Is Opendoor Stock Your Ticket to Becoming a Millionaire?

Key Points

Opendoor is a money-losing startup that is attempting to build a business around house flipping.

The stock rocketed higher after the company brought in a new CEO.

With a game plan laid out, investors can watch to see if Opendoor can live up to the new CEO's promises.

- 10 stocks we like better than Opendoor Technologies ›

Investing is always a balancing act between risk and reward. The problem, of course, is that if you take too much risk with an investment, you could end up with huge losses. This is the investment situation today with Opendoor Technologies (NASDAQ: OPEN). A new CEO, a shift in the company's business approach, and a significant rise in the share price indicate that Opendoor is only suitable for the most aggressive investors. Still, could this high-risk stock be your ticket to becoming a millionaire?

What does Opendoor do?

Opendoor's business model is fairly simple. It buys homes from sellers, fixes them up, and then resells them at a, hopefully, higher price. This is what's known as house flipping, a practice that has been around for a long time. However, it is an investment tactic typically employed by small investors. Often, those small, local investors also upgrade the homes themselves. House flipping isn't something that has been done on a large scale by a public company.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Trying to scale up the house-flipping model hasn't worked out well so far for Opendoor. It has steadily lost money since it was brought public via a merger with a special-purpose acquisition company (SPAC). The company's financial performance was so bad that the stock had fallen into penny stock land.

Only the most aggressive and active investors should invest in penny stocks. But that's when things got really interesting with Opendoor. An activist investor stepped in, the CEO was ousted, and CEO Kaz Nejatian was brought in as the new CEO, touting artificial intelligence (AI) as a tool to turn the business around. The stock rocketed higher on the news even though nothing at all had changed at the company by that point.

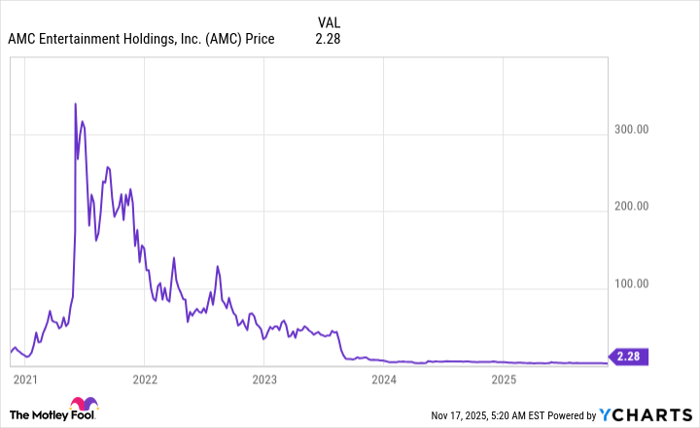

Very quickly, Opendoor became a meme stock. Emotions are supporting the price, as investors simply believe the future will be better for the business. If that doesn't turn out to be true, the stock will probably be a bad investment. The risk is highlighted by the steep decline in the price of headline-grabbing meme stocks, such as AMC Entertainment.

AMC data by YCharts.

Where to from here for Opendoor?

To the new CEO's credit, a business roadmap was quickly laid out when Opendoor reported third-quarter 2025 earnings. The big picture plan is to turn profitable on a go-forward basis by the end of 2026, with the CEO stating specifically that, "We are refounding Opendoor as a software and AI company."

This represents a significant shift for Opendoor, and it is far from clear that the company can successfully execute this business transformation. However, the company has given explicit yardsticks that Wall Street can track across three key business initiatives.

Opendoor aims to scale acquisitions, enhance unit economics and velocity, and enhance operational leverage. Acquisition volume can be monitored by watching the number of homes the company buys; economics and velocity can be checked by monitoring the number of homes on the market for 120 days or longer; and operating leverage can be tracked by looking at operations expense as a percentage of revenues.

There are two key problems for investors to consider here. The first is that the stock price advance that followed the installation of a new CEO is pricing in improvements that have yet to transpire. The second problem is that buying more homes increases risk if the company fails to sell them in a timely fashion. In other words, buying Opendoor right now exposes you to potentially increasing risks, and the potential reward might already be priced into the stock.

Opendoor won't be a great fit for most investors

Opendoor is a stock that most investors should probably avoid. If the new game plan is successful, it could be a viable business. However, that won't be known until at least the end of 2026, and a lot of good news has already been baked into the stock's valuation. If you do buy it, hoping the new CEO turns it into a millionaire-maker stock, make sure to closely track the business' success over the next year. Luckily, key benchmarks have been provided for you to watch.

Should you invest $1,000 in Opendoor Technologies right now?

Before you buy stock in Opendoor Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Opendoor Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $615,279!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,111,712!*

Now, it’s worth noting Stock Advisor’s total average return is 1,022% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.