Bitcoin Struggles at $110,000 as Traders Pull Back Across Markets

- 270,000 People Instantly Liquidated. Crypto Earthquake, Just Because This Person Might Take Over the Fed?

- Is Silver’s ‘Meme Moment’ Arriving? Surging Prices Mask Momentum Bubble Concerns

- Gold Price Forecast: XAU/USD gains momentum to near $5,050 amid geopolitical risks, Fed uncertainty

- Dollar Slumps to Four-Year Low, Trump Still Says ‘Dollar Is Doing Great’?

- Bitcoin No Longer Digital Gold? Gold and Silver Token Market Cap Hits Record $6 Billion

- Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH and XRP deepen sell-off as bears take control of momentum

Bitcoin is trading 10% below its all-time high, pressured by heavy profit-taking that has wiped out some of its value since August 14.

The leading cryptocurrency now trades around the $110,000 level, with on-chain signals suggesting a deeper correction could be imminent.

BTC Futures Traders Retreat as Selloffs Continue

On-chain data shows that sell-side pressure continues to mount, threatening to push BTC below the psychological $110,000 threshold.

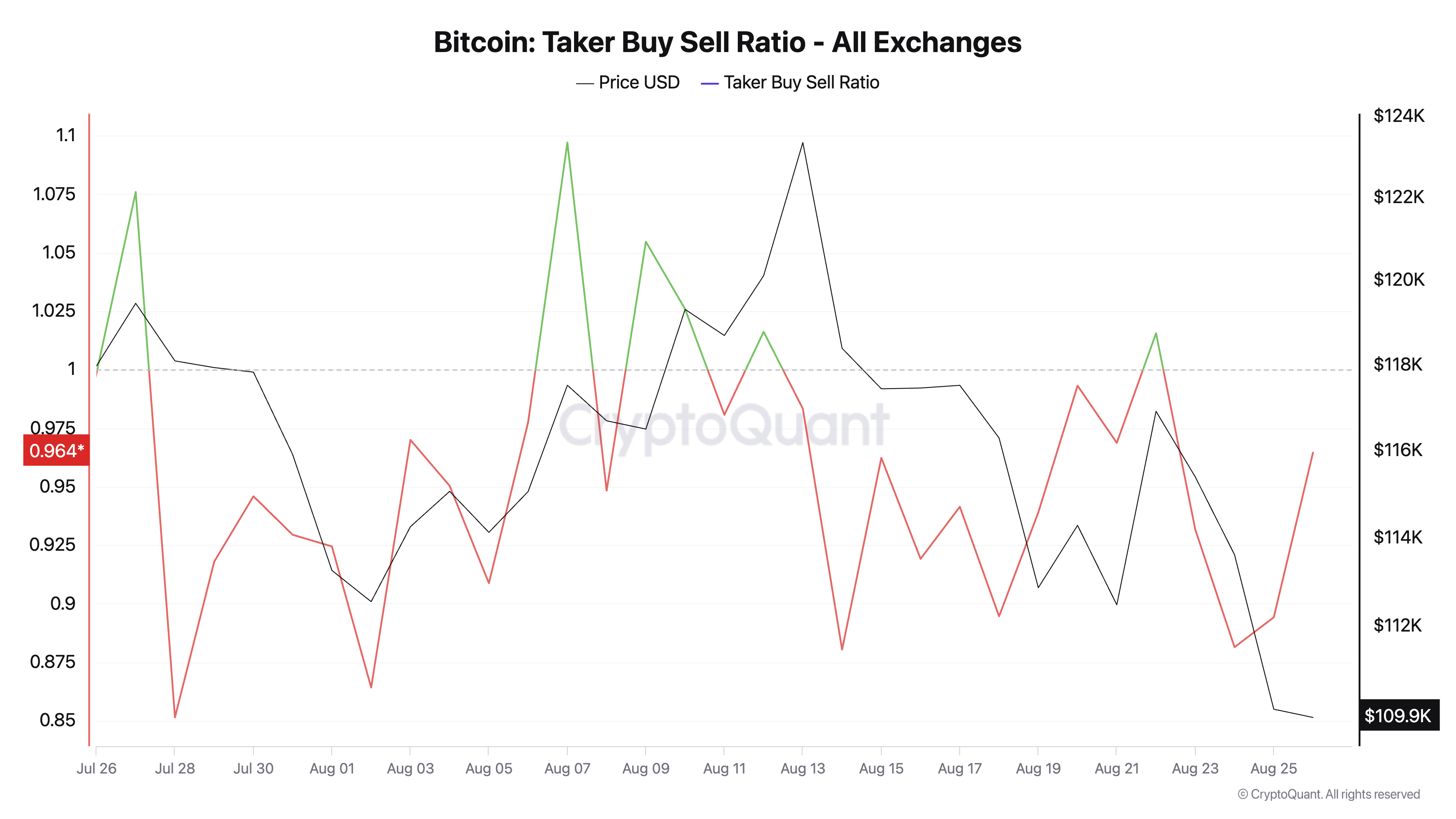

One of the most telling signs is BTC’s Taker-Buy Sell Ratio, which has been predominantly negative since July. At press time, it stands at 0.96 per CryptoQuant, indicating that sell orders dominate buy orders across the coin’s futures market.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

BTC Taker Buy Sell Ratio. Source: CryptoQuant

BTC Taker Buy Sell Ratio. Source: CryptoQuant

An asset’s taker buy-sell ratio measures the ratio between the buy and sell volumes in its futures market. Values above one indicate more buy than sell volume, while values below one suggest that more futures traders are selling their holdings.

