Ahead of Nvidia Q2 Earnings, Wall Street Races to Raise Nvidia Price Targets

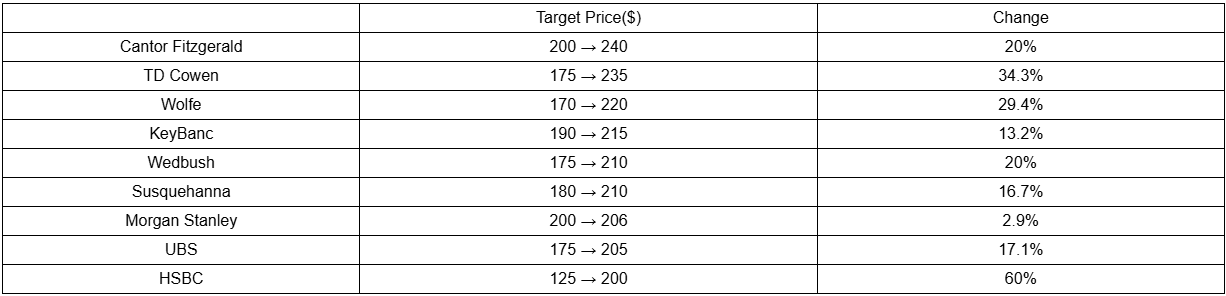

TradingKey - In the week leading up to Nvidia’s (NVDA) Q2 FY2026 earnings report on August 27, nine Wall Street firms have raised their target prices for the AI chip leader, reflecting broad confidence in its growth outlook.

As of Thursday, August 21, the average Wall Street target price for Nvidia has been raised to $194, a new historical high and a 3% increase from the previous average — at least 10% above Wednesday’s closing price.

According to Visible Alpha, analysts expect Nvidia’s Q2 revenue to reach $46.4 billion, potentially exceeding the company’s guidance of $44.1–45.9 billion, driven by strong sentiment around its data center segment.

Morgan Stanley raised its Q2 revenue estimate from $45.2 billion to $46.6 billion, citing significant improvements on both supply and demand sides — demand described as “significant, unmet, and massive” — while easing Blackwell chip supply constraints are boosting revenue.

As tech giants like Amazon, Google, and Meta continue to ramp up data center investments, computing power demand remains largely unfulfilled, providing strong support for Nvidia’s revenue growth.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.