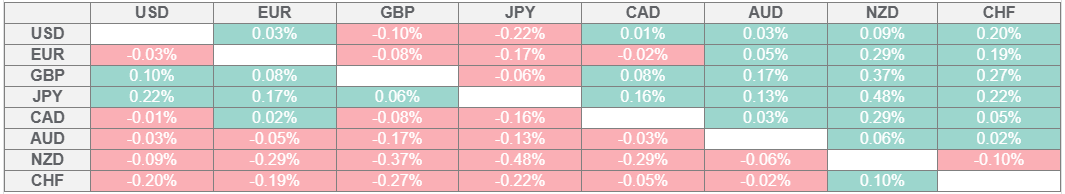

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.