- Markets in 2026: Will gold, Bitcoin, and the U.S. dollar make history again? — These are how leading institutions think

- US Q4 Earnings Season Set to Begin: Can US December CPI Data Bolster Rate Cut Case? [Weekly Preview]

- Gold Price Forectast: XAU/USD rises above $4,600 on US rate cut expectations, Fed uncertainty

- US Dollar Index steadies above 99.00 ahead of Retail Sales, PPI data

- WTI maintains position above $59.00 as supply risks grow

- Silver Price Forecast: XAG/USD corrects to near $86.50 as Iran stops killing protesters

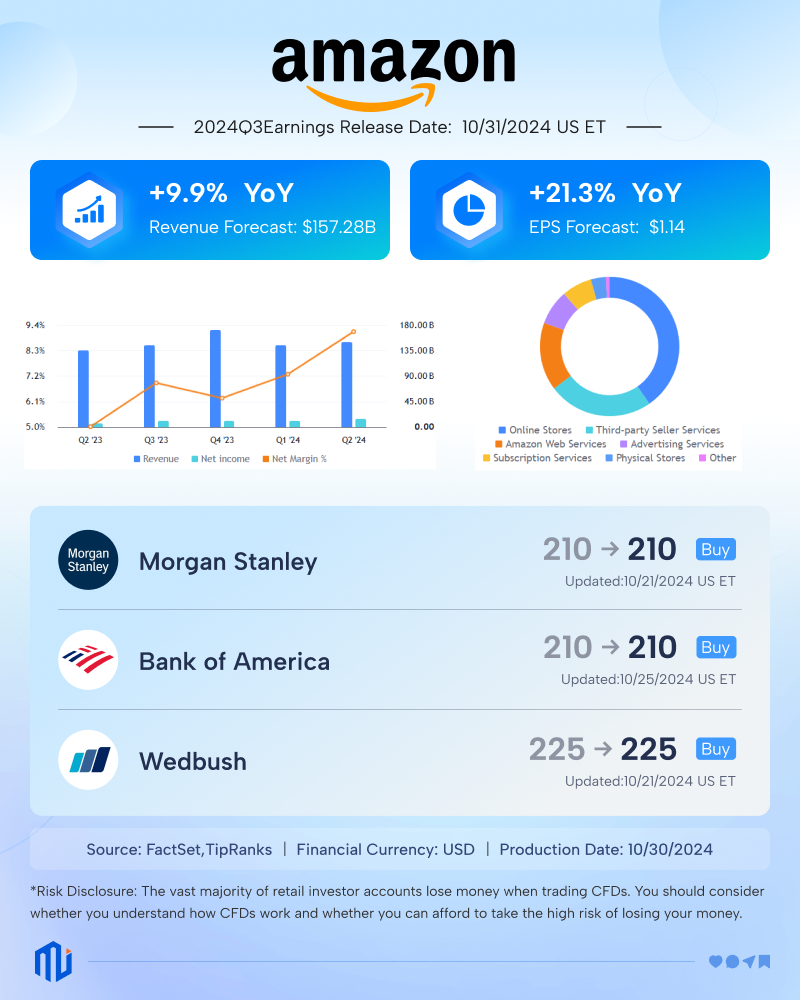

Insights - On October 31, after the U.S. market closes, e-commerce giant Amazon (AMZN) will release its Q3 2024 earnings report.

Market expectations are that Amazon’s Q3 revenue will reach $157.28 billion, representing a year-over-year increase of 9.9%. Earnings per share (EPS) are expected to be $1.14, up 21.3% year-over-year. Year-to-date, Amazon’s stock has gained 26%.

Retail Business and AWS Growth in Focus

Retail remains Amazon’s primary revenue driver, encompassing its e-commerce business and third-party seller services.

Last quarter, Amazon’s e-commerce revenue fell short of expectations, and overall retail revenue growth has slowed for two consecutive quarters. Thus, investors will be closely monitoring Amazon’s retail revenue growth and profit margins to see whether the company can maintain sales growth while controlling costs.

Meanwhile, AWS, Amazon’s cloud business, remains a key growth driver. AWS holds a 32% market share, surpassing Microsoft Azure’s 23% and Google Cloud’s 12%, making it the industry leader. AWS revenue grew 19% year-over-year, beating expectations in Q2 2024. The market will be watching to see if this strong growth continues.

Will Q4 Guidance Surprise?

Furthermore, the market is particularly focused on Amazon’s Q4 earnings guidance.

Last quarter, Amazon’s revenue and profit guidance fell short of expectations, causing the stock to drop 9% post-earnings. Analysts attributed the sharp slowdown in profit guidance primarily to larger-than-expected investments in AI services.

Jefferies estimates Amazon’s Q4 revenue to be between $179.5 billion and $186.5 billion, slightly below the Wall Street consensus of $186.4 billion. Operating profit is expected to range from $12 billion to $16 billion, also below the anticipated $17.4 billion.

The firm cited recent wage increases for warehouse employees as a reason for lowering profit expectations and suggested that Wall Street may be overestimating Amazon’s Q4 outlook based on historical trends.

What Lies Ahead for Amazon?

According to TipRanks, over the past 12 quarters, Amazon’s stock has had a 50% chance of rising or falling after earnings, with an average price movement of ±7.8%.

Source: TipRanks; Amazon Stock Performance After Earnings

Most analysts on Wall Street have maintained their price targets for Amazon.

Bank of America reiterated its “Buy” rating with a price target of $210. Morgan Stanley also maintained its $210 price target, indicating that Amazon’s stock could still rise by 10% from current levels.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.