Prediction: 2 Stocks That'll Be Worth More Than Amazon 3 Years From Now

Key Points

Amazon's size means it isn't growing as fast as other tech companies.

TSMC and Broadcom, on the other hand, are just behind Amazon on the market cap list and are clocking impressive growth.

Both these companies could be worth more than the e-commerce giant in the next three years.

- 10 stocks we like better than Taiwan Semiconductor Manufacturing ›

Amazon (NASDAQ: AMZN) is the fifth-largest company in the world with a market share of $2.55 trillion. The tech giant reached this position thanks to its dominant stature in the e-commerce and cloud computing markets.

However, Amazon's already huge market cap helps explain why it isn't growing at eye-popping rates anymore. The company's 2025 revenue is expected to jump 12% to $715 billion when it reports earnings on Feb. 5. Analysts predict a slightly slower top-line increase of 11% in 2026. A similar pattern is expected in the company's bottom line as well, with analysts expecting an 11% increase in Amazon's earnings in 2026 after a robust jump of 28% in 2025.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

This slow but steady growth explains why Amazon stock hasn't been a great investment over the past year, rising just 6% compared to the 16% appreciation in the S&P 500 index during the same period. On the other hand, the two companies trailing Amazon on the market-cap list -- Taiwan Semiconductor Manufacturing (NYSE: TSM) and Broadcom (NASDAQ: AVGO) -- are growing much faster and have posted impressive gains in the past year.

Let's look at the reasons these two semiconductor companies have the potential to overtake Amazon's market cap in the next three years.

Image source: Amazon

Taiwan Semiconductor Manufacturing

TSMC is now the sixth-largest company in the world, with a market cap of $1.77 trillion (44% lower than Amazon's). TSMC's stock price jumped an impressive 65% over the past year, significantly outpacing Amazon's gains during the same period. Looking ahead, TSMC is likely to continue outperforming Amazon due to its stronger growth profile.

TSMC recently released its fourth-quarter 2025 results, ending the year with a 36% increase in revenue to $122.4 billion. The strong demand for the chips TSMC fabricates for its diversified customer base led to higher factory utilization. A high utilization rate means that TSMC's factories were churning out chips at a robust pace, driven mainly by the demand for artificial intelligence (AI).

As a result, TSMC's factories saw low idle time, leading to an improvement of 3.8 percentage points in its gross margin last year. This explains why TSMC's 2025 earnings rose 51% to $10.65 per share. The good part is that TSMC expects to clock an annual revenue growth rate of 25% through 2029.

At the same time, TSMC is focused on reducing manufacturing costs and improving productivity. It also raised the price of its advanced chipmaking nodes. These factors could help it achieve further margin improvements, leading to strong earnings growth in the future.

Assuming TSMC's earnings increase at an annual rate of 30% for the next three years, which is slightly higher than the 25% top-line growth it is estimating, its bottom line could hit $23.40 per share in 2028 (using its 2025 earnings of $10.65 per share as the base). Multiplying the projected earnings in 2028 by the tech-laden Nasdaq-100 index's forward earnings multiple of 26 points toward a stock price of $608 after three years, a potential jump of 76% from current levels.

That could be enough to help TSMC become a bigger company than Amazon, and the potential upside that this semiconductor stock could deliver makes it worth buying for the long run.

2. Broadcom

The world's seventh-largest company, Broadcom, has a market cap of $1.67 trillion, about 53% lower than Amazon's. What's worth noting is that Broadcom has reduced the gap with Amazon in the past year, as the former's shares have jumped by 50% during this period.

Broadcom's outperformance is a result of the company's fast-growing revenue from sales of AI chips. The company designs custom AI processors and networking components that are in terrific demand from hyperscalers and AI companies due to their performance and cost advantages over graphics processing units (GPUs).

This explains why Broadcom's growth is forecast to accelerate in the current fiscal year. The company's revenue in fiscal 2025 (which ended on Nov. 2) increased by 24% year over year to $64 billion. Its earnings increased at a stronger pace of 40% to $6.82 per share. What's worth noting is that Broadcom was sitting on a massive order backlog of $162 billion at the end of the previous quarter, $73 billion of which was related to AI.

This impressive backlog explains why Broadcom management expects the company's AI revenue to double year over year in the current quarter. Moreover, the backlog sets Broadcom up for improved financial performance in the current year and beyond.

Consensus estimates project its sales to increase by 51% this year, along with an almost identical jump in earnings. Looking ahead, Broadcom's earnings should keep growing at a solid pace.

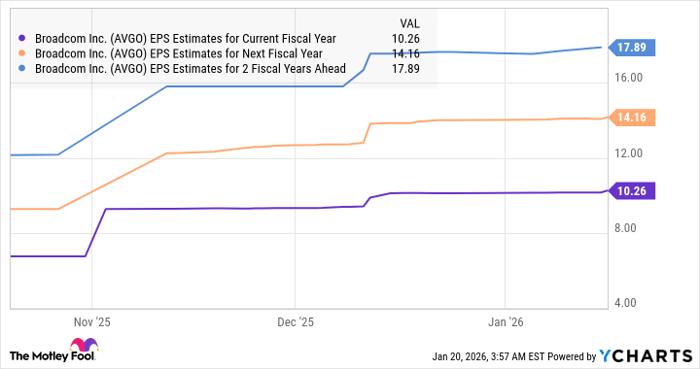

Data by YCharts.

Broadcom stock trades at 35 times forward earnings, a premium to the Nasdaq-100 index's average forward earnings multiple (using the index as a proxy for tech stocks). However, as its earnings are poised to increase at a stronger pace than the broader market, it can maintain that premium. Assuming Broadcom trades at 35 times earnings after three years and earns $17.89 per share (as seen in the chart above), its stock price could jump to $626.

That's a potential upside of 78%, indicating that it indeed has the potential to overtake Amazon's market cap in the next three years by delivering solid gains to investors.

Should you buy stock in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $460,340!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,123,789!*

Now, it’s worth noting Stock Advisor’s total average return is 937% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 22, 2026.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.