This ETF Almost Doubled Last Year and It's Nearly Twice as Cheap as the S&P 500. Is It a Buy?

Key Points

The iShares South Korea ETF was one of the best-performing ETFs last year, gaining more than 90%.

The fund is paced by two memory chip stocks, Samsung and SK Hynix.

The ETF is already up nearly 20% this year.

- These 10 stocks could mint the next wave of millionaires ›

Exchange-traded funds (ETFs) are one of the easiest ways to invest. Instead of having to pick individual stocks, ETFs do the hard work for you, allowing investors to get exposure to a bunch of stocks with just one ticker.

Some of the most popular ETFs follow indexes like the S&P 500, but there are a wide range of options in ETFs. You can invest in funds that follow a certain sector of the stock market, have a theme like growth or dividends, or track a certain country or region.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

While the overall stock market did well in 2025, and index investors were likely pleased with their results, there was one ETF that destroyed the broad market and came from an unlikely place.

That was the iShares MSCI South Korea ETF (NYSEMKT: EWY), which has continued to soar in 2026, already up 19.3% year-to-date through Jan. 23.

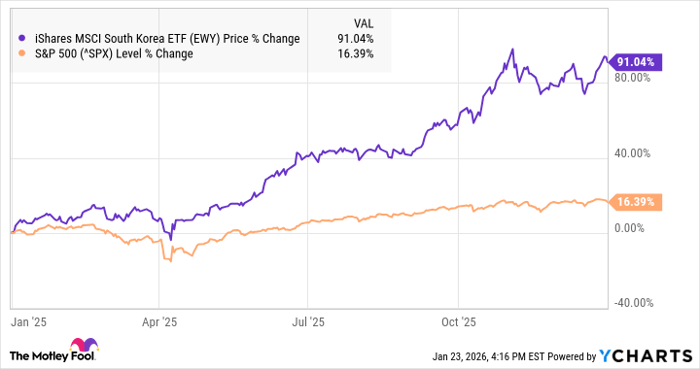

As the chart below shows, the ETF jumped 92% last year, delivering steady gains through most of the year.

EWY data by YCharts

Why South Korean stocks are soaring

South Korean stocks have soared due to the AI boom, but that's not the whole story. Two of the largest memory chipmakers in the world hail from South Korea, SK Hynix and Samsung, and both had breakout years as memory prices jumped on skyrocketing demand. U.S.-based Micron, the other big memory chip company, also saw triple-digit growth last year.

The country also benefited from a weak Korean won, which favors exports, and the ETF had underperformed in previous years, which gave it a low valuation. As of Jan. 23, the EWY still traded at a price-to-earnings ratio of 17 compared to the S&P 500 at 28. Based on forward earnings, the Korean index trades at a multiple of roughly 10. President Lee Jae Myung has also issued a number of shareholder-friendly policies, including improving corporate governance and cutting the top tax rate on dividends from 50% to 30%. There's also a push to reform inheritance tax rules, which could further drive valuations higher.

Image source: Getty Images.

What's in the EWY

Samsung and SK Hynix dominate the iShares South Korea ETF, accounting for 45% of the fund, with Samsung at 26.8% and SK Hynix at 18.3%, but there are other intriguing stocks in the fund.

Hyundai Motor, for example, has become a leading maker of electric vehicles and owns an 80% stake in Boston Dynamics, which, according to some analysts, is ahead of Tesla in humanoid robotics.

Other top holdings include Kia, another growing Korean auto stock, Hanwha Aerospace, a leading South Korean aerospace and defense company and a supplier of companies like GE and Rolls-Royce, and Naver, an online platform known as the Korean Google with a search engine, maps, and other features.

Is the iShares South Korea ETF a buy?

With the EWY already up nearly 20% year-to-date and trends in the memory chip sector looking strong, the EWY looks like it's set for another winning year.

The fund's success and its low valuation are also a reminder that investors can find opportunities outside the U.S. In fact, the iShares MSCI World ETF also outperformed the S&P 500 last year with a 21% gain, showing that diversifying internationally would have paid off.

Looking ahead, the EWY's exposure to memory chips makes it risky as that subsector has a history of being notoriously volatile, but those memory stocks look poised to keep gaining as long as AI infrastructure spend is expanding.

From that perspective, scooping up some shares of the EWY looks like a smart move, especially if you're looking to diversify away from the U.S. at a time when the S&P 500 is about as expensive as it's ever been.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 937%* — a market-crushing outperformance compared to 195% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Stock Advisor.

See the stocks »

*Stock Advisor returns as of January 24, 2026.

Jeremy Bowman has positions in Micron Technology. The Motley Fool has positions in and recommends Micron Technology and Tesla. The Motley Fool recommends Rolls-Royce Plc. The Motley Fool has a disclosure policy.