Ethereum Weekly Price Forecast: ETF and retail selling pressure dominate amid sustained network growth

- Ethereum ETFs recorded net outflows of $611.1 million this week.

- During the period, retailers distributed 520K ETH while whales held steady.

- ETH could fall to $2,628 if it breaches the $2,880 support.

In a week dominated by geopolitical tensions over Greenland and back-and-forth tariff threats, Ethereum (ETH), like much of the broader crypto market, once again showed a strong correlation with macroeconomic factors. The top altcoin has declined by 12% since the beginning of the week.

The price reflects de-risking from traditional players and crypto-native retailers. US spot ETH exchange-traded funds (ETFs) have recorded $569.4 million in outflows across three consecutive days of negative flows so far this week, according to SoSoValue data.

A similar sentiment is evident across retailers or wallets holding 100-1K ETH and 1K-10K ETH. These groups sustained their selling activity that dates back to December, distributing a combined 520K ETH since Sunday.

-1769235546452-1769235546454.png)

Accumulation from whales (wallets holding 10K-100K ETH) has offset the pressure in previous weeks. However, net buying from this cohort was fairly neutral during the period.

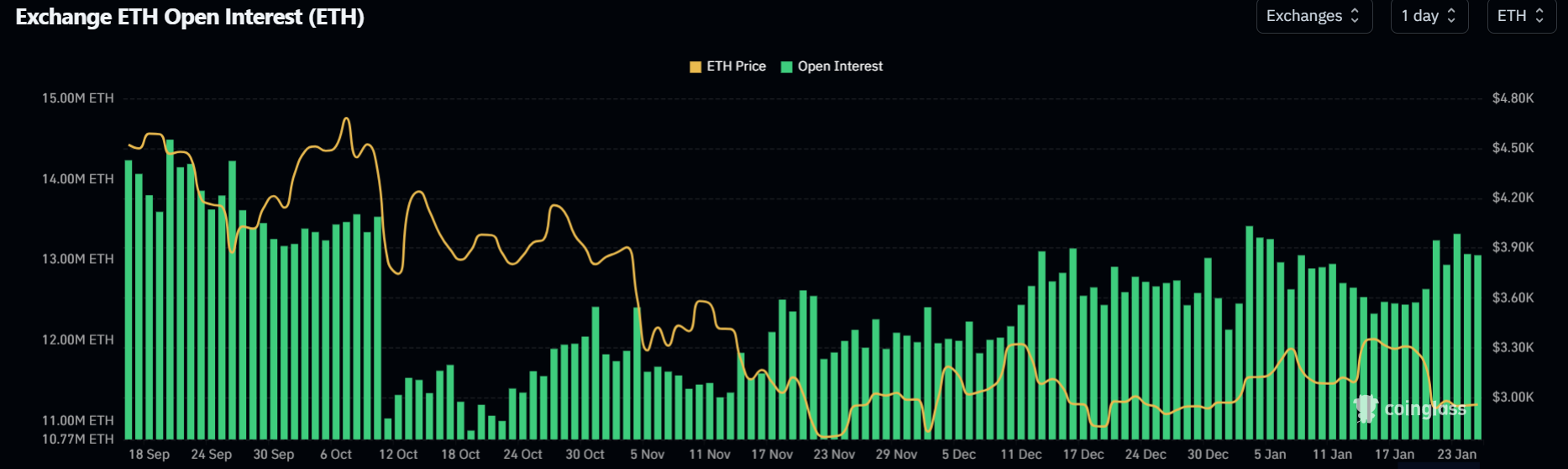

On the derivatives side, open interest grew by 520K ETH to 12.99 million ETH, but that growth isn't entirely focused on long bets as funding rates have been fluctuating more strongly than in normal conditions.

Meanwhile, Ethereum's active addresses and transaction counts continue to surge to record highs, sustaining their newfound momentum since the Fusaka upgrade. However, JPMorgan analysts have cautioned that such network activity booms after major upgrades tend not to last.