For BTC, this trend indicates that its futures traders are pulling back from aggressive bullish bets, adding to the pressure already weighing on the market. It shows a lack of conviction among derivatives traders that the king coin could see a notable near-term recovery.

Bitcoin Spot Traders Turn Sellers

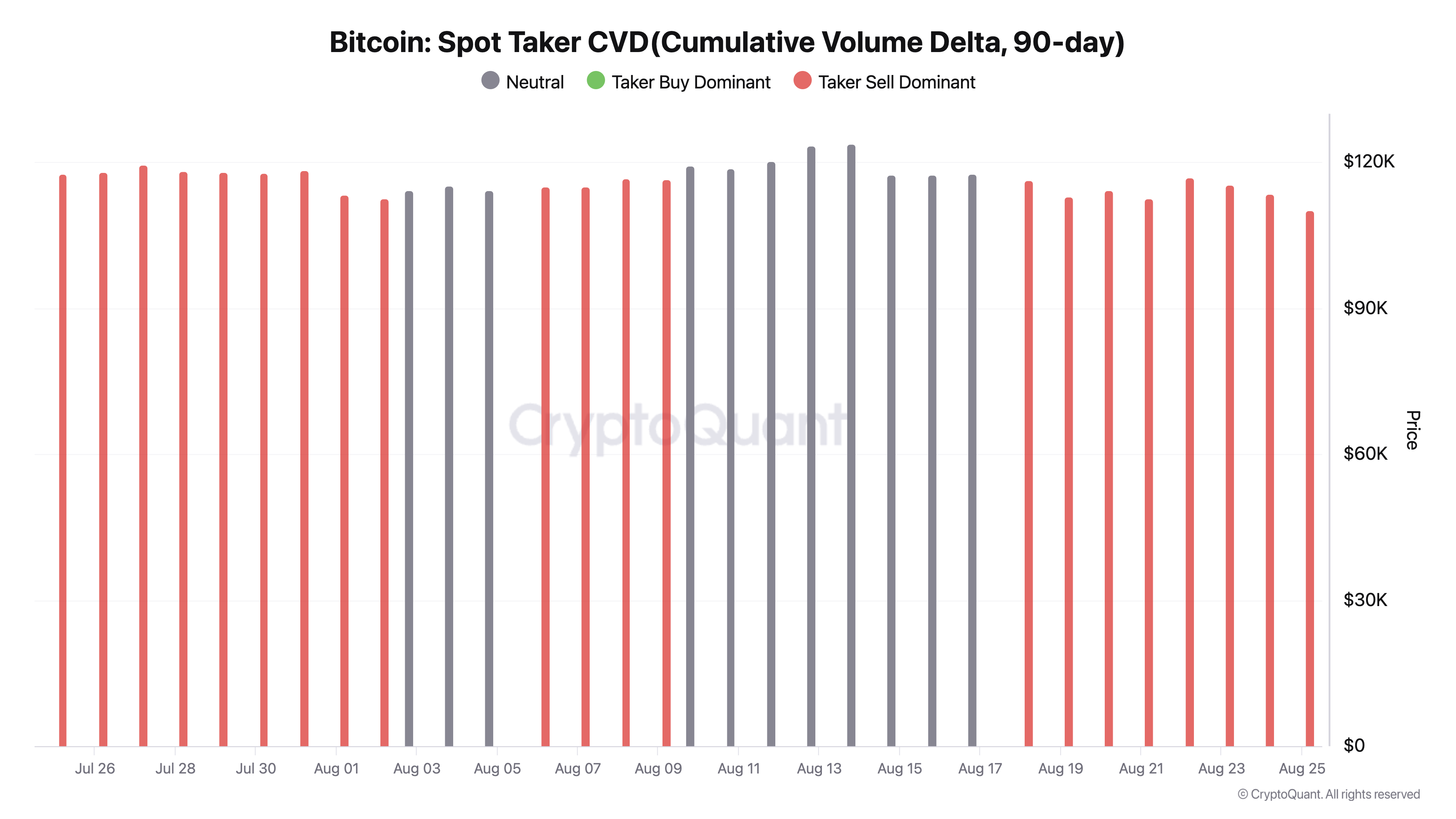

The trend is no different among spot market participants. Per CryptoQuant’s data, Bitcoin’s Spot Taker CVD (Cumulative Volume Delta, 90-day), which tracks net buying and selling activity in the spot market over a 90-day period, flipped from “neutral” on August 18.

Since then, it has consistently posted red bars, signaling that sellers are dominating spot market activity.

BTC Spot CVD. Source: CryptoQuant

BTC Spot CVD. Source: CryptoQuant

This shift into a taker-sell dominant phase for BTC reflects fading demand and weaker buy-side absorption of increasing supply. With spot traders increasingly offloading rather than accumulating, the imbalance heightens the risk of further downside.

$110,000 Support Under Siege Amid Fading Demand

As demand thins across both spot and futures markets, leading coin BTC risks plunging below $110,000. In this scenario, the coin’s price could fall to $107,557, its next major support level.

BTC Price Analysis. Source: TradingView

BTC Price Analysis. Source: TradingView

However, if buyers regain dominance and drive a rally, they could drive BTC’s price to $111,961. A breach of this wall could trigger a move to $115 892.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.