Additionally, the Ethereum validator entry queue has been rising to new highs, reaching 3.13 million ETH on Friday. The total value of assets staked on the network is also at a record high of 36.3 million ETH.

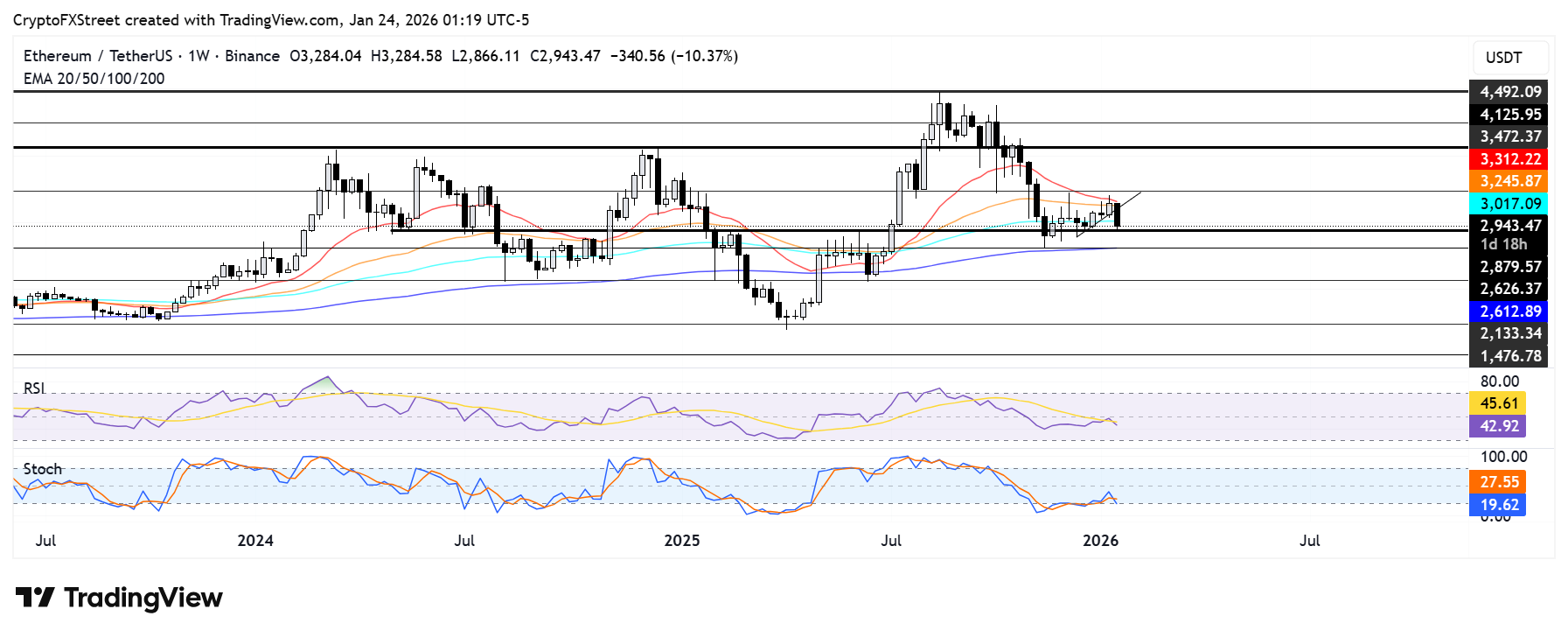

Ethereum Price Forecast: ETH could fall to $2,627 if it loses the $2,880 support

ETH tested the support level near $2,880 this week after a rejection around the 20-week Exponential Moving Average (EMA) and a decline below the ascending triangle support.

On the downside, ETH could find support near $2,627 — strengthened by the 200-week EMA — if it loses the $2,880 level. On the upside, ETH has to rise above $3,470 to begin an uptrend.

The Relative Strength Index (RSI) is below its neutral level while the Stochastic Oscillator (Stoch) is in oversold territory, indicating a dominant bearish momentum.